Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

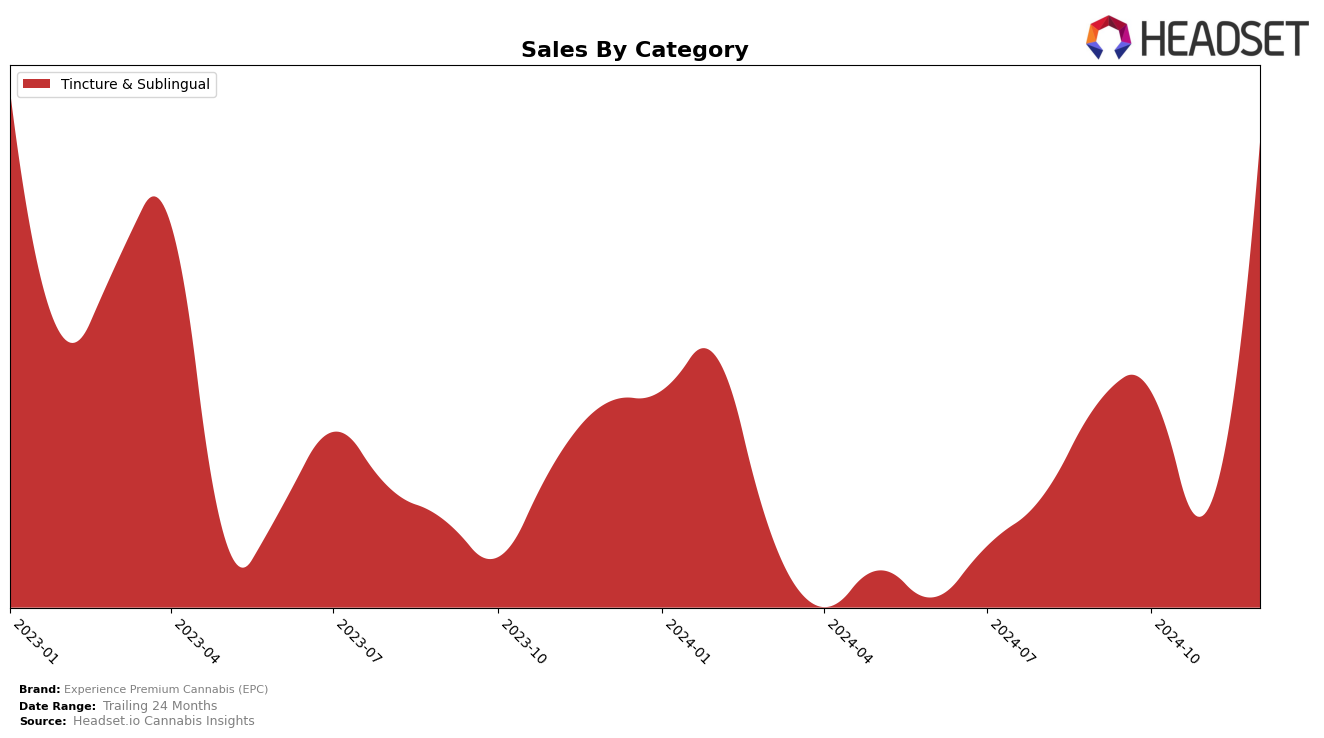

Experience Premium Cannabis (EPC) has shown a notable entry into the Tincture & Sublingual category in Nevada by securing the 4th position in December 2024. This marks a significant leap, as the brand was absent from the top 30 rankings in the preceding months of September, October, and November. Such a movement suggests that EPC has successfully captured consumer interest, potentially through strategic marketing or product innovation, leading to a remarkable rise in sales within this category in Nevada. However, the absence of previous rankings indicates a late but impactful entry, which could be a point of concern if sustained growth is not maintained.

While EPC's performance in Nevada's Tincture & Sublingual category is commendable, the lack of data for other states or provinces suggests that the brand may not have achieved similar success elsewhere. This could indicate a focused strategy in Nevada or potential challenges in expanding their market presence across other regions. The absence of EPC in the top 30 rankings in other states or categories might highlight areas for improvement or untapped opportunities. Observing how EPC capitalizes on its recent success in Nevada could provide insights into potential growth strategies or adjustments needed to enhance its presence in broader markets.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Nevada, Experience Premium Cannabis (EPC) has shown a notable rise in December 2024, securing the 4th position, marking its entry into the top rankings. This ascent highlights a significant improvement in EPC's market presence, especially considering its absence from the top 20 in the preceding months. The leading competitor, Doctor Solomon's, consistently holds the top spot, with sales figures significantly higher than EPC's, indicating a strong market dominance. Meanwhile, Spiked Flamingo maintains a stable position at 2nd place, showcasing steady sales growth. EPC's recent ranking achievement suggests a positive trend and potential for increased market share, although it still faces a considerable gap in sales compared to its top competitors.

Notable Products

In December 2024, the top-performing product for Experience Premium Cannabis (EPC) was CBN Good Night Tincture (500mg CBN, 14ml), maintaining its first-place rank for four consecutive months with a notable sales figure of 241 units. The CBD/THC 1:1 Golden Mylk Tincture (100mg CBD, 100mg THC) climbed to second place, showing a significant improvement from its previous third position in October 2024. CBD/THC 20:1 Breath Easy Tincture (400mg CBD, 20mg THC, 14ml) dropped one spot to third place, despite consistent sales figures over the months. CBD/THC 8:1 Cannabis Tincture (270mg CBD, 30mg THC) settled in fourth place after a previous absence in November 2024 rankings. Overall, the Tincture & Sublingual category continues to dominate the sales chart for EPC, showcasing strong consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.