Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

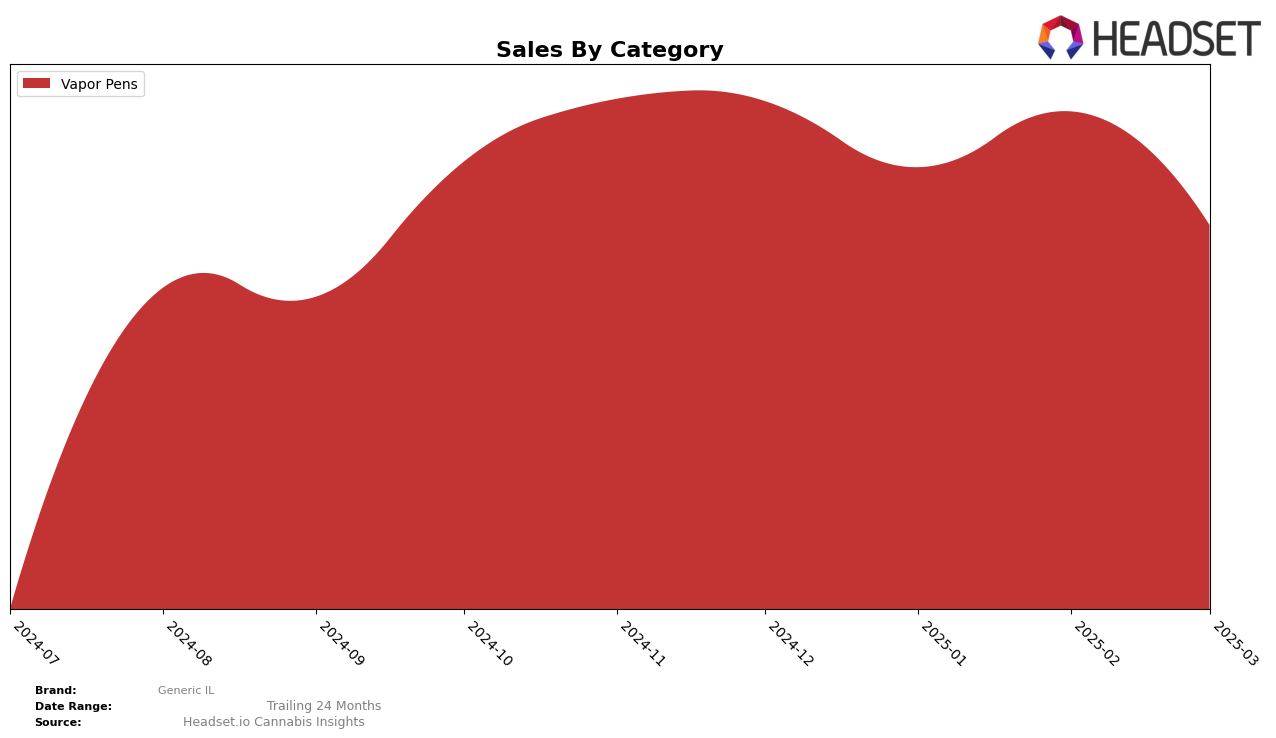

Generic IL's performance in the Vapor Pens category across states has shown varying trends, particularly in Illinois. The brand maintained a consistent rank of 24th from December 2024 through February 2025 but experienced a drop to 28th in March 2025. This decline in ranking could be indicative of increased competition or a shift in consumer preferences within the state. The sales figures reflect a similar trend, with a noticeable dip in March 2025 compared to previous months, which may suggest challenges in maintaining market share or possibly seasonal fluctuations affecting consumer demand.

The absence of Generic IL from the top 30 brand rankings in other states or provinces during this period could suggest a limited geographic reach or focus primarily on the Illinois market. This lack of presence outside of Illinois could be seen as a missed opportunity for expansion and increased brand visibility. However, the consistent ranking within Illinois for most of the observed period indicates a steady, albeit niche, market position within the state. Understanding the dynamics of consumer preferences in Illinois and assessing potential for growth in new regions could be key areas for strategic development for Generic IL moving forward.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Generic IL has experienced notable fluctuations in its rank over the months from December 2024 to March 2025. Initially holding steady at 24th place, the brand saw a decline to 28th by March 2025, indicating increased competition and a potential decrease in market share. This drop is significant when compared to competitors like Nuvata, which maintained a higher rank, consistently staying in the top 26, and Dabstract, which improved its position to 27th by March. Despite a strong start in December with robust sales figures, Generic IL's sales saw a downward trend by March, contrasting with the upward sales trajectory of Kushy Punch, which improved its rank from 33rd to 29th. This competitive pressure suggests that while Generic IL has a solid presence, it may need to innovate or adjust its strategies to regain its footing in the dynamic Illinois vapor pen market.

Notable Products

In March 2025, the top-performing product for Generic IL was the Granddaddy Purple Distillate Cartridge (1g) in the Vapor Pens category, reclaiming the number one rank after a brief dip to the third position in January 2025. It achieved sales of 2547 units, marking a notable recovery from its January performance. The Pineapple Express Distillate Cartridge (1g) dropped to the second rank, despite being the top product in both January and February. Green Crack Distillate Cartridge (1g) maintained its third position from February, showing consistent performance. Meanwhile, the Skywalker OG Distillate Cartridge (1g) re-entered the rankings at fourth place, and the Alaskan Thunder Distillate Cartridge (1g) debuted in fifth place for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.