Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

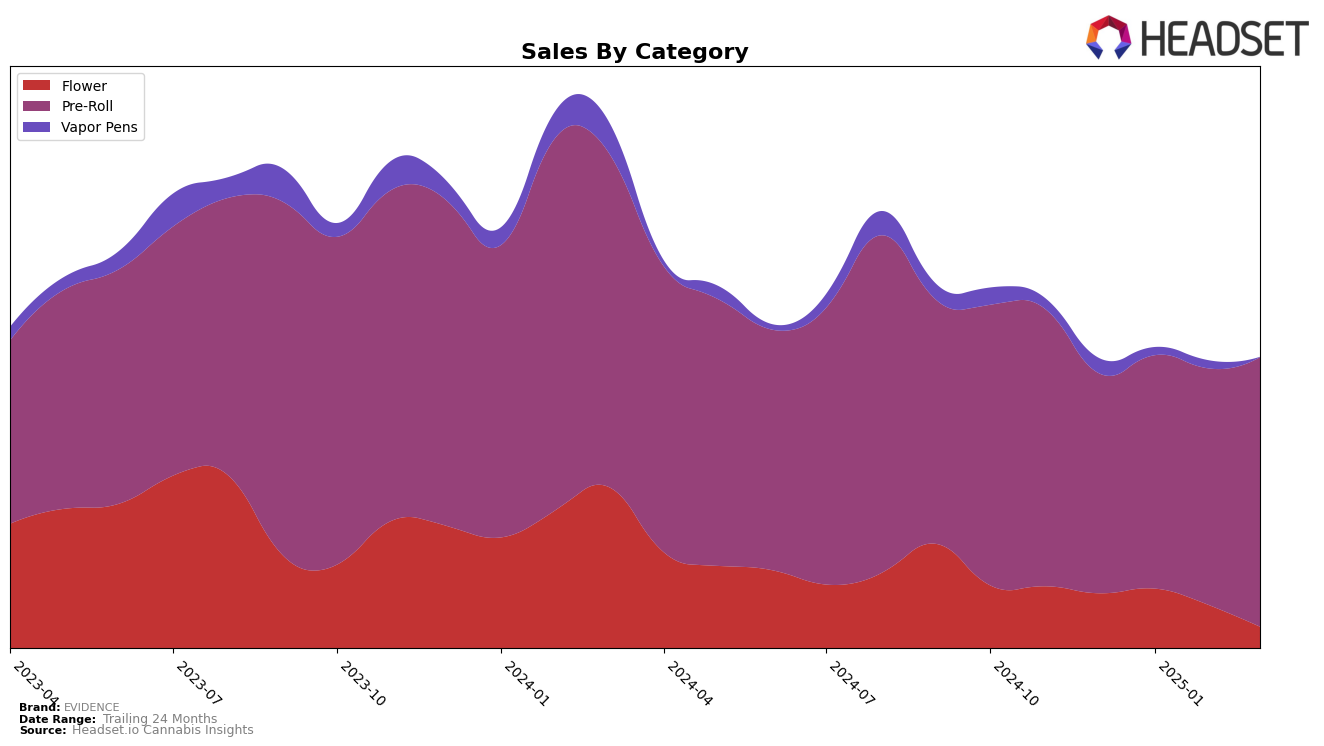

EVIDENCE has shown a consistent upward trend in the Pre-Roll category in California over the past few months. Starting from a rank of 31 in December 2024, the brand improved its position to 25 by March 2025. This steady climb in rankings indicates a growing consumer preference for EVIDENCE's offerings in this category. The brand's sales figures reflect this positive momentum, with a notable increase from December to March, highlighting its strengthening market presence in California's competitive landscape.

However, it's important to note that EVIDENCE did not appear in the top 30 rankings for the Pre-Roll category in any other states or provinces during this period. This absence suggests that while the brand is making significant headway in California, it may not yet have the same level of penetration or consumer recognition in other markets. The focus on California might be a strategic choice, but it also highlights potential areas for growth and expansion as EVIDENCE looks to enhance its footprint beyond its current stronghold.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, EVIDENCE has shown a steady improvement in its ranking from December 2024 to March 2025, moving from 31st to 25th place. This upward trajectory is noteworthy, especially when compared to brands like UpNorth Humboldt, which, despite improving its rank from 26th to 23rd, has seen a more modest sales increase. Meanwhile, Sunset Connect experienced a decline in rank from 17th to 24th, alongside a decrease in sales, suggesting potential challenges in maintaining its market position. Froot and Clsics have also shown some fluctuations, with Froot slightly improving its rank and Clsics experiencing a minor decline. These shifts indicate that EVIDENCE is gaining traction and could capitalize on the vulnerabilities of its competitors to capture a larger market share in the coming months.

Notable Products

In March 2025, the top-performing product from EVIDENCE was Prison Shortys - Berry Pie Infused Pre-Roll 5-Pack (3.5g), which climbed to the number one spot from a previous rank of 3 in February. It achieved notable sales of 1548 units. Prison Shortys - Strawberry Shortcake Infused Pre-Roll 5-Pack (3.5g) slipped to the second position after holding the top rank in January and February, with sales of 1510 units. Prison Shortys - Orange Sherbert Infused Pre-Roll 5-Pack (3.5g) returned to the rankings in third place, having not ranked in January or February. Lastly, Prison Shortys - Grape Ape Infused Pre-Roll 5-Pack (3.5g) and Prison Shortys - Guava Infused Pre-Roll 5-Pack (3.5g) maintained their positions in fourth and fifth place, respectively, showing consistent sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.