Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

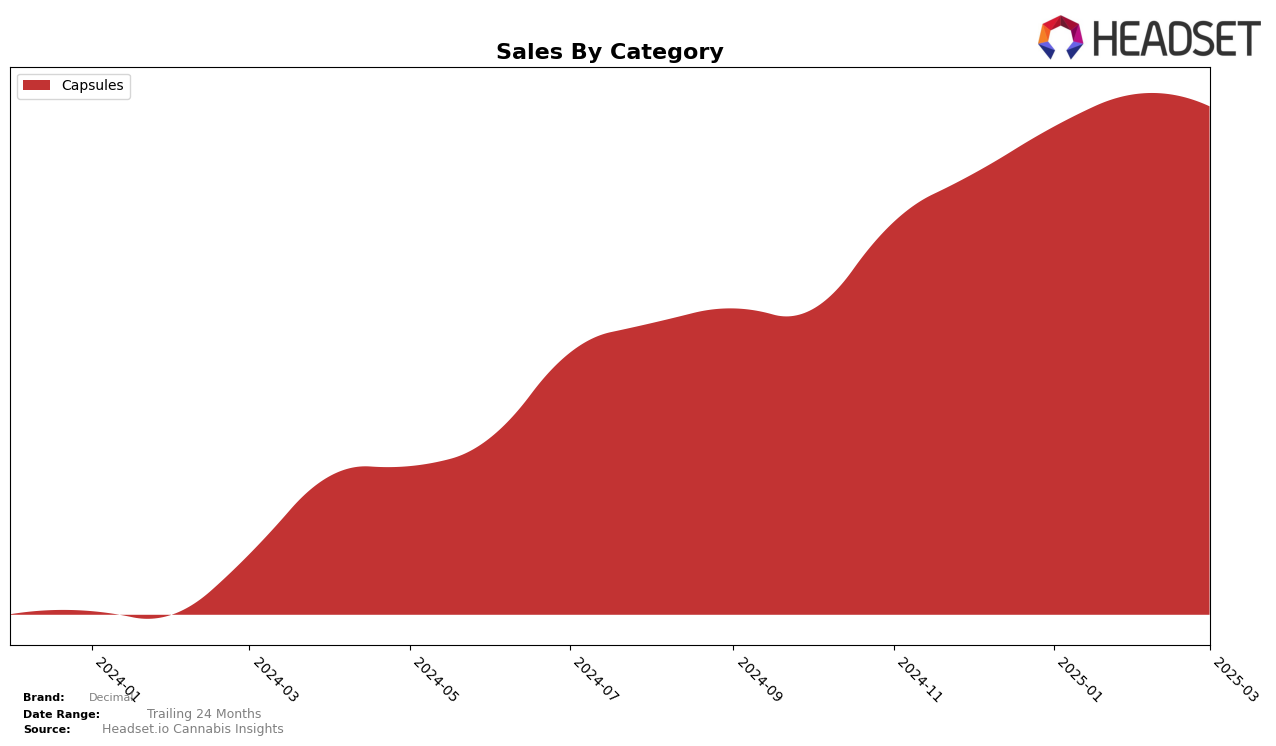

Decimal has shown a consistent performance in the Capsules category in Ontario, maintaining its rank at seventh place from January through March 2025. This stability suggests a strong foothold in the market, as the brand improved from a ninth-place ranking in December 2024. Such a steady position within the top ten indicates a robust demand for their products, reflecting positively on their market strategy. Despite the competitive landscape, Decimal's ability to hold its rank suggests that their product offerings resonate well with consumers in Ontario.

However, it is important to note that Decimal's presence is not highlighted in other states or provinces, as they do not appear within the top 30 brands in any additional markets for the Capsules category. This absence could be viewed as a limitation in their geographical reach or market penetration outside of Ontario. While the sales figures indicate a positive trajectory in Ontario, with a notable increase from December 2024 to February 2025, their lack of ranking in other regions may suggest potential areas for growth and expansion. Understanding the factors contributing to their success in Ontario could provide valuable insights for replicating this performance in other regions.

Competitive Landscape

In the competitive landscape of the Capsules category in Ontario, Decimal has shown a promising upward trend, moving from the 9th position in December 2024 to securing the 7th spot by January 2025, where it has maintained its rank through March 2025. This improvement in rank suggests a positive reception and growing consumer preference for Decimal's products. In contrast, Dosecann experienced fluctuations, dropping from 7th to 9th before slightly recovering to 8th place by March 2025. Meanwhile, Emprise Canada consistently held the 5th position, indicating a stable market presence. Despite Decimal's lower sales compared to top competitors like Emprise Canada and Indiva, which have sales figures significantly higher, Decimal's consistent rank improvement signals potential for further growth and market penetration. This trend positions Decimal as a brand to watch in the coming months, as it continues to close the gap with its higher-ranked competitors.

Notable Products

In March 2025, Decimal's top-performing product was the THC Capsules 90-Pack (900mg), maintaining its first-place rank consistently since December 2024 with sales of 907 units. The CBD:THC 1:1 Balance Softgels 30-Pack (150mg CBD, 150mg THC) secured the second position, showing a steady increase in sales from previous months. The THC 10 Softgels 30-Pack (300mg) held firm in third place, despite a slight dip in sales compared to February 2025. The CBD/THC 5:5 Balanced Softgels 90-Pack (450mg CBD, 450mg THC) and CBD Capsules 90-Pack (1800mg CBD) remained in fourth and fifth positions respectively, with the former seeing a notable increase in sales. Overall, Decimal's top products have shown consistent performance with only minor fluctuations in rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.