Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

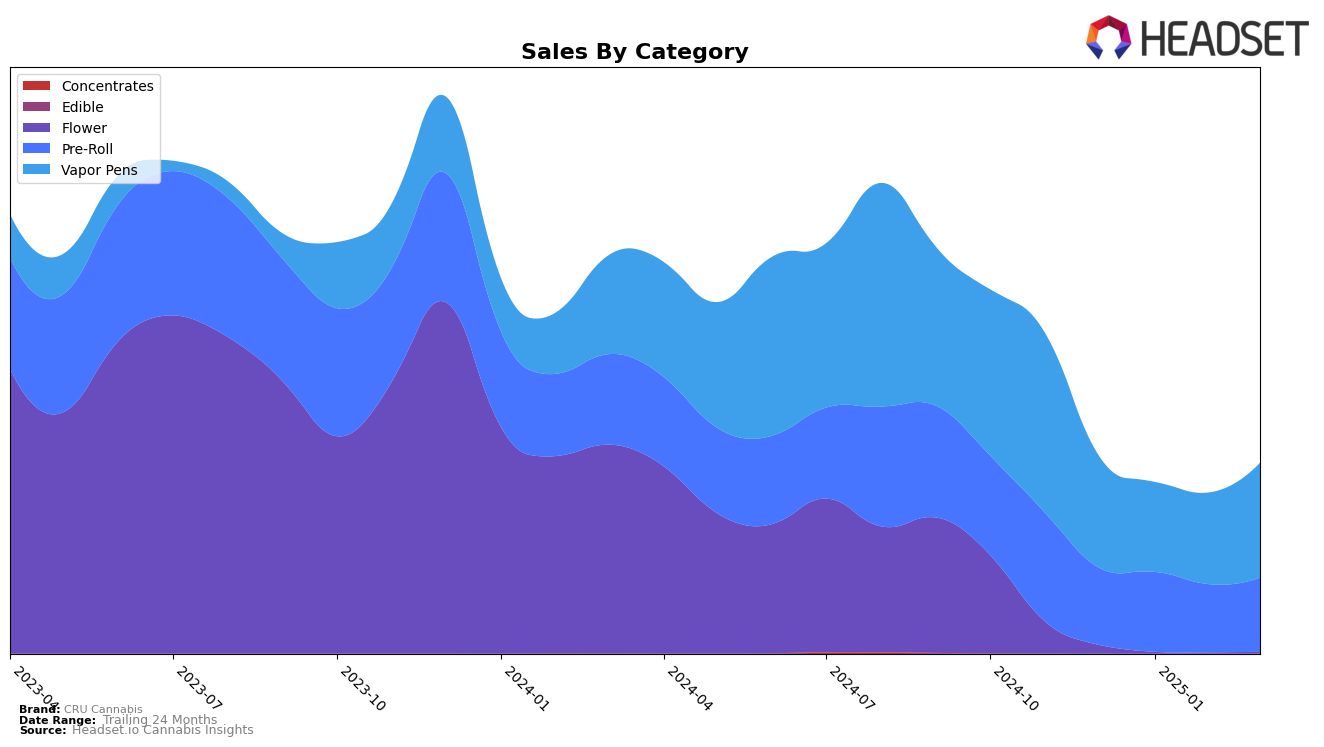

CRU Cannabis has shown a mixed performance in the New York market across different categories. In the Pre-Roll category, the brand has consistently maintained a presence within the top 30, with rankings fluctuating between 26th and 29th from December 2024 to March 2025. Notably, there was an improvement in March 2025, where the brand climbed to 27th place from 29th in February, which could indicate a positive trend. However, in the Vapor Pens category, CRU Cannabis faced a slight decline in January 2025, dropping to 29th before falling out of the top 30 in February. Fortunately, the brand managed to recover by March 2025, regaining a spot at 29th. This fluctuation suggests a competitive landscape in the Vapor Pens category, where maintaining a steady ranking poses a challenge.

Sales figures for CRU Cannabis in New York reveal interesting dynamics. In the Pre-Roll category, sales dipped slightly in February 2025 but rebounded strongly in March, reflecting a potential seasonal or promotional influence. Meanwhile, the Vapor Pens category experienced a notable sales increase in March 2025, despite the earlier ranking challenges. This surge in sales might hint at successful marketing efforts or consumer preference shifts favoring CRU Cannabis products. The brand's ability to recover its ranking in the Vapor Pens category, coupled with the sales growth, underscores its resilience and potential for further advancement in this competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in New York, CRU Cannabis has experienced notable fluctuations in its ranking over the past few months. Starting at 26th place in December 2024, CRU Cannabis saw a decline to 32nd in February 2025 but rebounded to 29th by March 2025. This volatility is contrasted by the steady ascent of Olio, which improved its rank from 35th to 30th over the same period, indicating a strong upward momentum. Meanwhile, Jetty Extracts maintained a relatively stable position, peaking at 21st in February before dropping to 27th in March. Hudson Cannabis also showed a positive trend, climbing from 36th to 28th. Despite CRU Cannabis's sales increase in March, the brand's fluctuating rank suggests a need for strategic adjustments to maintain competitiveness against these rising brands in the New York vapor pen market.

Notable Products

In March 2025, the top-performing product for CRU Cannabis was the Blackberry Diesel Infused Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank from previous months with sales of 1764 units. The Purple Martian Infused Pre-Roll (0.5g) climbed to the second position, showcasing a significant increase in sales compared to previous months. Super Silver Haze Infused Pre-Roll (0.5g) dropped to third place, despite consistent performance. Orange Dream Infused Pre-Roll (0.5g) held steady at fourth place, showing a gradual increase in sales over the months. A new entry, Lemon Cherry Gelato Infused Pre-Roll (1g), debuted at fifth place, indicating a promising start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.