Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

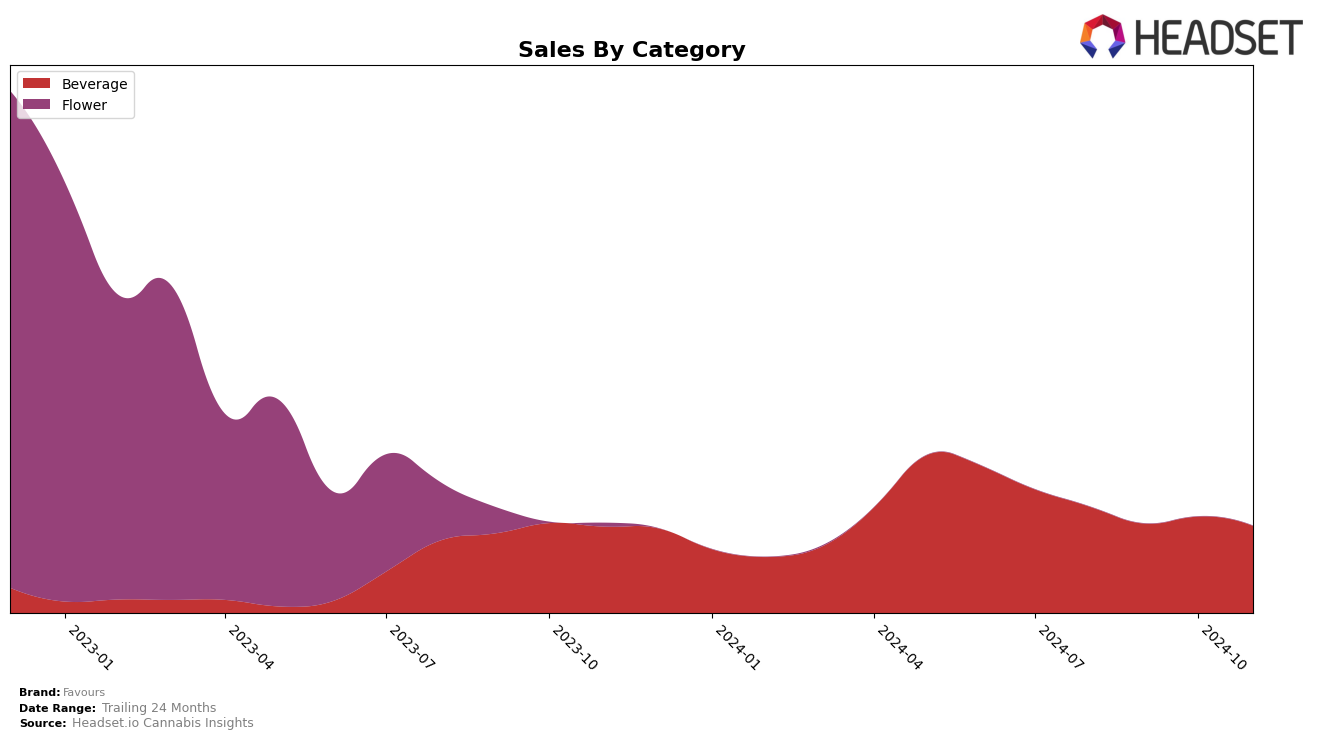

Favours, a cannabis brand known for its beverages, has shown varied performance across different states and categories. In Alberta, the brand was ranked 18th in the beverage category as of August 2024, but unfortunately, it did not maintain its position in the top 30 for the subsequent months of September, October, and November. This drop indicates a significant decline in its market presence within Alberta's beverage sector. While the August sales figures were promising, the absence from the rankings in the following months suggests that Favours might need to reassess its strategy or face increased competition in this market.

Across other states and categories, Favours' performance remains less transparent due to the lack of available ranking data, which implies that the brand has not secured a position within the top 30 in these areas. This could be interpreted as a challenge for Favours, as it seems to struggle to make a notable impact outside of Alberta's initial success. The absence of ranking data in other regions and categories underscores the potential areas for growth and improvement for Favours. It will be crucial for the brand to identify and leverage opportunities to expand its market footprint and enhance its competitive standing across various states and categories.

Competitive Landscape

In the Alberta beverage category, Favours has faced significant competitive pressure, particularly evident in its absence from the top 20 rankings from September to November 2024, following an 18th place ranking in August. This suggests a downward trend in both visibility and sales performance. In contrast, brands like 7 Acres and HYTN have maintained a presence in the rankings, albeit with some fluctuations, indicating a more stable market position. Notably, Palmetto emerged in November at 12th place, highlighting a potential shift in consumer preferences or effective marketing strategies that Favours might consider analyzing. The competitive landscape suggests that Favours may need to reassess its market strategies to regain its footing and improve its rank and sales in the Alberta beverage market.

Notable Products

In November 2024, the top-performing product for Favours was the Peach Mixer Drink Shot (10mg THC, 60ml) in the Beverage category, reclaiming the first position with a sales figure of 439 units. The Berry Mixer Shot (10mg THC, 60ml) held the second position, dropping from its first-place rank in October. The Lemon Beverage Shot (10mg THC, 60ml) consistently maintained the third rank from the previous month. Notably, the Peach Mixer Drink Shot, which was the top seller in August and September, regained its leading position after a brief drop in October. This indicates a strong consumer preference for the Peach Mixer Drink Shot over time, despite fluctuations in rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.