Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

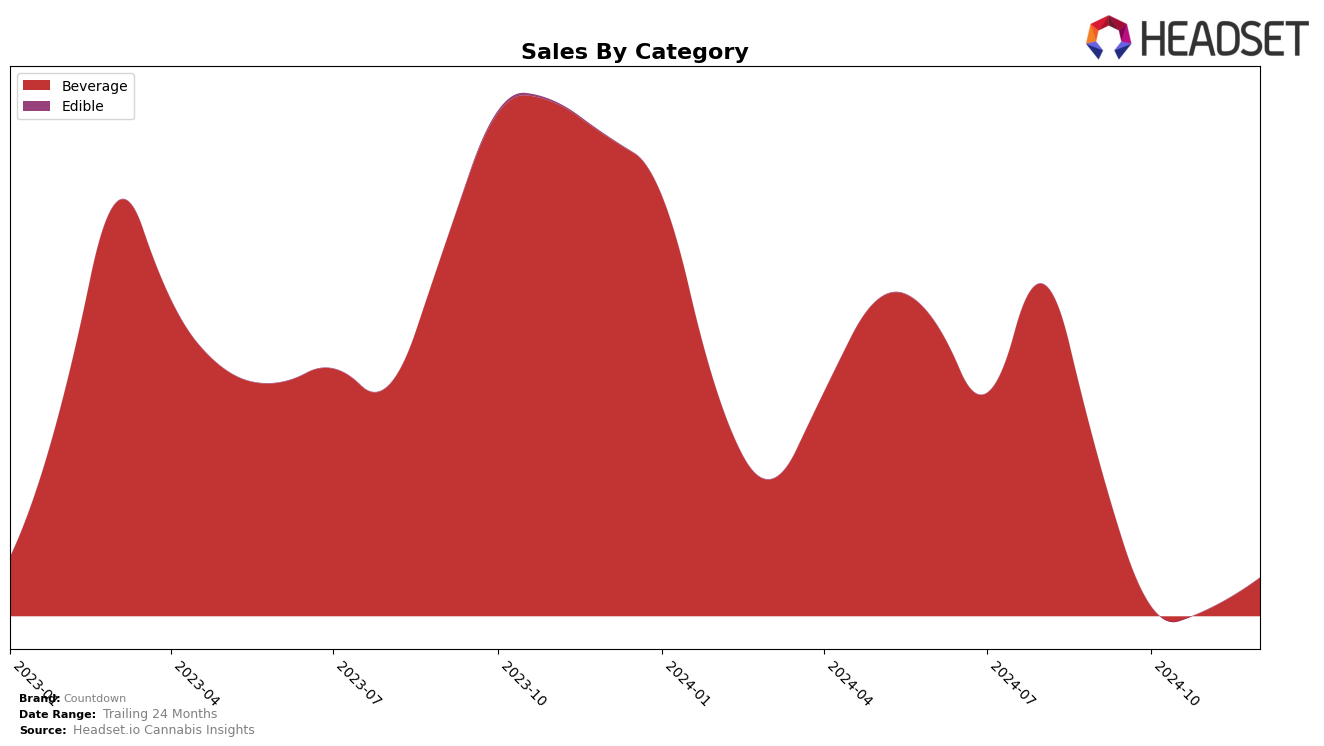

Countdown has shown a notable presence in the cannabis beverage category in Missouri, where it held a strong position at rank 6 in September 2024. However, the absence of rankings in the subsequent months of October, November, and December suggests a potential decline in its market penetration or increased competition that may have edged it out of the top 30 brands. This fluctuation indicates a need for strategic adjustments to regain or maintain its competitive edge in the state. Such shifts are crucial for understanding the dynamics of consumer preferences and the competitive landscape in Missouri's cannabis beverage market.

Despite the lack of rankings in the latter months, the September sales figure of $22,512 highlights Countdown's capability to generate significant revenue when well-positioned. The absence from the top 30 in the following months could be a red flag for the brand's market strategy or an indication of seasonal demand changes that affected its performance. Observing these trends can provide insight into the challenges Countdown faces in maintaining a consistent presence in the competitive cannabis beverage sector. By analyzing these movements, industry stakeholders can better understand the factors influencing brand performance across different states and categories.

Competitive Landscape

In the Missouri beverage category, Countdown experienced a notable shift in its competitive standing over the last quarter of 2024. Initially ranked 6th in September, Countdown did not maintain a position in the top 20 for the subsequent months, indicating a significant drop in visibility and possibly sales. This contrasts sharply with competitors like Drink Loud, which maintained a strong presence in the top ranks, only slipping from 2nd to 6th place by December, and High Five (MO), which improved its rank from 8th to 5th by November and held steady through December. The consistent performance of these competitors suggests they are capturing more market share, potentially at Countdown's expense. This trend highlights the need for Countdown to reassess its market strategies to regain its competitive edge in Missouri's beverage market.

Notable Products

In December 2024, the top-performing product from Countdown was Cosmic Lemonade Seltzer (100mg THC, 12oz) in the Beverage category, which climbed to the number one rank with notable sales of 274 units. This product improved from its previous second-place ranking in November 2024. Orange Blast Seltzer (25mg THC, 8.5oz), which had maintained the top spot from September through November, slipped to second place in December with 71 units sold. The Berry Force Seltzer (50mg THC, 12oz) did not rank in December, despite being in the top four in previous months. Overall, the rankings show a dynamic shift in consumer preference, with Cosmic Lemonade Seltzer overtaking the previously dominant Orange Blast Seltzer.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.