Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

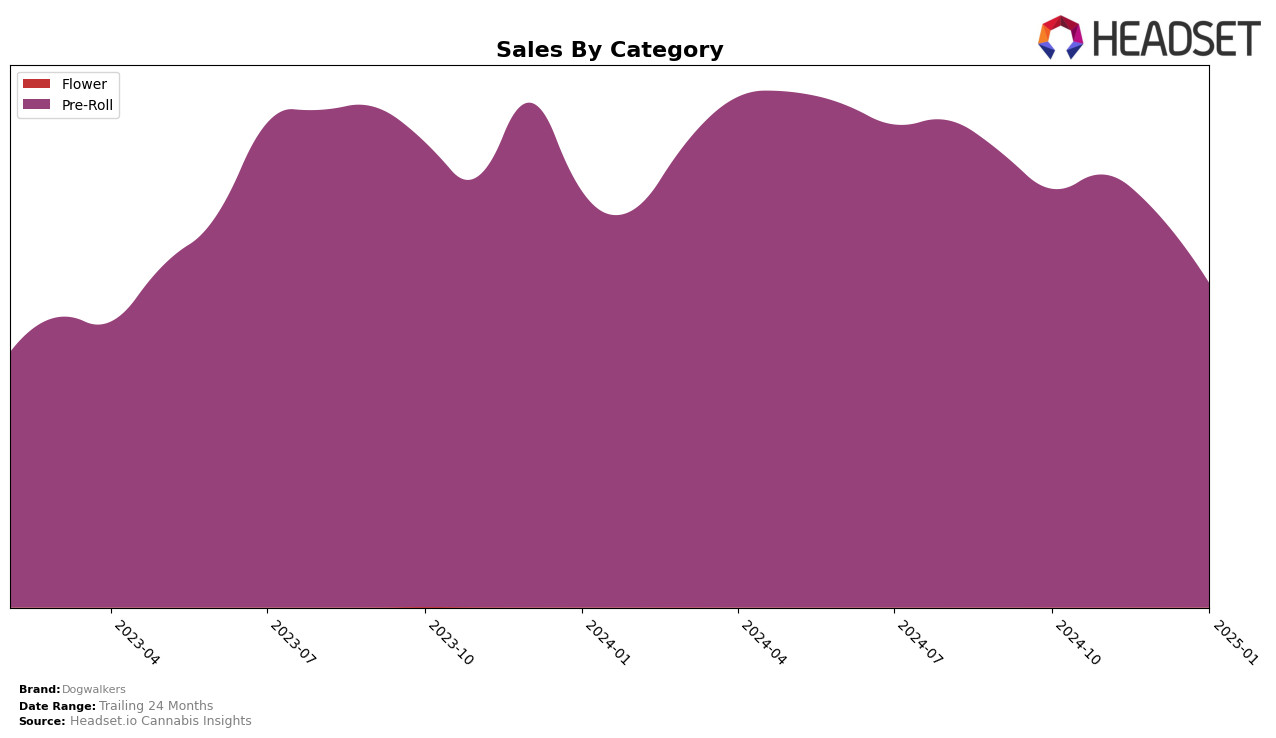

Dogwalkers has shown a strong performance in the Illinois and Maryland markets, consistently holding the top rank in the Pre-Roll category from October 2024 to January 2025. However, despite maintaining the leading position in these states, there has been a noticeable decline in sales figures over the months, particularly in Illinois, where sales decreased from $3,171,189 in October to $2,209,078 in January. In contrast, in Nevada, Dogwalkers has maintained a steady third-place ranking, with sales figures showing slight fluctuations but overall stability. This indicates a strong foothold in these states, though the declining sales in Illinois and Maryland suggest potential challenges that could be affecting consumer demand or market dynamics.

In Massachusetts, Dogwalkers has seen a gradual improvement in its ranking within the Pre-Roll category, moving from 14th place in November to 11th place by January. This upward trend, alongside relatively stable sales figures, points to a growing acceptance and popularity of the brand in the state. Conversely, the brand's performance in New York has been less favorable, as it failed to break into the top 30 rankings consistently, with positions fluctuating around the 35th to 41st range. This suggests that Dogwalkers may face stronger competition or market entry barriers in New York, highlighting a potential area for strategic focus if the brand aims to enhance its presence there.

Competitive Landscape

In the Illinois pre-roll category, Dogwalkers has maintained a consistent top position from October 2024 to January 2025, showcasing its strong brand presence and customer loyalty. Despite a downward trend in sales over these months, Dogwalkers has successfully retained its rank, indicating a robust market strategy that keeps it ahead of competitors. Notably, Ozone consistently held the second position during this period, with sales figures significantly lower than Dogwalkers, suggesting that while Ozone is a formidable competitor, it has not yet closed the gap in market leadership. Meanwhile, Rythm showed a positive trajectory by climbing from sixth place in October 2024 to third place by November 2024, maintaining that rank through January 2025. This upward movement by Rythm highlights a potential emerging threat to Dogwalkers' dominance, as it reflects growing consumer interest and competitive pricing or marketing strategies that could impact Dogwalkers if not addressed proactively.

Notable Products

In January 2025, Dogwalkers' top-performing product was the Mini Dog - Afternoon Delight #4 Pre-Roll 5-Pack, which rose to the number one rank with sales of 16,380 units. The Big Dog - Animal Face Pre-Roll showed significant improvement, climbing to the second position from fifth in the previous two months, with a notable increase in sales. The Mini Dog - Brownie Scout Pre-Roll 5-Pack, although dropping to the third rank, maintained strong sales figures. The Mini Dog - Animal Face Pre-Roll 5-Pack, which held the top position for three consecutive months, fell to fourth place in January. Lastly, the Mini Dog - L'Orange Pre-Roll 5-Pack entered the rankings for the first time, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.