Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

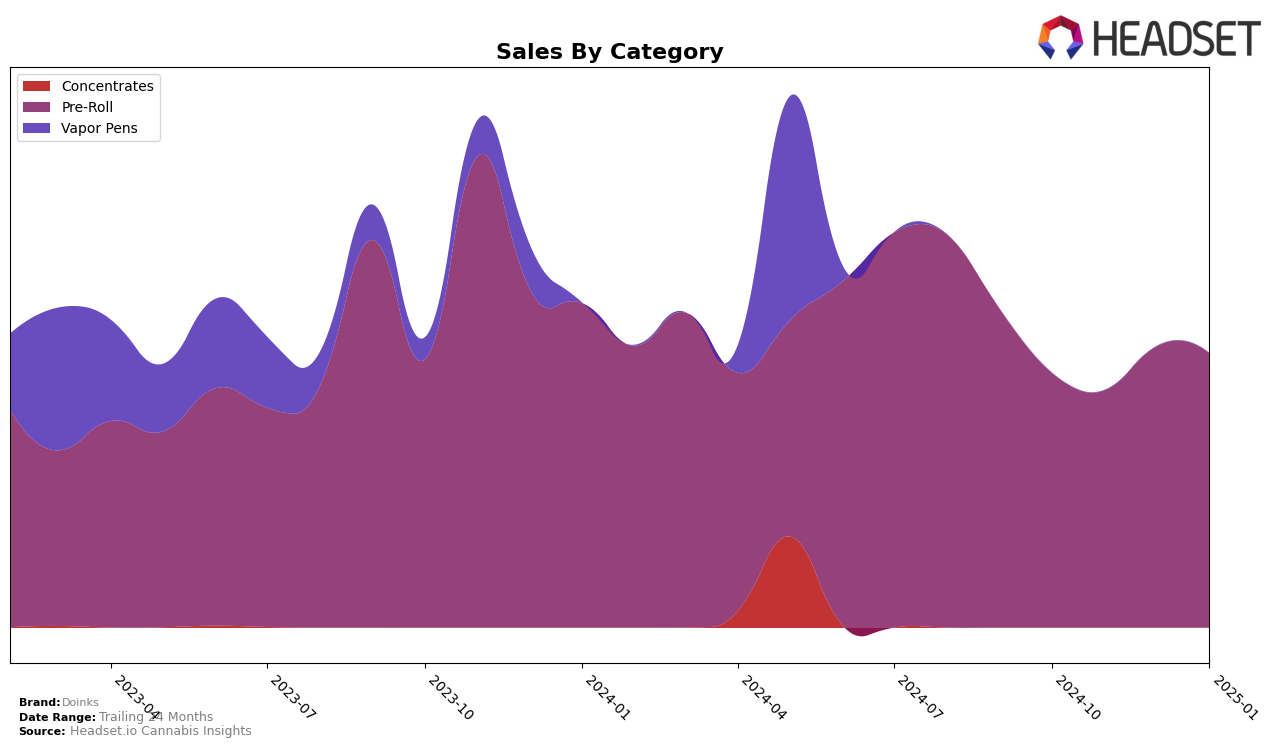

In examining Doinks' performance across various states, a notable trend emerges in the Nevada market. The brand has shown significant improvement in the Pre-Roll category, moving from not being in the top 30 in October 2024 to ranking 22nd by January 2025. This upward trajectory is indicative of a growing consumer base and increased brand recognition in the state. In contrast, Colorado presents a more challenging landscape for Doinks, as the brand consistently remains outside the top 30 rankings in the same category over the observed months. This persistent position suggests potential market saturation or competitive pressure in Colorado that Doinks has yet to overcome.

The category performance of Doinks in Nevada is particularly noteworthy, as it highlights a positive shift in sales momentum. The sales figures in Nevada nearly doubled from October 2024 to January 2025, a strong indicator of market penetration and consumer preference for Doinks' offerings. However, the situation in Colorado is less favorable, with declining sales figures over the same period, reflecting a need for strategic adjustments to capture a larger market share. These contrasting performances across states underline the importance of localized strategies and market-specific approaches for Doinks to enhance its overall brand positioning and growth trajectory.

Competitive Landscape

In the competitive landscape of the Nevada pre-roll category, Doinks has demonstrated a significant upward trajectory in its market rank over the past few months. Starting from a rank of 42 in October 2024, Doinks climbed to 22 by January 2025, showcasing a steady improvement in its market position. This rise is particularly notable when compared to other brands such as The Grower Circle, which fluctuated between ranks 19 and 22, and Cannavative, which saw a drop from 15 to 23 in the same period. Meanwhile, Pheno Exotic maintained a more stable ranking, moving from 30 to 21, while Panna Extracts experienced a slight decline from 21 to 24. The sales growth of Doinks, which more than doubled from October to January, suggests a strong consumer preference shift towards their products, potentially driven by effective marketing strategies or product innovations. This positive trend positions Doinks as a rising competitor in the Nevada pre-roll market, challenging established brands and capturing increasing market share.

Notable Products

In January 2025, Wild Melon Distillate Infused Blunt (1g) emerged as the top-performing product for Doinks, climbing from the fourth position in the previous two months to secure the number one spot with sales of 862 units. Rocket Pop Infused Blunt (1g) dropped slightly from its previous top positions in October and November but maintained a strong presence by ranking second. Grape Infused Blunt (1g), which had been unranked in November and December, made a notable comeback, securing the third position. The Grape OG Distillate Infused Pre-Roll 4-Pack (2g) and Blueberry Kush Distillate Infused Pre-Roll 4-Pack (2g) debuted in the rankings at fourth and fifth positions, respectively. This shift indicates a growing consumer interest in variety packs and distinct flavor profiles offered by Doinks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.