Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

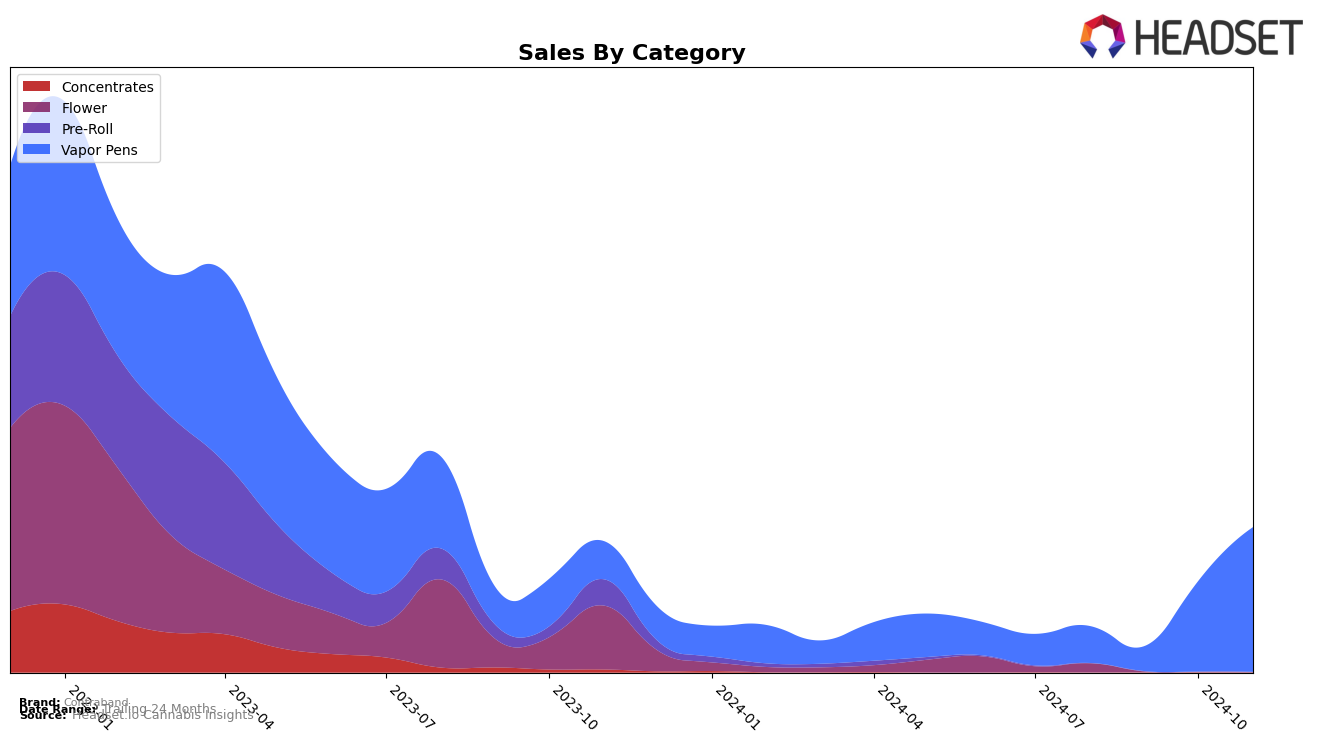

In the Canadian cannabis market, Contraband has shown varied performance across different provinces and product categories. In Alberta, the brand has been consistently outside the top 30 rankings for Vapor Pens, with its best position being 65th in November 2024. This indicates a fluctuating but relatively stable presence in the market, as it managed to climb back to its August ranking after a dip in September and October. Meanwhile, in British Columbia, Contraband made a breakthrough into the top 30 in October 2024, maintaining its position into November, which suggests a growing acceptance or strategic market penetration in this region.

In Ontario, Contraband's presence in the Vapor Pens category was marked by a notable re-entry into the rankings in November 2024, securing the 76th position after being absent in September and October. This resurgence could be indicative of a successful marketing strategy or product launch that has resonated with consumers. The absence of rankings in certain months for both British Columbia and Ontario highlights the competitive nature of these markets and suggests areas for potential growth. Overall, the brand's performance across these provinces demonstrates a mixed trajectory, with opportunities for improvement and strategic expansion.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Contraband has shown a notable upward trajectory in recent months. After not ranking in the top 20 for August and September 2024, Contraband made a significant leap to 30th place in October and improved further to 29th in November. This rise is indicative of a positive trend in sales, as evidenced by a substantial increase from October to November. In contrast, Flyte and Zyre have experienced fluctuating rankings, with Flyte dropping from 23rd in August to 27th in November, and Zyre moving from 24th in August to 28th in November. Meanwhile, Woody Nelson and Uncle Bob have also shown variable performance, with Woody Nelson peaking at 29th in October before falling to 31st in November, and Uncle Bob debuting at 37th in October and climbing to 30th in November. These dynamics suggest that while Contraband is gaining momentum, other brands are experiencing mixed results, potentially opening opportunities for Contraband to capture more market share in the coming months.

Notable Products

In November 2024, the top-performing product for Contraband was LA Confidential Live Resin Disposable (1g), maintaining its rank at number one with notable sales figures of 2662 units. Golden Apple BLNT Distillate Disposable (1g) remained steady at the second position, showing a significant increase in sales from previous months. Sunset Octane Live Resin Cartridge (1g) held the third spot, consistent with its performance in October. White Berry Live Resin Cartridge (1g) continued its descent in rankings, landing at fourth place in November. Meanwhile, Cali OG Live Resin Cartridge (1g) re-entered the rankings at fifth place after being unranked in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.