Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

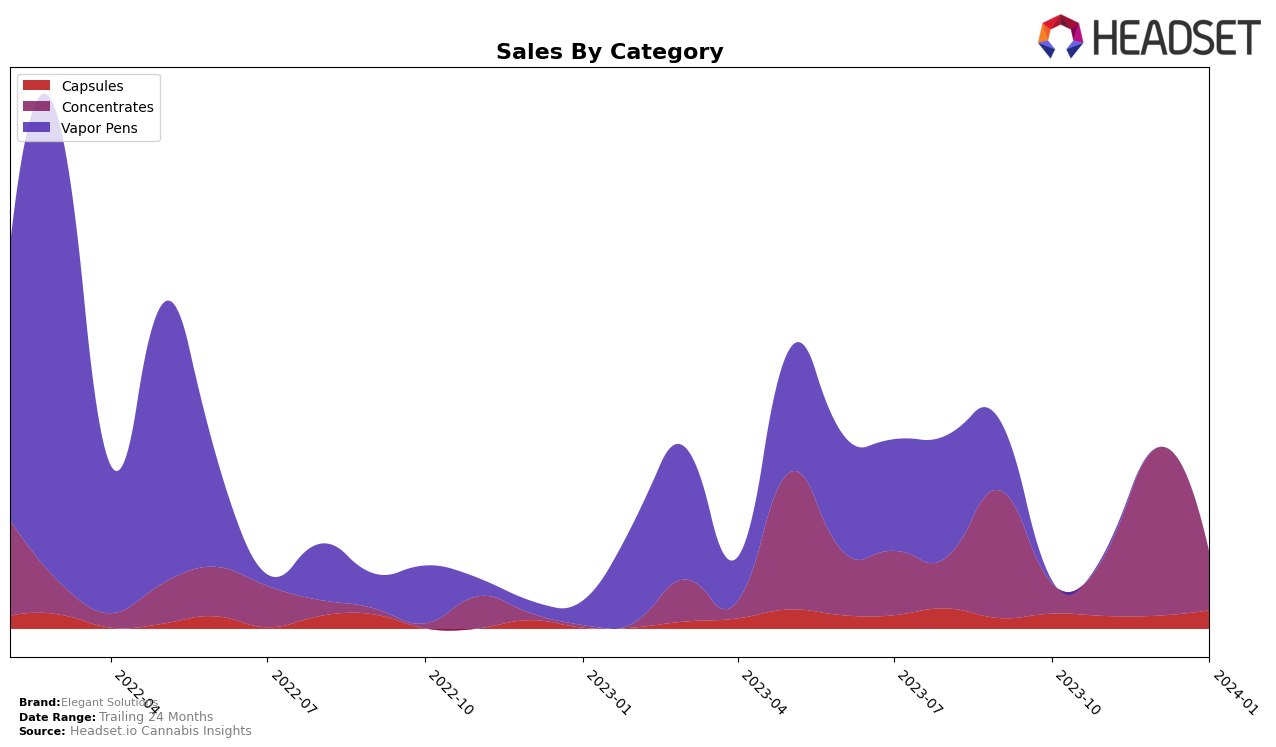

In the capsules category within Washington, Elegant Solutions has shown a commendable consistency, maintaining a presence in the top 20 brands over the last four months. Starting at a rank of 9 in October 2023, it experienced a slight dip to 11th place in November 2023, which indicates a minor fluctuation in its market positioning. However, it quickly regained its footing, returning to the 9th position in December 2023 and maintaining it into January 2024. This rebound is noteworthy, especially considering the competitive nature of the cannabis market in Washington. The sales data reveals an interesting trend; after a drop in sales in November 2023 to 573 units, sales rose to 582 units in December and significantly jumped to 831 units in January 2024, showcasing a strong start to the year for Elegant Solutions in the capsules category.

While the provided data focuses solely on the capsules category in Washington, the performance of Elegant Solutions in this segment offers valuable insights into its market dynamics and consumer preferences. The initial drop in rank and sales in November 2023 could have been influenced by various factors, including increased competition or seasonal market changes. Nevertheless, the recovery and subsequent sales increase suggest effective strategic adjustments and a resilient brand appeal among consumers. The absence of data from other states or provinces and categories means we cannot fully gauge the brand's overall market performance or its standing in different segments. However, the detailed view into its performance in the Washington capsules market hints at a brand that is capable of navigating market challenges and capitalizing on opportunities to enhance its position and sales performance.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Washington, Elegant Solutions has shown a consistent performance amidst fluctuating dynamics. Throughout the months from October 2023 to January 2024, Elegant Solutions maintained its position within the top 10 brands, oscillating between the 9th and 11th ranks, and witnessing a notable increase in sales by January 2024. Competing closely with brands like Silica Phoenix (WA), which consistently held the 8th rank with a significant rise in sales by January 2024, and Essence Entourage Extracts, which demonstrated a stronger sales performance but experienced a slight drop in rank by January 2024, Elegant Solutions has managed to hold its ground. Meanwhile, Northwest Cannabis Solutions made a notable entry into the top 10 by December 2023, showing a remarkable increase in sales by January 2024, indicating a competitive market that Elegant Solutions must navigate. The absence of Verdure from the rankings after November 2023 suggests a dynamic shift in consumer preferences or operational challenges that could impact Elegant Solutions' strategy moving forward.

Notable Products

In January 2024, Elegant Solutions saw THC Tablets 10-Pack (100mg) reclaim its top position in sales with 155 units sold, indicating a strong preference for capsule-based cannabis products among their clientele. Following closely behind in the rankings was MAC 1 Wax (1g) from the concentrates category, securing the second spot after previously leading in December 2023. The Purple Punch Crumble (1g), also a concentrate, experienced a slight dip, moving from being top-ranked in December to third in January. Notably, the White Truffle Wax (1g) maintained its fourth position, demonstrating a consistent demand within the concentrates category, despite a significant decrease in sales. These shifts in rankings highlight changing consumer preferences and the competitive dynamics within Elegant Solutions' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.