Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

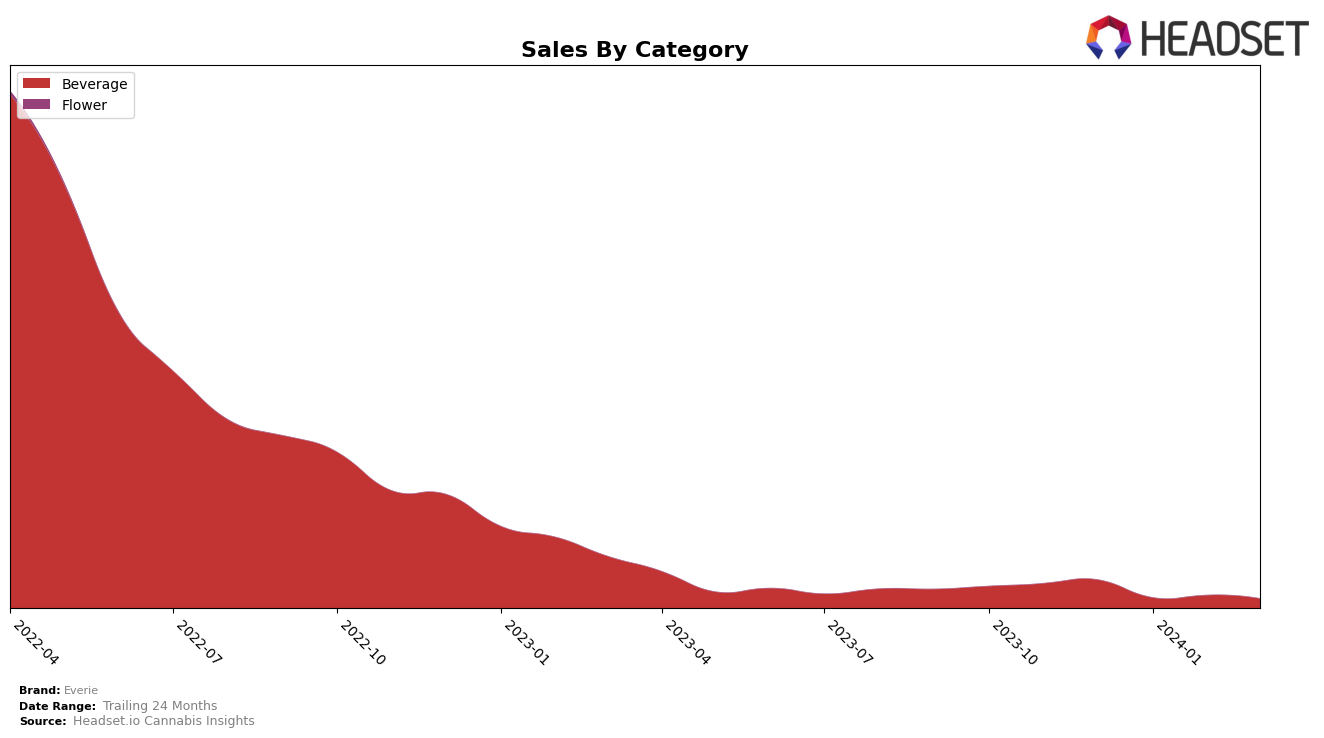

In the competitive cannabis beverage market, Everie has shown mixed performance across the Canadian provinces of Alberta, British Columbia, and Ontario. In Alberta, Everie managed to maintain a relatively stable position within the top 30 brands from December 2023 through March 2024, albeit with a slight fluctuation in rankings (27th in December, dropping to 33rd in January, then improving to 28th in February and March). This indicates a consistent presence in the Albertan market, despite facing challenges that caused a temporary dip in January 2024. The sales figures reflect a significant drop from December 2023 to January 2024, followed by a recovery in February and March, suggesting a resilience in Everie's market strategy and consumer demand in Alberta.

However, the brand's performance in British Columbia and Ontario tells a different story. In British Columbia, Everie's ranking slightly declined from 23rd in December 2023 to 30th by March 2024, barely holding onto a spot within the top 30 brands. This decline is mirrored by a stark decrease in sales from December to March, indicating a potential loss of market share or consumer interest in this region. Ontario presents an even more challenging landscape for Everie, where it was unable to secure a ranking within the top 30 brands throughout the observed period. Starting at 44th in December 2023 and slightly worsening to 47th by March 2024, the sales figures similarly show a downward trend. This performance in Ontario, Canada's largest market, highlights significant room for improvement and the need for strategic adjustments to enhance Everie's market penetration and consumer appeal in this province.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Everie has experienced a notable shift in its market position from December 2023 to March 2024, moving from rank 44 to 47. This trend indicates a decrease in its market share relative to its competitors. Noteworthy competitors include The Green Organic Dutchman, which has shown a slight improvement in rank, moving closer to Everie's position but remaining consistently behind in the rankings. House of Terpenes has demonstrated a more significant positive trajectory, moving from rank 35 in December 2023 to 43 by March 2024, indicating a growing presence in the market. Conversely, Nuveev and Steeprock Functional Coffee est. 420 have shown fluctuations but remain competitive, with Steeprock overtaking Everie in March 2024. This dynamic suggests that while Everie is facing challenges in maintaining its rank and sales, its competitors are actively capitalizing on opportunities to improve their standings in the Ontario beverage market.

Notable Products

In March 2024, Everie's top-performing product was the CBD Dragon Fruit Watermelon Sparking Beverage (10mg CBD, 269ml) in the Beverage category, maintaining its number one rank from the previous months with 108 sales. The second place was taken by CBD Peach Ginger Green Tea 3-Pack (30mg CBD), which saw a notable rise from fourth to second place since January 2024, reaching 80 sales. The third-ranked product, CBD Grapefruit Seltzer (15mg CBD, 355ml), consistently held its position from December 2023, showcasing steady demand. CBD Mint Tea 3-Pack (30mg CBD) moved up to the fourth position in March after not being ranked in January 2024, indicating a resurgence in its popularity. Lastly, CBD Lavender Chamomile Tea 3-Pack (30mg CBD) experienced a decline, dropping to the fifth position in March after previously holding the second spot, reflecting a shift in consumer preferences within Everie's beverage offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.