Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

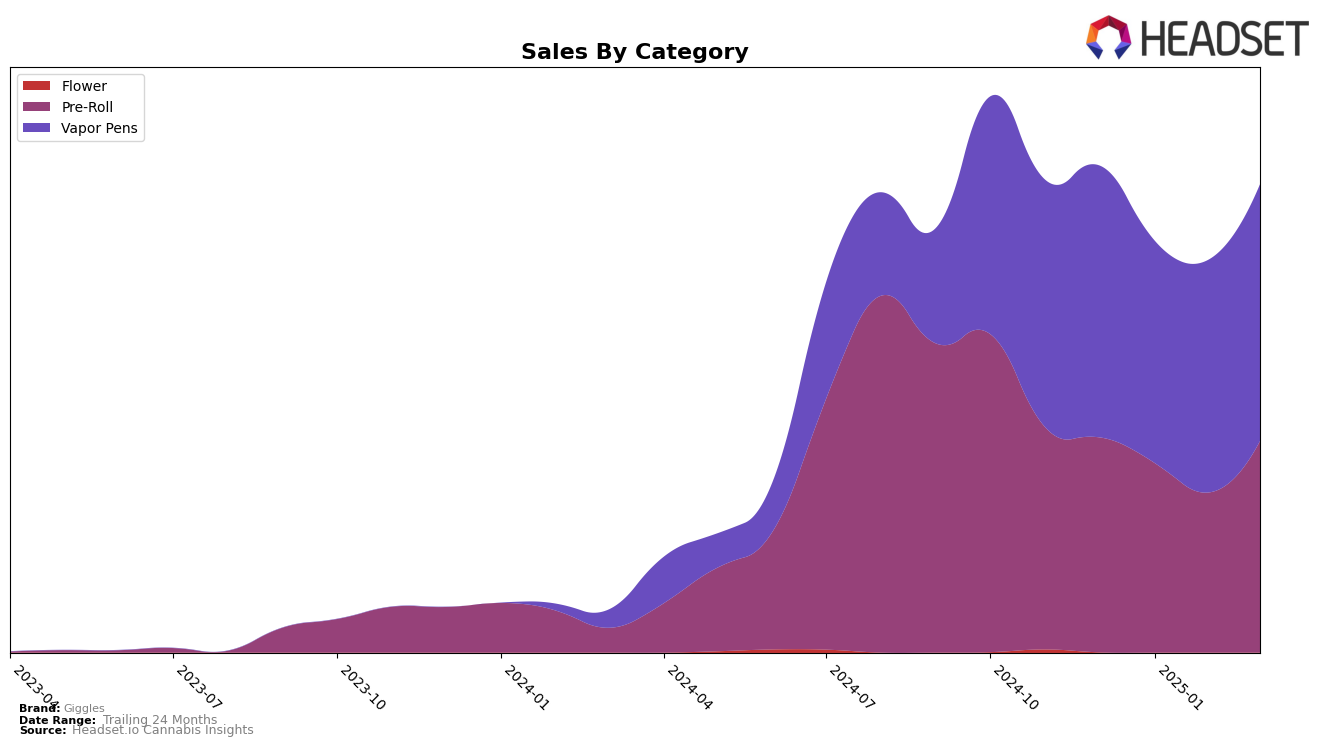

In the Michigan market, Giggles has shown a dynamic performance across different categories. Specifically, in the Pre-Roll category, Giggles was ranked 31st in January 2025, a slight improvement from its 32nd position in December 2024. However, by February 2025, the brand slipped to 36th place, indicating a potential challenge in maintaining its market position. By March 2025, Giggles managed to climb back to the 32nd rank, suggesting a recovery in sales momentum. This fluctuation highlights the competitive nature of the Pre-Roll category in Michigan and suggests that while Giggles has the potential to improve, it faces significant competition.

In contrast, Giggles exhibited a more stable performance in the Vapor Pens category within Michigan. Starting at the 28th position in December 2024, the brand experienced a slight dip to 30th in January 2025 but quickly rebounded to 29th in February 2025. By March 2025, Giggles improved its standing further, reaching the 25th position, which indicates a positive trend in its market penetration and consumer acceptance in this category. This upward movement in the Vapor Pens category suggests that Giggles is gaining traction and could potentially capitalize on this growth to enhance its market share in Michigan.

Competitive Landscape

In the competitive landscape of Vapor Pens in Michigan, Giggles has shown a dynamic performance from December 2024 to March 2025. Initially ranked 28th in December, Giggles experienced a slight dip to 30th in January, before recovering to 29th in February and climbing to 25th in March. This upward trajectory in the rankings suggests a positive reception in the market, despite facing stiff competition. Notably, Magic demonstrated a significant improvement, moving from 29th in December to 24th in March, indicating a strong competitive presence. Similarly, ErrlKing Concentrates made a remarkable leap from 41st in December to 23rd in March, showcasing a rapid increase in market traction. Meanwhile, Bloom maintained a relatively stable position, consistently hovering around the 26th rank, which suggests a steady but less aggressive market strategy. Giggles' ability to improve its rank amidst these competitive shifts highlights its resilience and potential for capturing a larger market share in the coming months.

Notable Products

In March 2025, Gigglesticks - Bog Walker Pre-Roll (1g) reclaimed its position as the top-performing product in the Pre-Roll category, achieving sales of 8,280 units. This product had previously dropped to the fifth rank in February but bounced back to first place. Gigglesticks - OC Skunk Infused Pre-Roll (1g) maintained a steady second position, continuing its strong performance from the previous months. Puffs- Cherry Pie Distillate Cartridge (1g) fell to third place after leading in February, indicating a slight decrease in its dominance in the Vapor Pens category. Meanwhile, the Puffs- Pineapple Express Distillate Disposable (1g) made its debut in March, securing the fourth rank, showcasing potential growth in the coming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.