Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

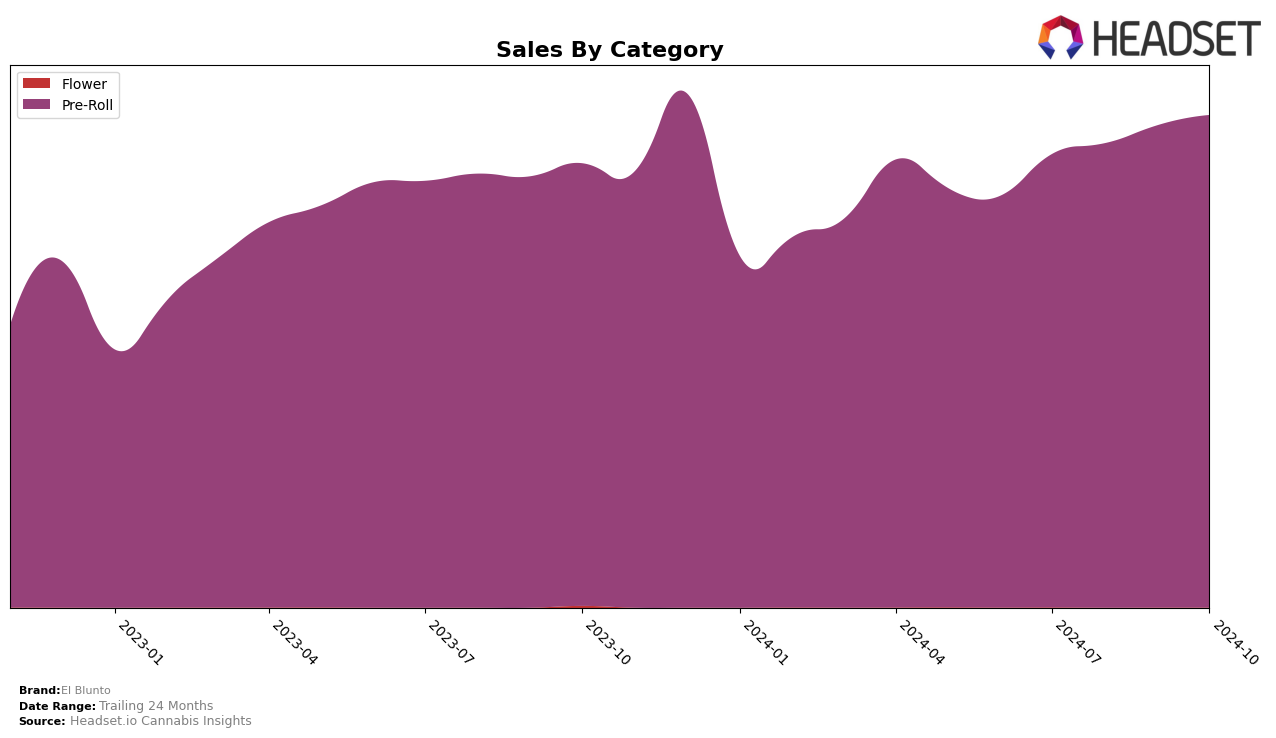

El Blunto has shown varied performance across different states and provinces, particularly in the Pre-Roll category. In Alberta, the brand's ranking fluctuated significantly, moving from 64th in July 2024 to 54th by October 2024, indicating a recovery after a dip in August. This fluctuation is accompanied by a notable increase in sales from August to September, illustrating an upward trend. In contrast, Massachusetts presents a more stable performance, with El Blunto consistently improving its ranking from 32nd in July to 22nd in October, reflecting steady growth and strengthening market presence.

In Arizona, El Blunto was not ranked in the top 30 during August and September, but made a notable comeback in October, securing the 43rd position. This suggests potential for growth or a successful marketing push during that period. Meanwhile, in Ontario, the brand maintained a consistent ranking at 43rd through September and October, suggesting a stable but not dominant market position. The performance in Missouri also indicates a positive trajectory, with the brand entering the rankings in August and improving to 37th by October, highlighting a growing acceptance in the market.

Competitive Landscape

In the competitive landscape of the pre-roll category in California, El Blunto has maintained a relatively stable position, ranking between 32nd and 35th from July to October 2024. Despite a slight dip in sales from July to September, El Blunto saw a modest recovery in October. Notably, UpNorth Humboldt has shown a consistent upward trajectory, climbing from 48th in July to 33rd in October, surpassing El Blunto in the latest month. Meanwhile, Cruisers made a significant leap from 70th in September to 32nd in October, indicating a strong surge in market presence. In contrast, Raw Garden and Blem have struggled to break into the top 30, with Raw Garden's rank fluctuating between 33rd and 37th, and Blem consistently ranking in the 40s. These dynamics suggest that while El Blunto holds a steady position, it faces increasing competition from brands like UpNorth Humboldt and Cruisers, which are gaining traction in the California pre-roll market.

Notable Products

In October 2024, El Blunto's top-performing product was the Cullinan Diamond Infused Blunt (2g) in the Pre-Roll category, maintaining its consistent rank of 1 since July with sales reaching 11,181. The El Bluntito - Viva Blunt (0.75g) held the second rank throughout the months, although its sales figures dropped significantly in October. The Especial Silver - Azul Diamond Infused Blunt (1.65g) climbed to the third position, showing a recovery in sales compared to previous months. New to the rankings, the Pink Legacy Diamond Infused Pre-Roll (2g) entered at fourth place, indicating strong market interest. Meanwhile, the Especial Silver - Rosa Diamond Infused Blunt (1.65g) slipped from fourth to fifth, despite a slight increase in sales from September to October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.