Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

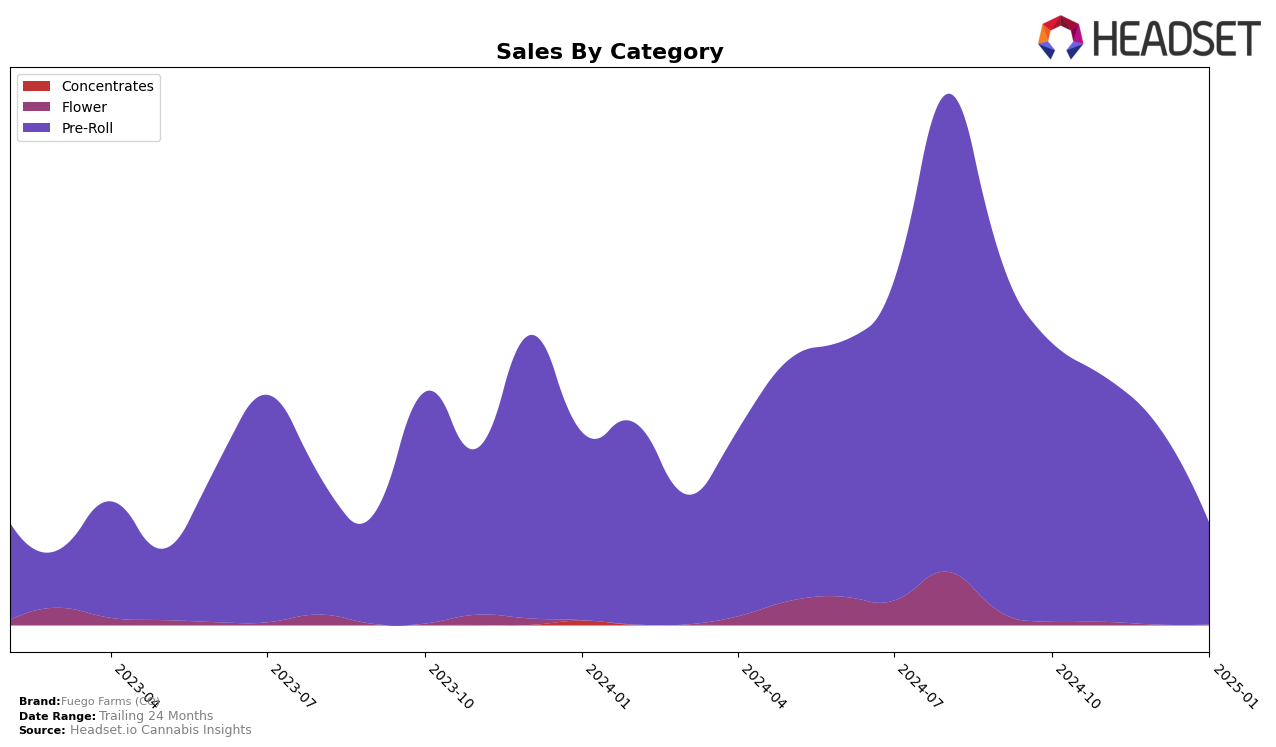

Fuego Farms (CO) has shown notable performance fluctuations in the Pre-Roll category within the state of Colorado. In October 2024, the brand was ranked 17th, marking a strong presence in the top 20. However, by January 2025, their rank had slipped to 26th, indicating a downward trend over the four-month period. This decline is reflected in their sales figures, which dropped significantly from October 2024 to January 2025. The brand's inability to maintain its ranking within the top 20 by the end of this period suggests challenges in sustaining market share amidst competitive pressures.

Despite the decline in rankings, Fuego Farms (CO) managed to maintain a position within the top 30 brands in the Pre-Roll category throughout the observed months in Colorado. This consistent presence, albeit with decreasing sales, indicates that while they are facing challenges, they still hold a significant foothold in the market. The fact that they did not drop out of the top 30 entirely is a positive aspect, as it shows resilience in a competitive landscape. However, the downward movement in rankings highlights the need for strategic adjustments to regain lost ground and improve their standing in the coming months.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Fuego Farms (CO) has experienced a notable decline in its market position, dropping from a rank of 17 in October 2024 to 26 by January 2025. This downward trend in ranking is mirrored by a significant decrease in sales, which have more than halved over the same period. In contrast, competitors like TWAX have shown remarkable improvement, climbing from a rank of 78 in October to 24 by January, alongside a steady increase in sales. Meanwhile, Binske and D's Trees have maintained relatively stable positions, with D's Trees consistently outperforming Fuego Farms (CO) in sales. The fluctuating performance of Magic City further highlights the competitive volatility in this market segment. These dynamics suggest that Fuego Farms (CO) may need to reassess its strategies to regain its competitive edge and stabilize its sales trajectory in the Colorado Pre-Roll market.

Notable Products

In January 2025, Black Sugar Sherbet Pre-Roll (1g) emerged as the top-performing product for Fuego Farms (CO), leading the sales rankings with a notable figure of 1172 units sold. Trainwreck Pre-Roll (1g) followed closely, securing the second position, while All Gas OG Blunt (1g) ranked third, experiencing a significant drop from its top position in November 2024. MAC Pre-Roll (0.5g) and Vanilla Latte Pre-Roll (1g) completed the top five, ranking fourth and fifth respectively. Notably, Vanilla Latte Pre-Roll (1g) experienced a decline from its third-place ranking in November 2024. Overall, the Pre-Roll category dominated the sales for Fuego Farms (CO) in January 2025, with some products experiencing shifts in their rankings compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.