Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

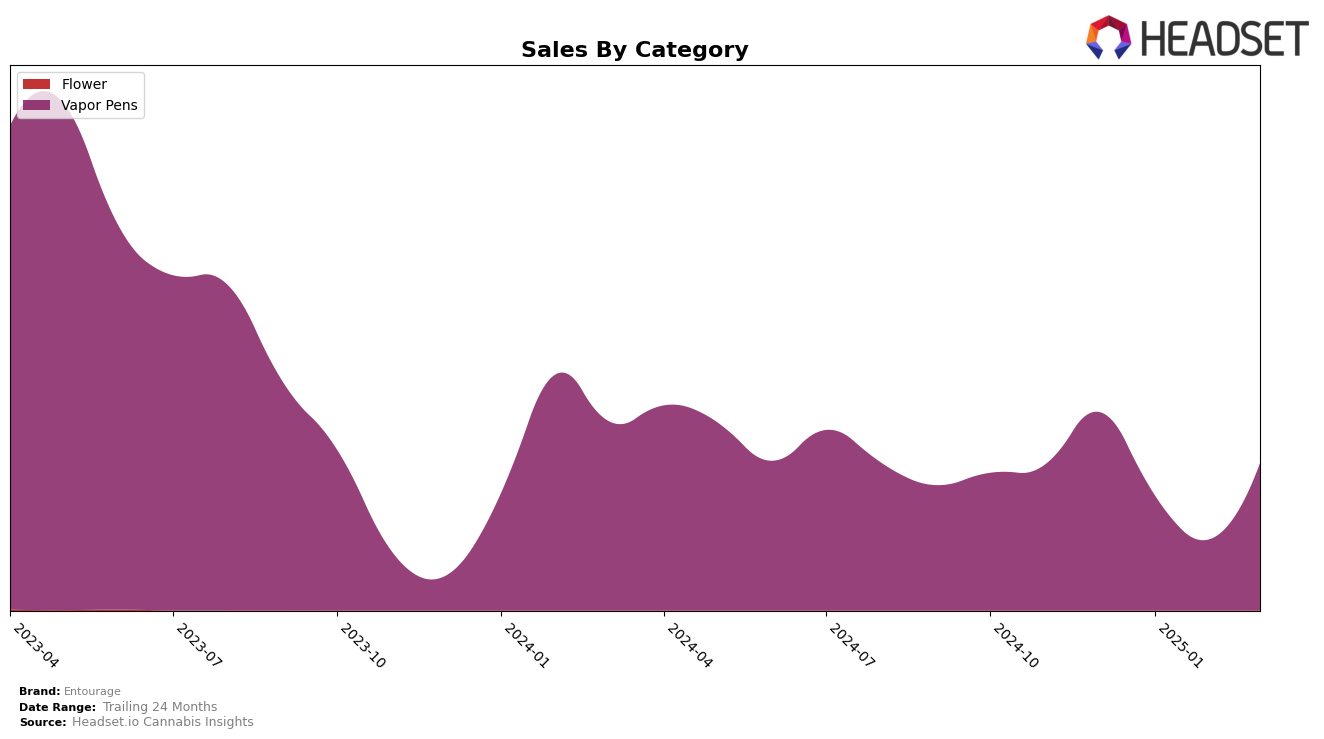

Entourage's performance in the New Jersey market for Vapor Pens has shown some variability over the past few months. In December 2024, the brand was ranked 20th, but it slipped to 29th in January 2025 and further out of the top 30 in February. However, by March 2025, it had regained its position at 20th. This fluctuation could indicate a recovery in market strategy or consumer demand. The sales figures reflect this trend, with a notable dip in January and February, followed by a rebound in March. Such movements suggest that while the brand has faced challenges, it has managed to regain its footing in this category within New Jersey.

In contrast, the performance of Entourage in the Oregon market for Vapor Pens has been less favorable. The brand did not make it into the top 30 rankings in December 2024, and while it entered at 90th in January 2025, it only improved slightly to 82nd by February. The absence from the top 30 in March indicates ongoing struggles to capture a significant market share in Oregon. Despite these challenges, there was a small increase in sales from January to February, suggesting some positive traction. However, the brand's inability to break into the top tier of rankings highlights the competitive nature of the Oregon market and the hurdles Entourage faces in establishing a stronger presence there.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Entourage has experienced notable fluctuations in its market position from December 2024 to March 2025. While Entourage started at rank 20 in December 2024, it saw a significant drop to rank 29 in January 2025 and further to 34 in February 2025, before recovering to rank 20 in March 2025. This volatility contrasts with competitors like Illicit / Illicit Gardens, which maintained a relatively stable presence within the top 20, and Clade9, which consistently ranked around 18-19 during the same period. Notably, Seed & Strain Cannabis Co. showed a positive trend, climbing from rank 22 in December 2024 to 18 in March 2025. These dynamics suggest that while Entourage has the potential for strong sales recovery, as evidenced by its March 2025 rank, it faces stiff competition from brands that have maintained or improved their market positions. Understanding these shifts can provide valuable insights for strategizing market positioning and sales efforts in the New Jersey vapor pen category.

Notable Products

In March 2025, the Blue Dream Distillate Cartridge (0.5g) maintained its top position in the Vapor Pens category for Entourage, with sales reaching 1,187 units. The Champagne Kush EHO Terp Cartridge (1g) emerged as a strong contender, securing the second spot with notable sales of 1,014 units. Following closely, the Tahoe OG Distillate Cartridge (1g) ranked third, reflecting its growing popularity. The Champagne Kush EHO Terp Cartridge (0.5g) saw a rise in its ranking from fourth position in January to fourth again in March, showing resilience despite a dip in February. Meanwhile, the White Rntz Distillate Cartridge (1g) experienced a decline, dropping from first place in February to fifth in March, indicating shifting consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.