Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

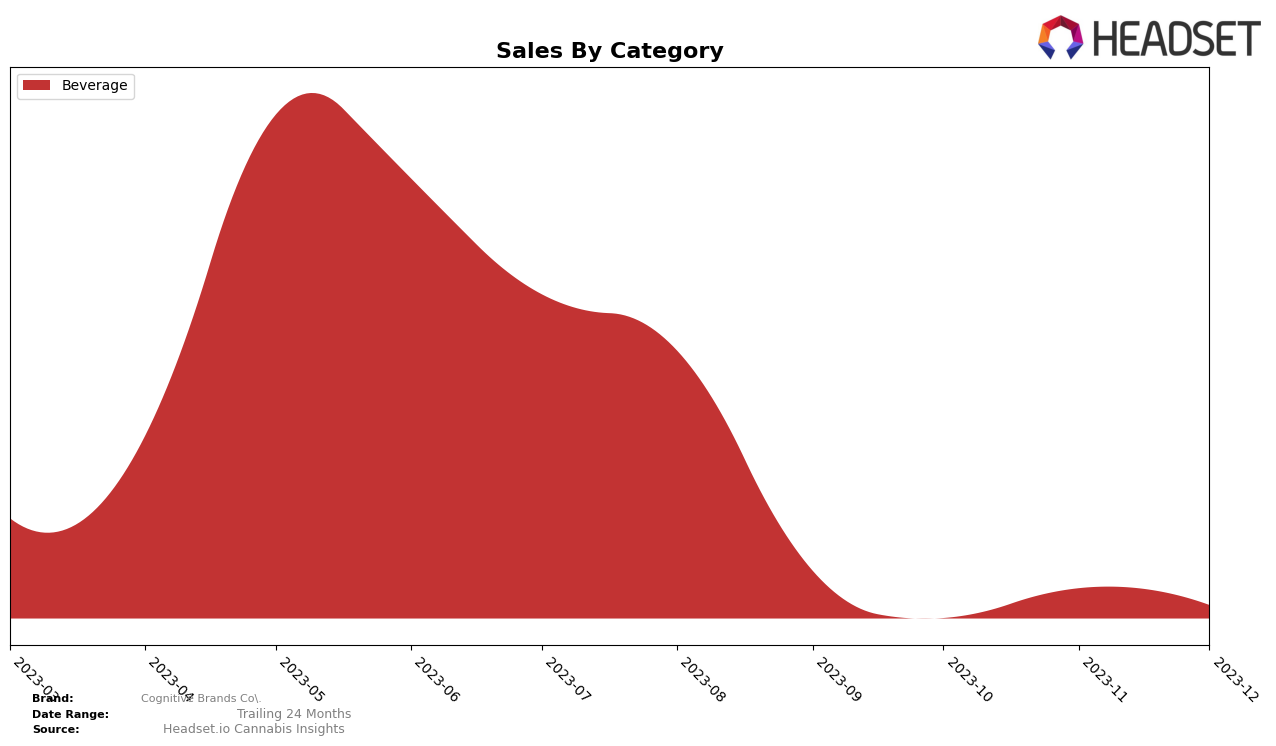

In the Beverage category, Nevada, Cognitive Brands Co. has shown a fluctuating performance over the last four months of 2023. The brand began in September with a rank of 19, dropped to 20 in October, then rose to 17 in November, and finally settled at 18 in December. This inconsistent ranking indicates a volatile market position within the top 20 brands in the state. It's worth noting that while Cognitive Brands Co. was able to maintain a presence in the top 20, the downward trend in ranking from November to December could be a point of concern.

Looking at the sales data, we can observe a similar trend. Cognitive Brands Co. started with sales of approximately $2636 in September, which dramatically dropped to $928 in October. However, the brand managed to recover in November with sales increasing to $2001, only to decline again in December to $1400. The fluctuating sales figures reflect the brand's unstable market position in the Beverage category within Nevada. These movements offer a fascinating insight into the brand's performance and potential strategies for improvement.

Competitive Landscape

In the Nevada Beverage category, Cognitive Brands Co. has shown a fluctuating performance in the last quarter of 2023. The brand started at rank 19 in September, dropped to 20 in October, but managed to climb back to 17 in November, and ended the year at rank 18 in December. This indicates a competitive market with brands like Two Roots Brewing Co. and Pamos consistently ranking higher. Interestingly, Vada has shown a similar trend to Cognitive Brands Co., with their ranks closely following each other. One notable competitor, TRYKE, was not in the top 20 brands in October, November, and December, suggesting a potential opportunity for Cognitive Brands Co. to capitalize on. While sales data is not explicitly provided, the changes in rank suggest a dynamic market with opportunities for growth and improvement for Cognitive Brands Co.

Notable Products

In December 2023, the top-performing product from Cognitive Brands Co. was the Cafe Mocha Coffee (100mg) from the Beverage category. It ranked first, with sales figures reaching 30 units, a significant improvement from its third place ranking in the previous month. The second highest performing product was the Cream & Sugar Coffee (100mg), which consistently held a top two position in the last four months. The Cognitive Black Coffee (100mg), also from the Beverage category, slipped from first place in November to third place in December. This analysis reveals a dynamic competition within the Beverage category, with rankings shifting each month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.