Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

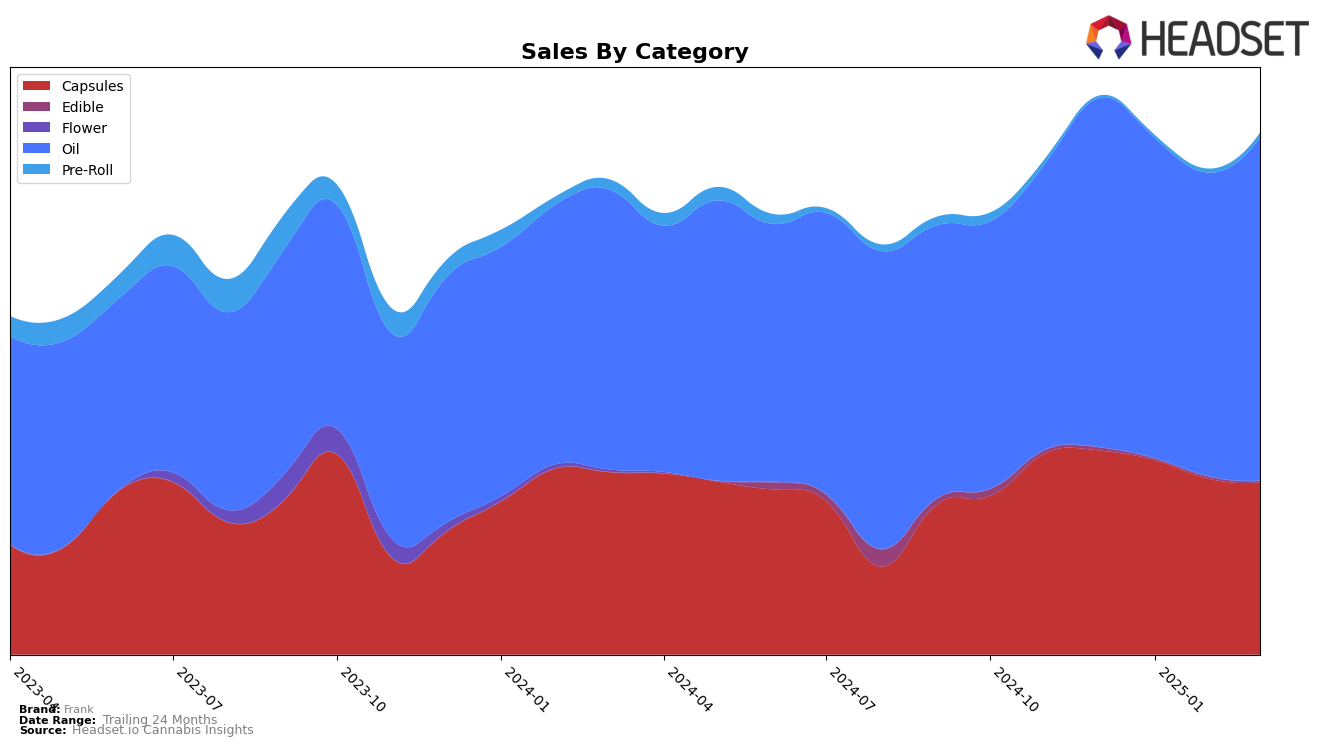

In the Canadian market, Frank has demonstrated varied performance across different provinces and product categories. In Alberta, Frank's Capsules category maintained a consistent ranking, fluctuating between 4th and 5th place over the months, indicating a stable presence despite a dip in sales from December to February. Conversely, the Oil category in Alberta saw a more dynamic shift, with Frank holding a solid 3rd place in December and February, but dropping to 5th in January before recovering to 4th in March. This suggests a competitive landscape in the Oil category, where Frank has managed to regain its footing after a brief decline. In British Columbia, Frank's Capsules showed improvement, climbing from 8th to 6th place in February, although it slightly dropped to 7th in March. Meanwhile, the Oil category remained stable in 6th position throughout the observed months, indicating consistent performance in this segment.

In Ontario, Frank's Capsules improved its ranking from 15th in December to 13th by March, suggesting a positive trend in market acceptance, despite a dip in sales in February. The Oil category in Ontario, however, experienced more volatility, dropping to 18th place in February but rebounding to 13th in March, highlighting a potential recovery phase. In Saskatchewan, Frank's presence in the Oil category was notable, with rankings in December and February, but the absence of a rank in January suggests a temporary lapse in top-tier performance. This gap could indicate a competitive challenge or a strategic shift that temporarily impacted their standings. Overall, Frank's performance across these regions and categories reflects both resilience and areas for growth, with particular strengths in Alberta's Oil category and emerging potential in Ontario's Capsules segment.

Competitive Landscape

In the competitive landscape of the oil category in Alberta, Frank has experienced notable fluctuations in its rank and sales performance over recent months. Starting from December 2024, Frank held a strong position at rank 3, but by January 2025, it slipped to rank 5, indicating increased competition and possibly a dip in consumer preference. However, Frank rebounded to rank 3 in February 2025, demonstrating its resilience and ability to recapture market share, before settling at rank 4 in March 2025. This fluctuation is particularly significant when considering the consistent top positions of competitors like MediPharm Labs, which maintained the number 1 rank throughout this period, and Tweed, which consistently held the number 2 spot. Meanwhile, Glacial Gold and NightNight also posed competitive threats, with Glacial Gold notably climbing to rank 4 in February before dropping back to rank 6 in March. These dynamics suggest that while Frank remains a strong player, it faces stiff competition and must continue to innovate and adapt to maintain and improve its market position.

Notable Products

In March 2025, Frank's top-performing product was CBD 100 Oil 30ml, maintaining its number one rank for four consecutive months with sales reaching 5887 units. CBD Capsules 30-Pack 1500mg CBD also held steady in second place throughout the same period. The CBD Smokes Infused Pre-Roll 10-Pack 5g showed a consistent performance, ranking third for the second month in a row, with a notable increase in sales from 42 units in December 2024 to 83 units in March 2025. CBD Lemon Gummies 30-Pack 1500mg CBD remained in fourth place, despite a decline in sales over the months. The rankings for these products have shown stability, with no changes in their positions from February 2025 to March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.