Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

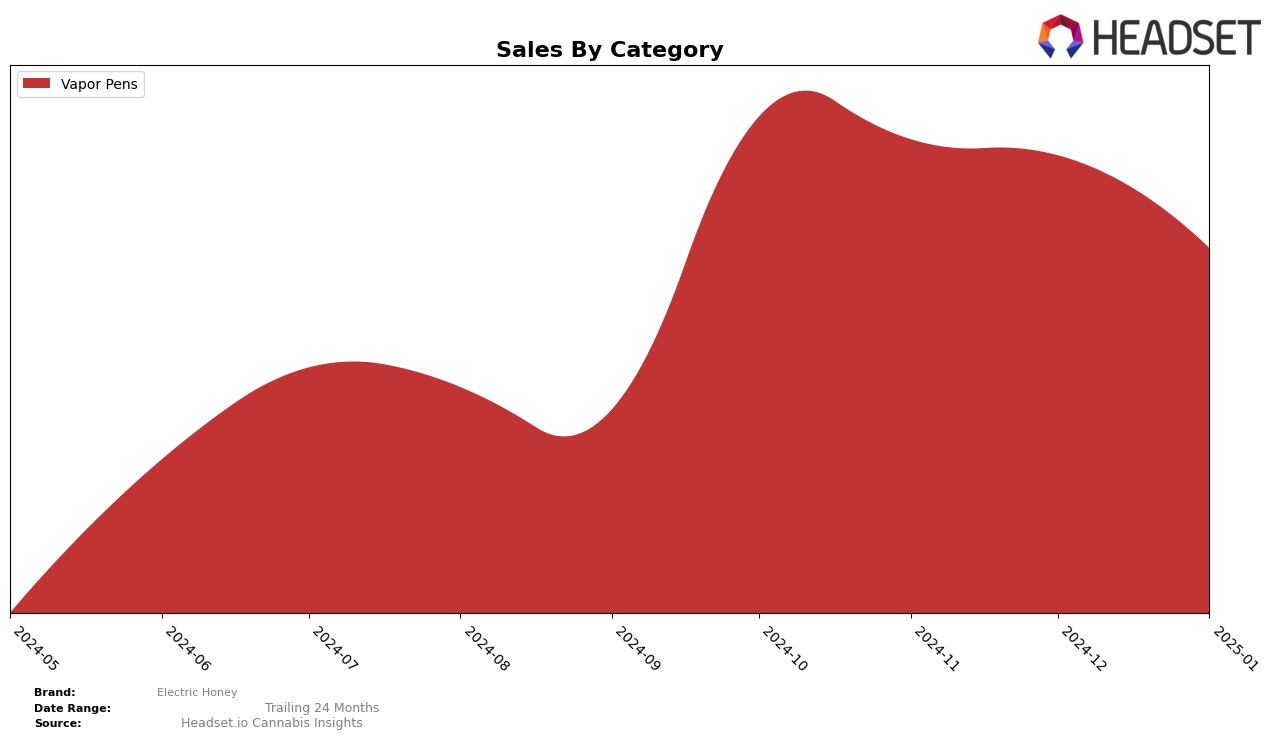

Electric Honey's performance in the Vapor Pens category in Missouri has shown a gradual decline over the past few months. Starting in October 2024, the brand was ranked 25th, but by January 2025, it had slipped to 30th. This downward trend is mirrored in their sales figures, which decreased from $335,135 in October to $247,237 by January. The consistent drop in both rank and sales suggests challenges in maintaining market share in this category. Notably, Electric Honey managed to stay within the top 30, which indicates that while they are facing stiff competition, they are still a recognized player in the Missouri market.

Electric Honey's absence from the top 30 rankings in other states and categories could be seen as a missed opportunity for growth. The lack of presence in these rankings might indicate limited geographical reach or a need for diversification in their product offerings. However, the brand's ability to maintain a presence in the Missouri Vapor Pens category suggests there is a foundation upon which to build. Exploring strategic expansions or enhancements in marketing efforts could potentially improve their standing in other regions and categories.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Electric Honey has experienced a dynamic shift in its market position over the past few months. Despite a promising start in October 2024 with a rank of 25, Electric Honey saw a slight decline to 30 by January 2025. This downward trend coincides with a decrease in sales, which could be attributed to the rising competition from brands like Pinchy's, which made a significant leap from rank 61 in October to 28 in January, showcasing a strong upward trajectory in sales. Meanwhile, Head Change maintained a relatively stable presence, hovering around the mid-20s in rank, but also saw a decrease in sales, suggesting a broader market contraction or shifting consumer preferences. Additionally, Kusch experienced volatility, dropping to rank 39 in December before recovering to 32 in January, indicating potential fluctuations in consumer loyalty or supply chain issues. As Electric Honey navigates this competitive environment, understanding these trends and the strategies of its competitors will be crucial for regaining and sustaining a higher market position.

Notable Products

In January 2025, Electric Honey's top-performing product was Energize - Blazeberry Lemonade Distillate Disposable (0.5g) in the Vapor Pens category, maintaining its first-place ranking from the previous months despite a decrease in sales to 1534 units. Following closely was Inspire - Cereal Berries Distillate Disposable (0.5g), which consistently held the second position with sales dropping to 1157 units. Relax - Magic Marsh Mellow Distillate Disposable (0.5g) improved its rank from fourth to third, indicating a positive trend despite lower sales. Relax - Glacial Peach Distillate Disposable (0.5g) slipped from third to fourth place, showing a decline in popularity. Newly ranked, Creme Pied Distillate Disposable (0.5g) entered the top five, securing the fifth position with notable sales of 603 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.