Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

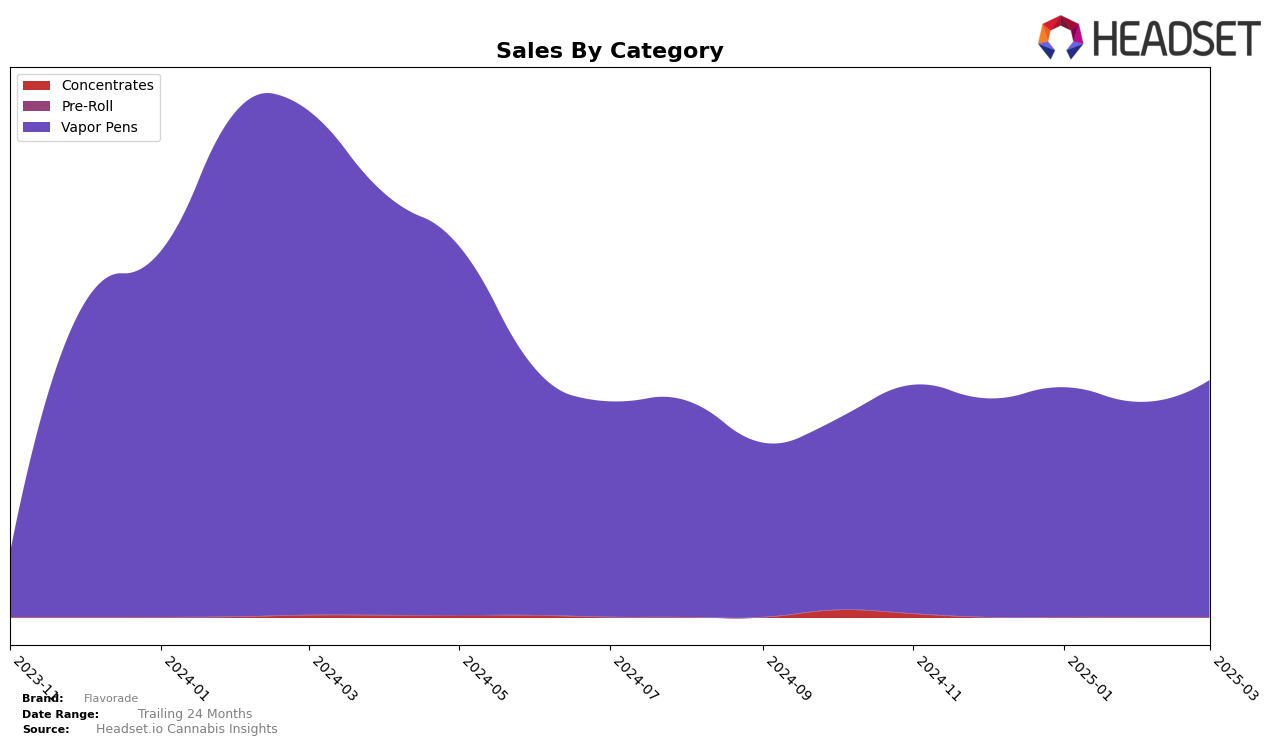

Flavorade has shown a notable upward trend in the Vapor Pens category in California. Starting from December 2024, the brand was ranked 31st, and by March 2025, it had improved to 27th place. This steady climb in the rankings indicates a positive reception and increasing popularity among consumers in the state. Despite a slight dip in sales in February, the brand experienced a robust recovery in March, suggesting effective strategies or product offerings that resonated well with the market. The improvement in ranking is particularly significant given its initial position just outside the top 30, highlighting Flavorade's potential to further solidify its presence in the California Vapor Pens market.

While Flavorade's performance in California is promising, it's important to note the absence of rankings in other states or categories, which suggests that the brand is not yet a top contender outside of its current market. This could be seen as a limitation or an opportunity, depending on the strategic goals of the company. Expanding its reach or improving its standing in other categories could provide a substantial boost to its overall market presence. The focus on California might indicate a targeted approach, but diversification could be beneficial for long-term growth. Understanding the dynamics of other states and categories could offer insights into potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of vapor pens in California, Flavorade has shown a notable upward trend in rankings from December 2024 to March 2025. Initially positioned at rank 31 in December 2024, Flavorade improved its standing to rank 27 by March 2025. This positive shift in rank is indicative of a strategic gain in market presence, likely driven by effective marketing or product differentiation. In contrast, competitors such as Buddies and Alien Labs have experienced fluctuating ranks, with Buddies not making it into the top 20 during this period and Alien Labs slipping from rank 22 to 26. Meanwhile, Sluggers Hit maintained a steady position at rank 25, and PAX showed a slight improvement from rank 33 to 29. Flavorade's upward trajectory in rank, coupled with a steady increase in sales, suggests a strengthening brand performance in a competitive market.

Notable Products

In March 2025, the top-performing product for Flavorade was the Sherbet Cream Pie Cured Resin Cartridge (1g), leading the sales with a notable figure of 784 units sold. Close behind, the Flavorade x Sirius - Zombie Brains Live Resin Cartridge (1g) secured the second position with impressive sales. The Flavorade x Sirius - Gelato Ice Cured Resin Cartridge (1g) climbed to third place, improving from its previous fourth-place ranking in February. Meanwhile, the Flavorade x Sirius - Banana Cocktail Cured Resin Cartridge (1g) and Donald Burger Cured Resin Cartridge (1g) held the fourth and fifth positions, respectively. This month marks a consistent performance for Flavorade's vapor pen category, with slight shifts in rankings indicating a competitive market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.