Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

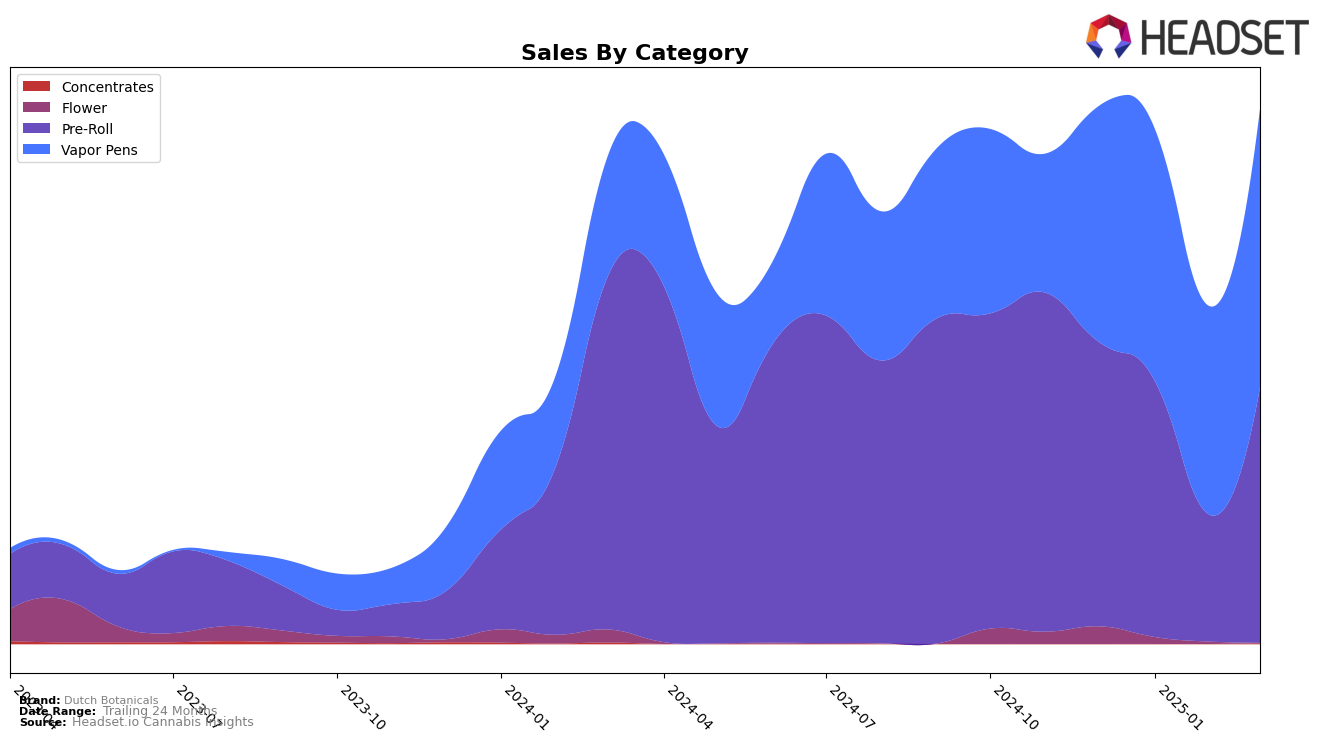

In the state of Colorado, Dutch Botanicals has demonstrated varied performance across different product categories. In the Pre-Roll category, the brand saw a dip in its ranking from 6th place in December 2024 to 18th in February 2025, before recovering to 8th place by March 2025. This fluctuation indicates a potential challenge in maintaining consistent market share, although the rebound in March suggests a positive adjustment or strategy that may have been implemented. The sales figures for Pre-Rolls also reflect this volatility, with a notable decrease in February before climbing back in March.

Conversely, Dutch Botanicals experienced an upward trend in the Vapor Pens category within Colorado. Starting from a ranking of 33 in December 2024, the brand improved its position to 27 by March 2025, consistently staying within the top 30 from January onwards. This steady climb in rankings suggests a growing acceptance or preference for their Vapor Pen products among consumers. The sales data supports this trend, showing a healthy increase from January to March, highlighting the brand's potential for future growth in this category. However, the initial absence from the top 30 in December indicates there is still room for improvement to secure a stronger foothold in the market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Dutch Botanicals has shown a commendable upward trajectory in rank from December 2024 to March 2025, moving from 33rd to 27th place. This improvement is particularly notable when compared to brands like 710 Labs, which fluctuated in rank, peaking at 17th in February 2025 before dropping to 26th in March 2025. Similarly, Tastebudz experienced a decline, moving from 16th in December 2024 to 25th by March 2025. Meanwhile, Sunshine Extracts showed a significant rise, climbing from 59th to 28th during the same period, indicating a potential emerging competitor. Despite these shifts, Dutch Botanicals' consistent improvement in rank suggests a positive reception in the market, potentially driven by strategic marketing efforts or product innovations, positioning them favorably against competitors in the Colorado vapor pen category.

Notable Products

In March 2025, Jenny's Pre-Roll (1g) emerged as the top-performing product for Dutch Botanicals, achieving the highest rank with notable sales of $15,666. Jenny's - Tangie Pre-Roll (1g) secured the second spot, while Blue Dream Pre-Roll (1g) moved down to third place from its previous second place in February. Dutch Botanicals x Jenny's - Superboof Pre-Roll (1g) saw a slight decline, dropping from second in January to fourth place in March. Jenny's - Blue Mystic Pre-Roll (1g) rounded out the top five, maintaining its position from the previous month. Overall, the rankings indicate a strong preference for Jenny's branded products within the Pre-Roll category for Dutch Botanicals in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.