Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

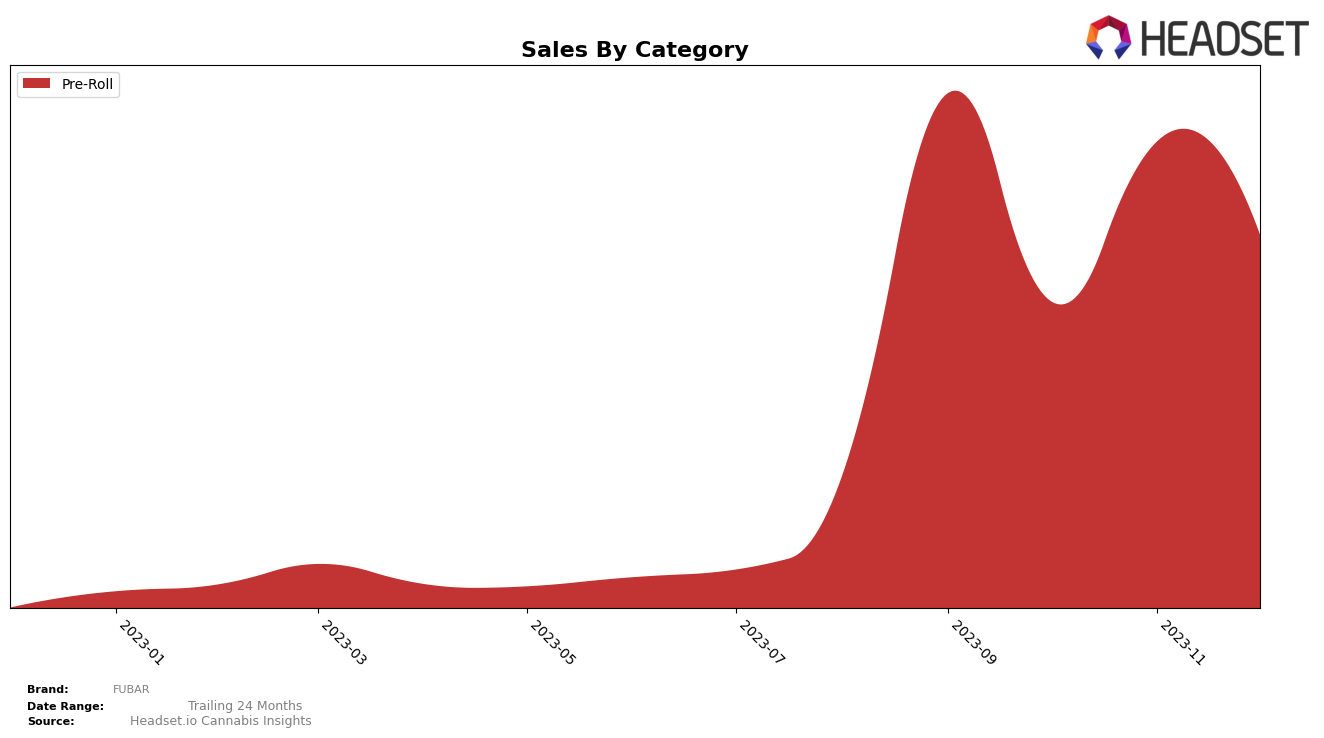

The cannabis brand FUBAR has been showing mixed performance in the Missouri market, especially in the Pre-Roll category. In September 2023, FUBAR ranked 12th among the top brands in the state, but slipped to 17th place in October. However, the brand saw a significant improvement in November, jumping up to the 10th position, before dropping again to the 18th spot in December. This fluctuation in rankings indicates a volatile market position for FUBAR in the Pre-Roll category in Missouri.

When it comes to sales, FUBAR experienced a downward trend from September to October 2023, with sales decreasing from approximately 291,707 to 175,439. However, there was a resurgence in November, with sales climbing back up to around 270,202. Despite this recovery, December saw another dip, with sales falling to 213,949. This pattern of sales, much like the ranking, shows a degree of instability in FUBAR's performance in the Missouri market. However, it also suggests potential for growth and improvement in the future.

Competitive Landscape

In the Pre-Roll category in Missouri, FUBAR has shown a fluctuating performance, with its rank changing from 12th in September to 18th in December 2023. While FUBAR initially ranked higher than its competitors, it has been overtaken by Willie's Reserve and Local Cannabis Co. by December. These brands have shown a steady upward trend, with Willie's Reserve moving from 36th to 17th and Local Cannabis Co. from 26th to 19th. However, FUBAR still ranks higher than Greenlight and Sunday Papers, which have remained relatively stable in their rankings. In terms of sales, while exact numbers are not provided, it's clear that FUBAR has experienced a decrease in sales from November to December, while all its mentioned competitors have seen an increase in the same period.

Notable Products

In December 2023, FUBAR's top-performing product was the Animal Runtz Diamond Infused Pre-Roll (0.75g) with sales of 3089 units. Following closely was the Zkittles Diamond Infused Pre-Roll (0.75g) which maintained its second position from the previous month. The OG Kush Breath Sauce Boss Infused Pre-Roll (1g) made a comeback in the rankings, securing the third spot after not being ranked in October and November. The Zkittles Sauce Boss Live Resin Infused Pre-Roll (1g) dropped to the fourth position, while the OG Wreck Diamond Infused Pre-Roll (0.75g) entered the rankings for the first time at fifth place. This data signifies a dynamic market with frequent changes in the product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.