Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

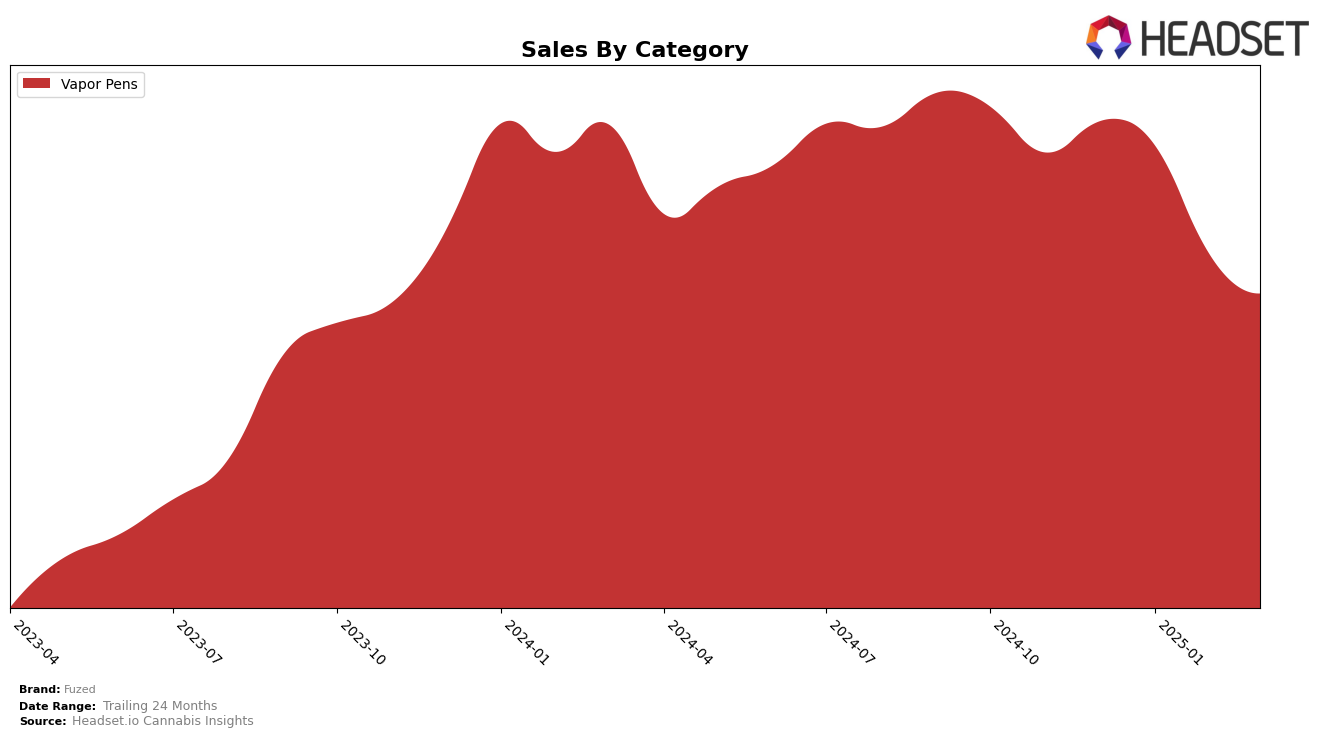

Fuzed, a notable player in the vapor pen category, has demonstrated varying performance across different states. In California, the brand struggled to maintain a position within the top 30, with rankings slipping from 83rd in December 2024 to failing to appear in the top 30 by March 2025. This decline is mirrored in their sales figures, which saw a significant decrease from December to March. In contrast, Fuzed showed resilience in Illinois, where they improved their rank from 46th in December 2024 to 39th by March 2025, alongside an increase in sales, indicating a strengthening presence in this market.

In Maryland, Fuzed maintained a strong position within the top 10 for the first three months of 2025 but saw a slight dip to 13th in March. Despite this, their sales figures remained robust, suggesting a solid consumer base. Meanwhile, in Missouri, the brand's ranking fell from 25th in December 2024 to 41st by March 2025, reflecting a downward trend in sales. In Ohio, Fuzed experienced a steady decline in rankings from 20th to 26th over the same period, although the sales figures showed a subtle uptick in March, indicating potential for recovery.

Competitive Landscape

In the competitive landscape of vapor pens in Maryland, Fuzed experienced a notable shift in its market position from December 2024 to March 2025. Initially holding a steady 8th rank through December and January, Fuzed saw a decline to 13th place by March 2025. This drop in rank coincided with a decrease in sales from January's peak, suggesting potential challenges in maintaining consumer interest or facing intensified competition. Meanwhile, Curio Wellness showed a fluctuating performance, ending March in the same 14th position as January, despite a sales rebound in February. Evermore Cannabis Company demonstrated a positive trajectory, improving its rank from 16th in December to 11th by March, alongside a substantial sales increase. Similarly, CULTA advanced from 19th to 15th, indicating a strengthening market presence. The competitive dynamics suggest that while Fuzed remains a key player, it faces pressure from brands like Evermore and CULTA, which are gaining traction and potentially capturing a larger share of the market.

Notable Products

In March 2025, Mango Mama Distillate Disposable (1g) maintained its top position in the Vapor Pens category, despite a decrease in sales to 2578 units. Wild Raspberry Distillate Disposable (1g) rose to the second position, showing an increase from its previous fourth place in February. Blueberry Distillate Disposable (1g) climbed from fifth to third place, reflecting a recovery in sales. Strawberry Blonde Distillate Disposable (1g) dropped to fourth place, continuing its decline from second place in January. Bad Apple Distillate Disposable (1g) re-entered the rankings at fifth place, marking its return since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.