Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

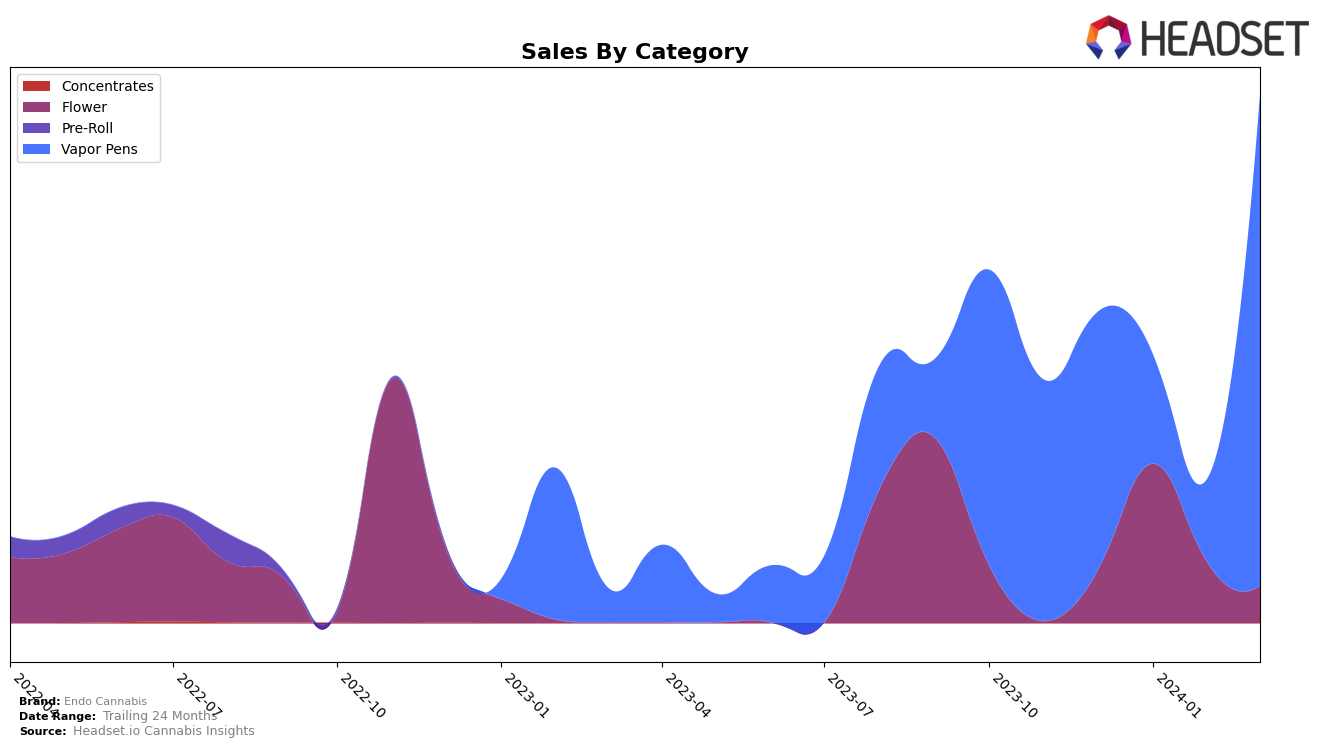

In the competitive cannabis market of Massachusetts, Endo Cannabis has shown a notable performance within the Vapor Pens category. Starting in December 2023, the brand was ranked 40th, which, while not in the top 30, still positioned it within a competitive stance among other brands. However, there was a discernible drop in ranking to 53rd in January 2024 and further down to 61st in February 2024, indicating a challenging period for the brand. Despite these setbacks, Endo Cannabis made a significant recovery in March 2024, jumping to the 26th rank. This upward movement is particularly noteworthy, not only because it marks the brand's entry into the top 30 but also because it reflects a substantial increase in sales, with March 2024 sales more than doubling from December 2023's figure of $90,227.

This trajectory suggests a remarkable turnaround for Endo Cannabis in Massachusetts, highlighting the brand's resilience and ability to rebound in the face of adversity. The initial decline in rankings and sales at the start of the year could be attributed to various market dynamics or internal challenges. However, the sharp improvement in March 2024 underscores the brand's effective strategies or market conditions favorably impacting its performance. While specific strategies or external factors contributing to this recovery are not detailed, the significant sales increase in March 2024 to $171,527 illustrates the brand's potential for growth and market penetration. This analysis underscores the importance of monitoring trends over several months to understand a brand's market position and trajectory fully.

Competitive Landscape

In the competitive landscape of Vapor Pens in Massachusetts, Endo Cannabis has shown a remarkable trajectory in terms of rank and sales, despite initial setbacks. Initially not ranking within the top 20 brands in December 2023, Endo Cannabis experienced a significant leap to 26th place by March 2024. This jump is particularly noteworthy when compared to its competitors, such as The Clear, which saw a decline from 20th to 27th place, and Hellavated, which slightly improved but remained close in rank at 28th by March 2024. Meanwhile, Glorious Cannabis Co., despite a higher starting point, only managed to reach 24th place, just two spots above Endo Cannabis by March 2024. Cresco Labs also showed modest improvement, ending at 25th place. The significant rank improvement and sales increase for Endo Cannabis in a short span highlight its potential and growing consumer interest, positioning it as a brand to watch in the Massachusetts Vapor Pens category.

Notable Products

In March 2024, the top-performing product from Endo Cannabis was the Red Pop Distillate Disposable (1g) in the Vapor Pens category, achieving remarkable sales figures of 2599 units. Following closely behind in second and third places were Sunny Sunday Distillate Disposable (1g) and Green Gary Poppins Distillate Disposable (1g), respectively, with the former climbing up from its previous third place in February 2024. Notably, Pink Pluto Distillate Disposable (1g) made its way into the top rankings, securing the fourth position after not being ranked in the previous months. The Grand Daddy Purple Distillate Cartridge (0.5g) rounded out the top five, marking its entrance into the competitive landscape. These shifts highlight dynamic consumer preferences and the competitive nature of product offerings within Endo Cannabis's Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.