Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

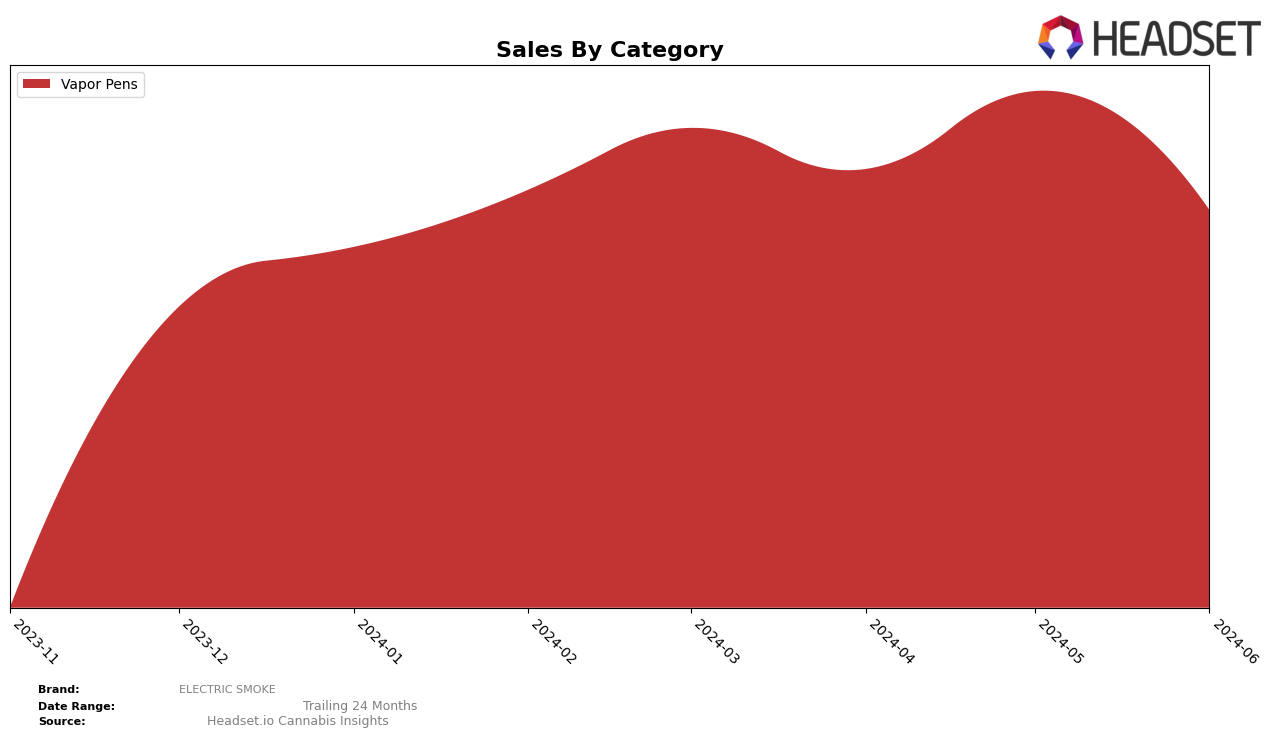

The performance of ELECTRIC SMOKE in the Vapor Pens category has shown significant fluctuations across different provinces. In Alberta, the brand has experienced a notable upward trend. Starting from a rank of 34 in March 2024, it climbed to 28 by June 2024, indicating a positive reception and increased market penetration. Contrarily, in Ontario, the brand's ranking has been more volatile. Despite a promising start at rank 32 in March, ELECTRIC SMOKE peaked at 29 in May only to drop to 37 in June. This drop suggests potential challenges in maintaining a consistent market position in Ontario.

Analyzing sales trends, ELECTRIC SMOKE's revenue in Alberta has shown a steady increase, with June sales reaching $107,197, suggesting strong consumer demand and effective market strategies. However, Ontario presents a contrasting picture where sales peaked in May at $255,087 but saw a significant decline to $157,567 in June. This decline could indicate market saturation or increased competition. The absence of ELECTRIC SMOKE from the top 30 rankings in some months highlights the competitive nature of the Vapor Pens category and the challenges the brand faces in maintaining a consistent presence across different markets.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, ELECTRIC SMOKE has experienced notable fluctuations in its ranking and sales over recent months. In March 2024, ELECTRIC SMOKE held a strong position at rank 32, improving to rank 31 in April and further climbing to rank 29 in May. However, by June, the brand saw a significant drop to rank 37. This decline contrasts with the more stable performance of competitors like Potluck, which consistently maintained its position around rank 33. Meanwhile, Papa's Herb and Roilty Concentrates have seen a downward trend, with Papa's Herb dropping out of the top 20 by May and June. Despite these fluctuations, ELECTRIC SMOKE's sales peaked impressively in May, indicating strong consumer demand before the subsequent decline in June. This dynamic market environment suggests that while ELECTRIC SMOKE has the potential for high sales, maintaining a stable rank amidst competitors requires strategic adjustments.

Notable Products

In June 2024, the top-performing product from ELECTRIC SMOKE was Juicy Grape Liquid Blunt Co2 Disposable (1g) in the Vapor Pens category, which climbed to the number one rank with notable sales of 4,274 units. This product consistently held the second position from March to May 2024, showcasing a significant rise in popularity. Creme Royale Liquid Blunt Co2 Disposable (1g), also in the Vapor Pens category, dropped to the second rank in June 2024 after maintaining the top spot for the previous three months. This shift indicates a strong consumer preference change towards Juicy Grape Liquid Blunt Co2 Disposable (1g). The sales figures for Creme Royale Liquid Blunt Co2 Disposable (1g) in June were 2,303 units, reflecting a substantial decrease from its previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.