Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

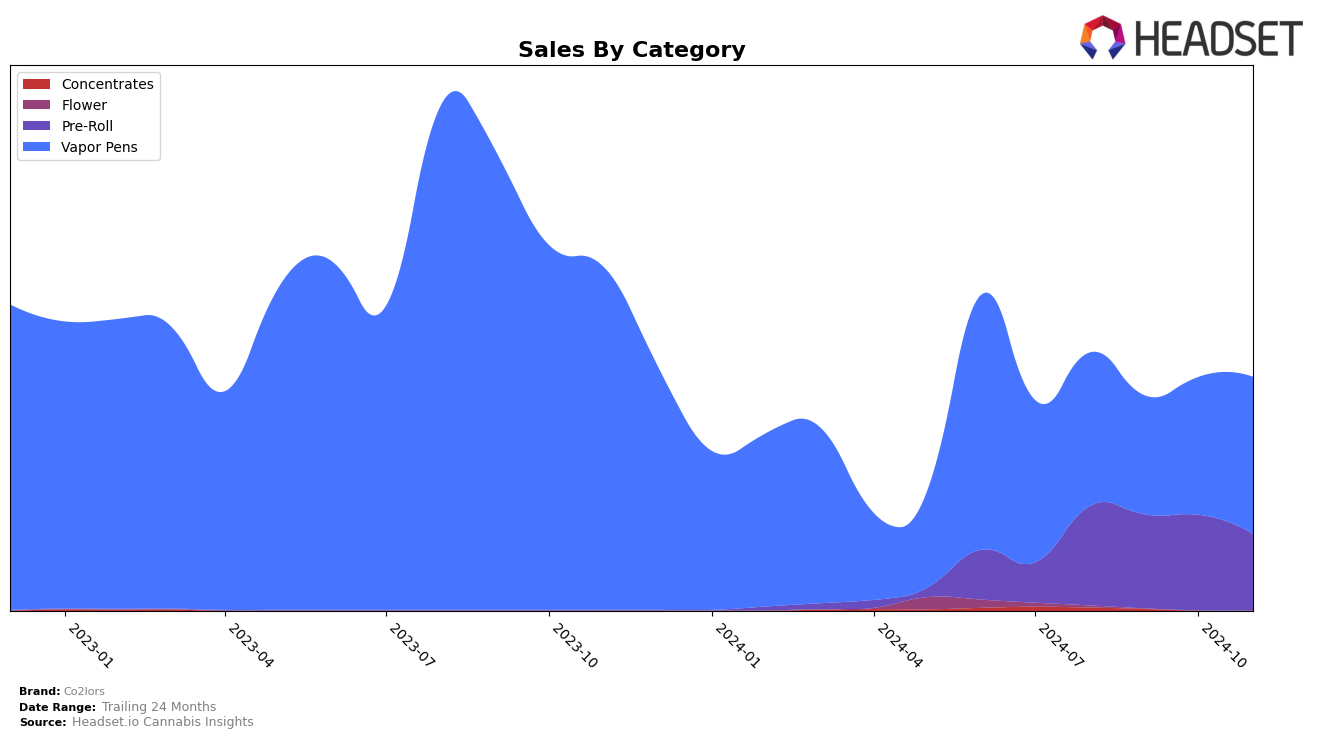

In the state of Arizona, Co2lors has shown fluctuating performance across different categories. In the Pre-Roll category, Co2lors was absent from the top 30 rankings in September and November 2024, which might indicate challenges in maintaining a consistent market presence. However, they managed to secure the 53rd spot in October, showing some potential for improvement. In the Vapor Pens category, Co2lors demonstrated a more stable trajectory, moving from 50th in August to 51st in November, with a slight dip in September. This suggests a gradual recovery and potential growth, as evidenced by the increase in sales from October to November.

Looking at Colorado, Co2lors experienced varied success. In the Pre-Roll category, the brand appeared in the rankings only in September and October, at 80th and 78th positions, respectively, indicating a struggle to break into the top tier. Conversely, their performance in the Vapor Pens category was more promising, with a notable jump from 66th in October to 45th in November. This upward trend in Vapor Pens could hint at a strategic focus or improved consumer preference for Co2lors in this segment. Meanwhile, in Maryland, Co2lors maintained a consistent presence in the Pre-Roll category, hovering around the mid-20s, which reflects a stable demand. However, their Vapor Pens ranking slightly declined from 39th in August to 41st in November, suggesting potential competitive pressures or shifts in consumer preferences.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Co2lors has demonstrated a notable improvement in its market position from August to November 2024. Initially ranked 59th in August, Co2lors climbed to 45th by November, showcasing a significant upward trend in rank. This improvement is particularly impressive given the competitive nature of the market, where brands like West Edison and Bud Fox Supply Co have shown fluctuating ranks, with West Edison dropping from 34th to 44th and Bud Fox Supply Co slightly declining from 37th to 43rd over the same period. Co2lors' sales trajectory also reflects a positive trend, with a substantial increase in November, surpassing its previous months' sales figures and closing the gap with competitors. This upward momentum in both rank and sales suggests that Co2lors is effectively capturing market share and could continue to rise if this trend persists.

Notable Products

In November 2024, the top-performing product for Co2lors was the Sweet Melon BDT Distillate Disposable (1g) in the Vapor Pens category, maintaining its leading position from September. Grape Dreams CO2 Distillate Disposable (1g) emerged as a strong contender, securing the second position with notable sales of 732 units. Watermelon Distillate Disposable (1g) debuted in the rankings at third place, indicating a new preference trend among consumers. The Blueberry Infused Pre-Roll 2-Pack (1g) experienced a drop from first place in October to fifth in November, reflecting a significant shift in consumer interest within the Pre-Roll category. The Apricot x Hippie Crasher Infused Pre-Roll 2-Pack (1g) remained steady at fourth place, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.