Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

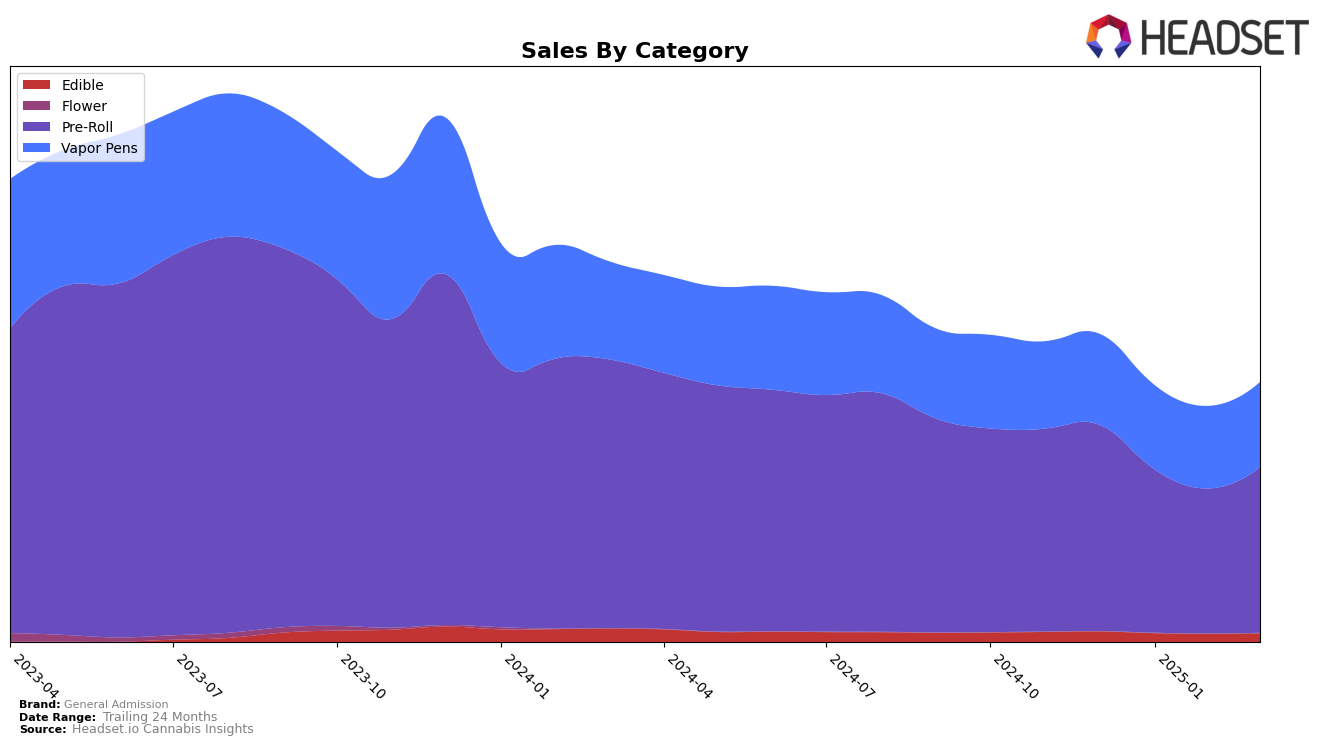

General Admission has demonstrated a strong presence in the Pre-Roll category across multiple Canadian provinces. Notably, the brand has maintained the top spot in Alberta, British Columbia, and Ontario from December 2024 to March 2025. This consistent top ranking indicates a robust market position and consumer preference for their Pre-Roll products. However, it's interesting to note that while they have maintained their number one ranking, there was a visible dip in sales figures in January and February 2025 across these provinces, followed by a recovery in March. This fluctuation could suggest seasonal trends or shifts in consumer behavior that might be worth exploring further.

In the Vapor Pens category, General Admission's performance is slightly more varied. In Alberta, the brand fluctuated between second and third place, indicating a competitive market landscape. Meanwhile, in British Columbia, they maintained a steady second place, which suggests a stable consumer base for their Vapor Pen products. In Ontario, the brand improved its ranking from fifth to fourth place by March 2025, reflecting a positive trajectory in this category. The absence of a ranking beyond the top five in some provinces highlights areas where the brand might focus on strengthening its market presence.

Competitive Landscape

In the competitive landscape of Ontario's Pre-Roll category, General Admission has demonstrated remarkable resilience and dominance, consistently maintaining a top position in the rankings. Despite a brief dip to second place in January 2025, General Admission swiftly reclaimed the number one spot by February and March 2025. This fluctuation in rank highlights a competitive tussle with Jeeter, which also held the top position in January 2025. Notably, Jeeter's sales figures were lower than General Admission's during this period, indicating that General Admission's brief slip in rank was not due to a significant sales decline but rather the competitive dynamics of the market. Meanwhile, Back Forty / Back 40 Cannabis consistently held the third position, suggesting a stable, yet less aggressive competitive threat. The data underscores General Admission's strong market presence and ability to rebound quickly, reinforcing its appeal to consumers and its strategic positioning in the Ontario Pre-Roll market.

Notable Products

In March 2025, the top-performing product from General Admission was the Tiger Blood Distillate Infused Pre-Roll 3-Pack in the Pre-Roll category, maintaining its consistent number one rank since December 2024, with sales of $50,005. The Tiger Blood Distillate Cartridge in the Vapor Pens category also held steady at the second position from January through March 2025. The Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack climbed to the third spot in March, recovering from a fourth-place rank in February. Tiger Blood Chews in the Edible category remained stable at fourth place for March 2025, despite minor fluctuations in sales figures. Lastly, the Glitter Bomb Distillate Infused Pre-Roll 5-Pack maintained its fifth-place rank since its introduction in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.