Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

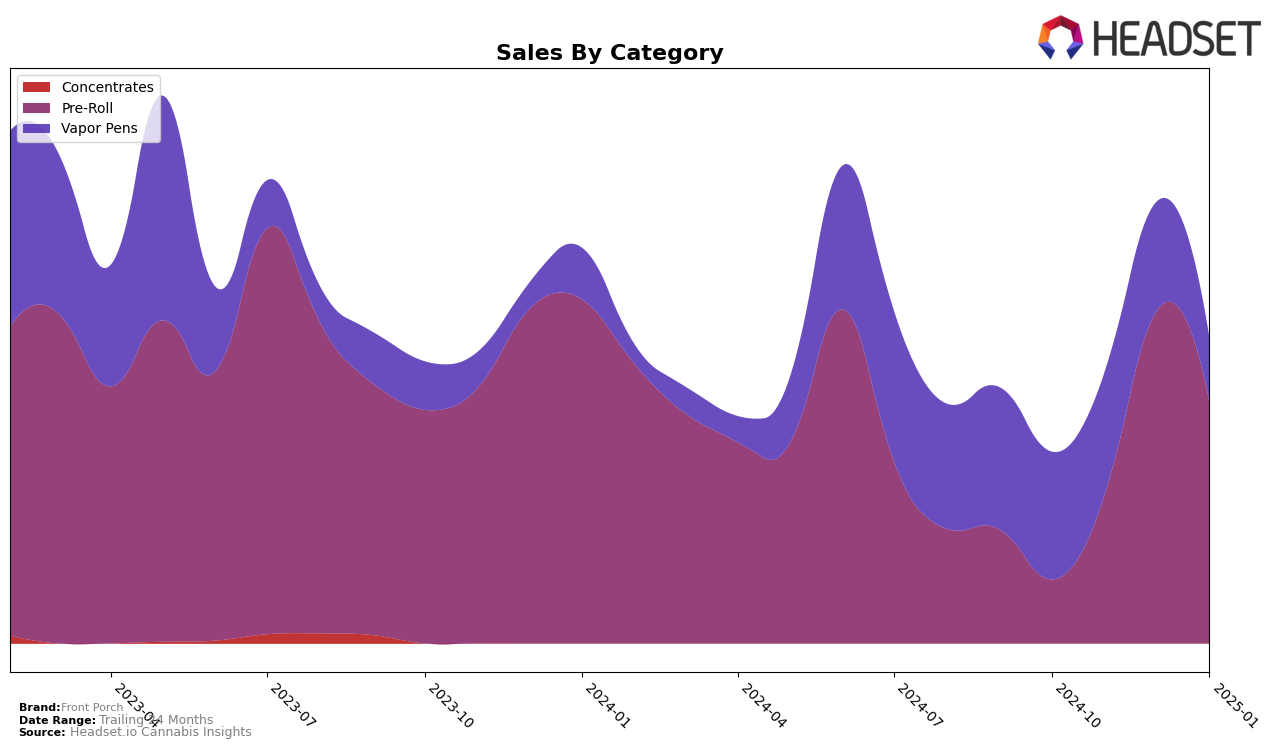

Front Porch has shown a dynamic performance across different states and product categories. In the Pre-Roll category in Illinois, the brand's ranking improved significantly from 64th in October 2024 to 33rd in December 2024, before slightly declining to 36th in January 2025. This upward movement indicates a growing presence in the Illinois market, although not yet breaking into the top 30. In Saskatchewan, Front Porch's Pre-Roll category has consistently improved, moving from 53rd in October 2024 to 26th by January 2025, demonstrating a strong upward trend and suggesting successful market penetration in this region.

In the Vapor Pens category in Saskatchewan, Front Porch maintained a relatively stable position, ranking 21st in both October and November 2024, before experiencing a slight decline to 26th by January 2025. This consistency, despite the minor drop, highlights the brand's steady foothold in the Vapor Pens category within this province. However, the absence of Front Porch in the top 30 for Vapor Pens in Illinois suggests that the brand might be facing challenges in this specific category within the state. Overall, while Front Porch is making notable strides in certain areas, there remain opportunities for growth and expansion, particularly in states where their presence is less pronounced.

Competitive Landscape

In the competitive landscape of the Illinois pre-roll category, Front Porch has demonstrated notable fluctuations in rank and sales over the recent months. From October 2024 to January 2025, Front Porch improved its rank from 64th to 33rd in December, before slightly dropping to 36th in January. This upward trend in December indicates a significant increase in market presence, although the slight decline in January suggests potential challenges in maintaining momentum. In contrast, Island has shown a consistent upward trajectory, moving from 49th to 33rd, which suggests a competitive threat to Front Porch. Meanwhile, Good News experienced a rank drop in January, which could present an opportunity for Front Porch to capitalize on. Additionally, Superflux and 1988 have maintained relatively stable positions, with Superflux missing from the top 20 in November, indicating a potential opening for Front Porch to further enhance its market share. Overall, while Front Porch has made significant strides, the competitive dynamics suggest that maintaining and improving its rank will require strategic efforts to outpace these competitors.

Notable Products

In January 2025, the top-performing product for Front Porch was the Bunny Hug Pre-Roll (1g), maintaining its consistent first-place ranking from previous months with sales of 5950. White Widow Infused Pre-Roll (0.5g) climbed to second place, showing a significant increase from its fourth position in December 2024. The Hard Rocker - High Noon Hybrid Blend Infused Pre-Roll (0.5g) dropped slightly to third place from its previous second position in December. Retro Bunny Hug- Thai Stick Co2 Cartridge (1g) secured the fourth spot, marking a return to the rankings after being unranked in December. Finally, the Hard Rocker - Sunrise Sativa Blend Infused Pre-Roll (0.5g) entered the top five for the first time, finishing in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.