Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

DayDay's performance in the Oil category shows a steady presence across Canadian provinces, with some fluctuations in ranking positions. In Alberta, the brand maintained a consistent rank around the 11th and 12th positions from August to November 2025. However, sales figures reveal a slight dip in November compared to August, indicating potential challenges in sustaining growth. Meanwhile, in British Columbia, DayDay's ranking showed improvement, peaking at 8th place in September and October before slightly dropping in November. This suggests a competitive edge in the British Columbia market, despite a notable decrease in sales from October to November. In Ontario, DayDay's rank remained stable at 12th place throughout the months, highlighting a consistent market presence but also indicating limited upward movement in the rankings.

In the Vapor Pens category in Ontario, DayDay's performance saw more volatility. Starting at the 93rd position in August, the brand climbed to 74th in September, indicating a significant improvement. However, the subsequent months saw a drop to 83rd and then 84th place, suggesting challenges in maintaining the momentum. The sales data for this category shows a peak in September, which aligns with the highest ranking, followed by a decline in the following months. This fluctuation highlights the competitive nature of the Vapor Pens market in Ontario and suggests that DayDay may need to focus on strategies to stabilize and improve its position in this segment. Notably, the absence of DayDay in the top 30 for this category in any province except Ontario suggests a limited reach or impact outside this region.

Competitive Landscape

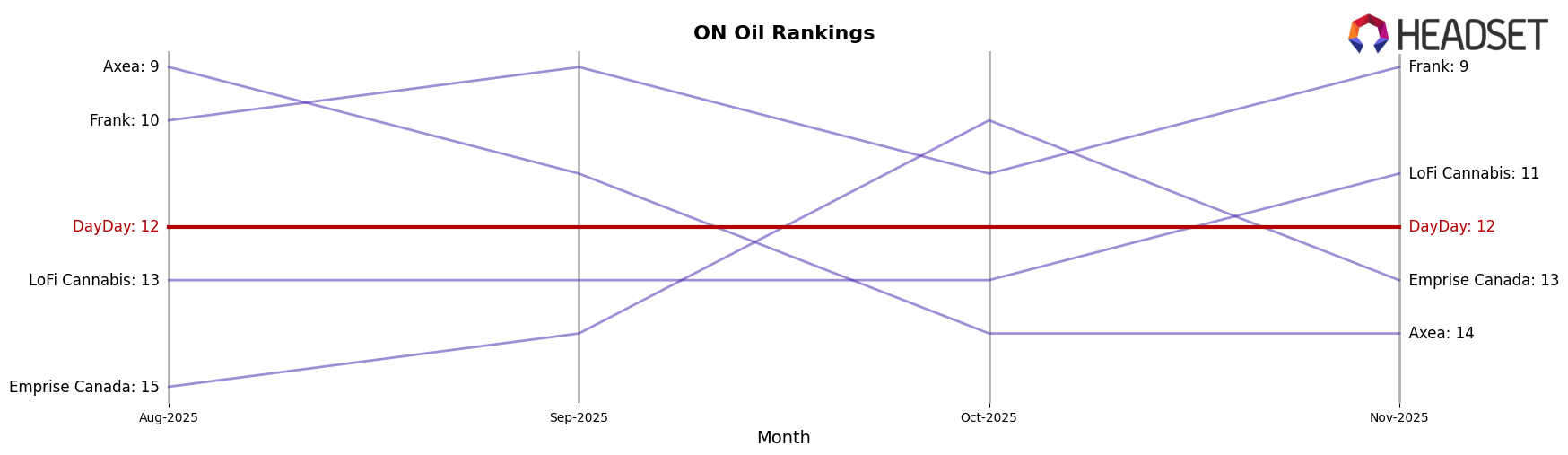

In the competitive landscape of the oil category in Ontario, DayDay has maintained a consistent rank of 12th place from August to November 2025. This stability in ranking indicates a steady performance, though it highlights a need for strategic initiatives to climb higher in the rankings. Notably, Frank has consistently outperformed DayDay, securing a top 10 position throughout the same period, with a notable sales surge in November. Meanwhile, Emprise Canada experienced a significant rank improvement from 15th in August to 10th in October, before slightly dropping to 13th in November, suggesting potential volatility in their market strategy. Axea and LoFi Cannabis have shown fluctuations in their rankings, with Axea dropping from 9th to 14th and LoFi Cannabis improving from 13th to 11th by November. These shifts in competitor rankings and sales volumes underscore the dynamic nature of the market, presenting both challenges and opportunities for DayDay to enhance its competitive positioning and capture a larger market share.

Notable Products

In November 2025, DayDay's top-performing product was the CBG:CBD 1:1 Full Spectrum Oil (30ml) in the Oil category, maintaining its first-place rank for four consecutive months despite a slight decline to 1776 in sales. The CBD/CBG/THC Mango Kush Full Spectrum Cartridge (1g) remained consistently in second place across the same period, showing stable performance in the Vapor Pens category. The THC/CBG/CBD 1:1:1 Elev8 Oil (30ml) also held its third-place position, indicating steady demand within the Oil category. Notably, the CBG+CBD Infused Pre-Roll 5-Pack (2.5g) appeared in the rankings in August but dropped out of the top positions in subsequent months. Overall, DayDay's top products demonstrated consistent rankings, with the top three maintaining their positions from August through November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.