Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

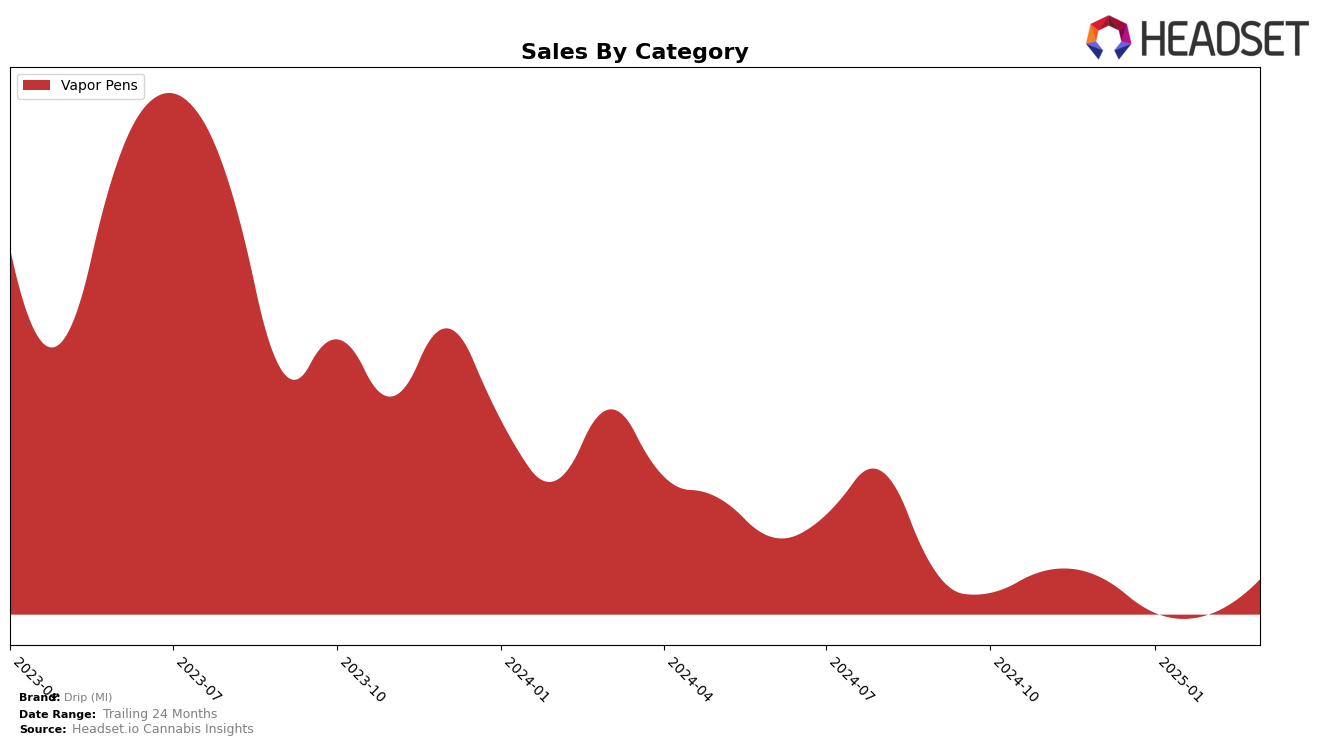

In the state of Michigan, Drip (MI) has demonstrated a consistent performance in the Vapor Pens category. The brand maintained a stable presence, ranking at number 5 in both December 2024 and March 2025, with a slight dip to number 6 in January and February 2025. This fluctuation in rankings suggests a competitive market environment, yet Drip (MI) has managed to remain within the top 10 consistently, indicating a strong foothold in this category. The sales figures reflect this stability, with a notable increase from February to March, suggesting a potential rebound or strategic adjustment that has positively impacted their market position.

Drip (MI)'s presence in other categories or states is not highlighted, as they did not rank within the top 30 brands outside of the Vapor Pens category in Michigan. This indicates that while the brand is performing well within its niche, there may be opportunities for growth or diversification that are currently untapped. The absence from top rankings in additional categories or regions could be viewed as a limitation in market reach, or it may simply reflect a strategic focus on dominating the Vapor Pens segment within Michigan. This focused strategy may be beneficial for brand identity and loyal customer base development in their primary category.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Michigan, Drip (MI) has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Drip (MI) started at rank 5 in December 2024, dropped to 6 in January and February 2025, and then regained its position at rank 5 by March 2025. This indicates a resilient performance amidst a competitive market. Notably, MKX Oil Company consistently held a strong position at rank 3 throughout the period, showcasing higher sales figures compared to Drip (MI). Meanwhile, Breeze Canna demonstrated a dynamic shift, moving from rank 3 in December 2024 to rank 4 by March 2025, reflecting a slight decline in sales but still maintaining a competitive edge above Drip (MI). Platinum Vape also showed a competitive presence, fluctuating between ranks 4 and 6, closely aligning with Drip (MI)'s movements. Despite these challenges, Drip (MI) managed to maintain its position within the top 6, indicating a stable market presence and potential for growth with strategic adjustments.

Notable Products

In March 2025, the top-performing product for Drip (MI) was the Green Crack Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking consistently from December 2024 to March 2025, with a notable sales figure of 28,396 units. Following closely, the Blue Dream Distillate Cartridge (1g) also held a steady second place throughout the same period. The Granddaddy Purple Distillate Cartridge (1g) improved its position to third place in March 2025 after dropping to fifth in February 2025. The Northern Lights Distillate Cartridge (1g) debuted in February 2025, securing the fourth spot by March 2025. The Mimosa Distillate Cartridge (1g) entered the rankings at fifth place in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.