Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

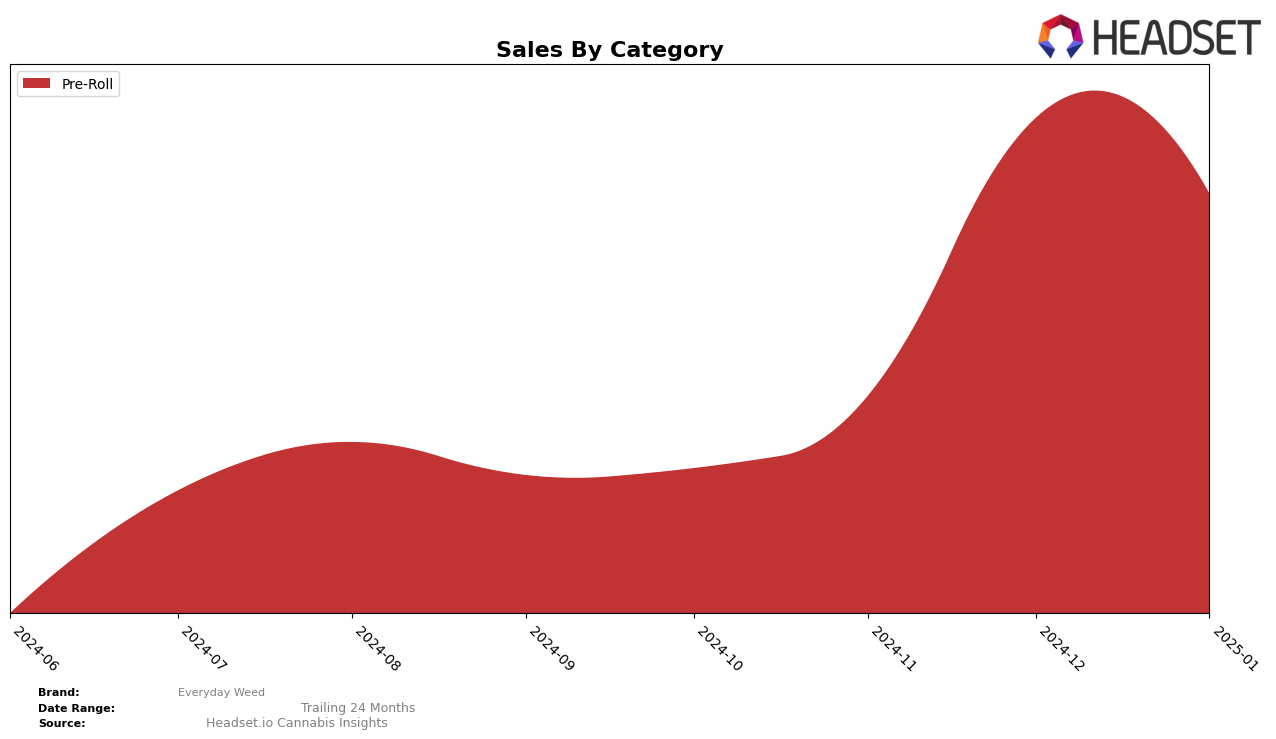

Everyday Weed has shown a significant upward trend in the Pre-Roll category within Colorado. Starting outside the top 30 in October 2024, the brand improved its ranking from 63rd to 29th by January 2025. This movement indicates a strong performance and growing consumer interest in their Pre-Roll products. The brand's sales trajectory is also noteworthy, with a substantial increase from October to December 2024, before experiencing a slight dip in January 2025. Such a trend suggests that Everyday Weed has been successful in capturing market share, although the slight decrease in January could indicate seasonal fluctuations or increased competition.

Despite the positive performance in Colorado, Everyday Weed did not appear in the top 30 brands for any other states or categories during the same period. This absence highlights a potential area for growth and expansion for the brand. The focus on Colorado's Pre-Roll category might be a strategic decision, but it also underscores the need for Everyday Weed to diversify its market presence to maintain long-term growth. Exploring new states or categories could help mitigate risks associated with regional market dynamics and bolster their overall brand footprint.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Everyday Weed has demonstrated a notable upward trajectory in brand rank from October 2024 to January 2025. Starting from a rank of 63 in October, Everyday Weed climbed to 29 by January, indicating significant market penetration and consumer acceptance. This rise is particularly impressive when compared to brands like Binske, which fluctuated between ranks 35 and 28, and Dadirri, which showed less consistent performance, moving from rank 40 to 30 over the same period. Meanwhile, Packs (fka Packwoods) experienced a decline from rank 28 to 34, suggesting a potential opportunity for Everyday Weed to capture more market share. Magic City maintained a relatively stable presence, with ranks ranging from 22 to 27, indicating steady competition. Everyday Weed's significant improvement in rank is mirrored by its sales growth, which suggests an effective market strategy and increasing consumer preference in the Colorado Pre-Roll market.

Notable Products

In January 2025, Everyday Weed's top-performing product was the Indica Pre-Roll (1g), which climbed to the first position with impressive sales of 4824 units. This marks a notable rise from its second-place ranking in December 2024. The Hybrid Pre-Roll (1g) secured the second spot, maintaining a strong presence despite a drop from its previous third-place ranking in December. Meanwhile, the Sativa Pre-Roll (1g), which had consistently held the top rank from October to December 2024, slipped to third place in January. These shifts highlight a dynamic change in consumer preferences towards Indica products at the start of the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.