Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

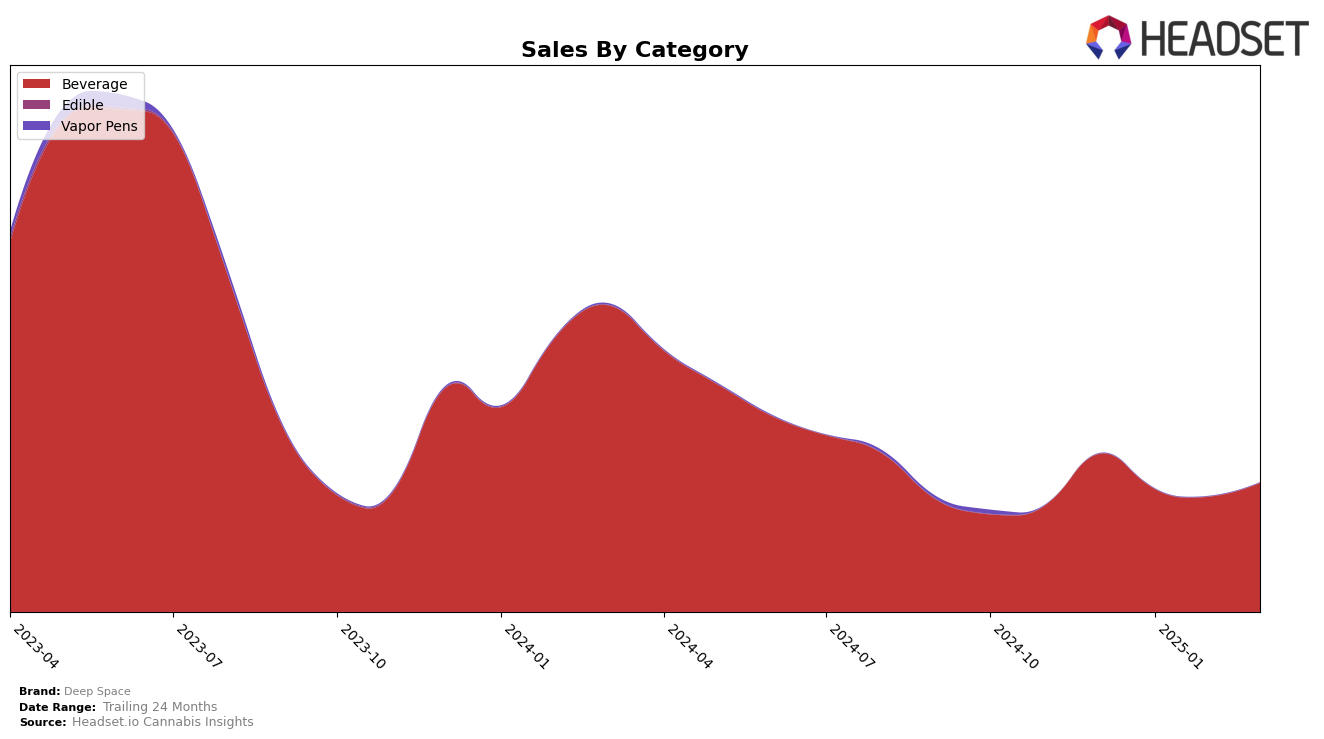

In the Canadian market, Deep Space has shown a consistent presence in the Beverage category, particularly in Alberta. Throughout the months from December 2024 to March 2025, Deep Space maintained a steady rank, hovering around the 8th position, with a slight improvement in March where it moved up to 7th place. This upward movement in March was accompanied by a notable increase in sales, suggesting a positive reception of their products in this region. This steady performance in Alberta indicates a strong foothold in the province's beverage sector, signaling potential for further growth.

Conversely, in Ontario, Deep Space's performance in the Beverage category has been more volatile. The brand fluctuated between 19th and 22nd place from December 2024 to March 2025, indicating challenges in maintaining a consistent ranking in this competitive market. Despite these fluctuations, the brand managed to regain its December position by March, hinting at potential strategies that might have been implemented to stabilize their market presence. However, it's noteworthy that they did not break into the top 18 during this period, which could suggest areas for improvement or increased competition in Ontario's beverage market.

Competitive Landscape

In the competitive landscape of the Alberta beverage category, Deep Space has demonstrated a notable upward trajectory in its market position. From December 2024 to March 2025, Deep Space improved its rank from 8th to 7th, indicating a positive shift in consumer preference and brand strength. This advancement is particularly significant when compared to competitors like Sense & Purpose Beverages, which experienced a decline from 7th to 8th place during the same period. Despite maintaining a consistent 9th position, Summit (Canada) saw a decrease in sales, contrasting with Deep Space's robust sales growth. Meanwhile, Zele and Bubble Kush have maintained higher ranks, but Deep Space's steady climb suggests potential for further advancement. These insights underscore Deep Space's growing influence and potential for continued success in the Alberta beverage market.

Notable Products

In March 2025, Deep Space's top-performing product was the Propulsion - THC/CBG 1:1 Cosmic Cherry Lime Soda, maintaining its number one rank since December 2024, with sales reaching 6112 units. The Pulsar Peach Soda also consistently held the second position throughout these months, showing a recovery in sales from February to March. The Root Beer Soda and Cream Soda remained stable in the third and fourth ranks, respectively, with slight increases in sales figures. The Orange Orbit Beverage showed a significant drop in sales, retaining its fifth position but with only 70 units sold in March 2025. Overall, the rankings have remained unchanged since December 2024, indicating a steady consumer preference for these top beverages.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.