Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

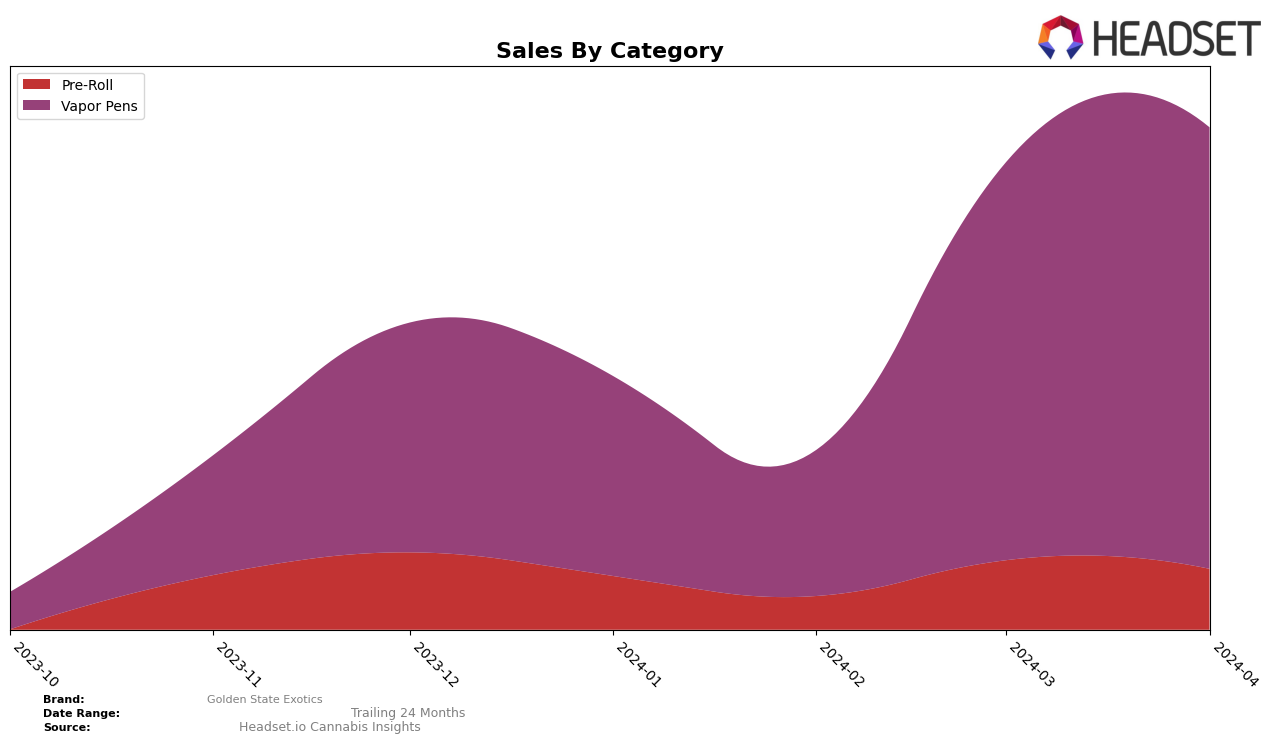

In Michigan, Golden State Exotics has shown a mixed performance across different cannabis product categories. Notably, in the Vapor Pens category, the brand has demonstrated a positive trajectory, improving its ranking from 41st in January 2024 to 22nd by April 2024. This upward movement, accompanied by a significant increase in sales from January's 229,179 to 506,561 by April, suggests a growing consumer preference and market share within Michigan's competitive vapor pens segment. However, the brand's journey in the Pre-Roll category tells a different story. Golden State Exotics only made it onto the rankings chart in March 2024 at 93rd and saw a slight improvement to 91st in April. The absence from top rankings in the earlier months and a low position when it did appear indicate challenges in capturing a significant share of Michigan's pre-roll market.

While the detailed sales figures and exact rankings for each month provide a snapshot of Golden State Exotics' performance, the contrasting fortunes between the Vapor Pens and Pre-Roll categories in Michigan highlight the brand's varying success across different product lines. The impressive sales growth and improved rankings in the Vapor Pens category could reflect effective marketing strategies, product quality, or consumer trends favoring vapor products. In contrast, the brand's struggle to rank within the top 90 in the Pre-Roll category until March 2024 suggests there may be areas for improvement, whether in product offerings, distribution, or promotional efforts. This analysis underscores the importance of a multifaceted approach to understanding brand performance, considering both the successes and the areas needing attention within different market segments.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Michigan, Golden State Exotics has shown a notable upward trajectory in rankings over the recent months, moving from not being in the top 20 in January and February 2024 to securing the 25th position in March and further climbing to the 22nd spot by April. This improvement in rank is indicative of a significant increase in sales, suggesting a growing consumer interest or successful marketing efforts. Competitors such as Terpene Tanks and Amnesia have experienced fluctuations, with Terpene Tanks dropping from the 7th to the 23rd position by April, and Amnesia seeing a drastic fall to the 24th spot in the same month after being in the 16th position in January. Meanwhile, North Cannabis and ErrlKing Concentrates have shown resilience, with North Cannabis breaking into the top 20 by April and ErrlKing Concentrates moving up to the 21st position. Golden State Exotics' recent performance, especially in comparison to its competitors, highlights its potential for growth and the importance of maintaining momentum in this dynamic market.

Notable Products

In April 2024, Golden State Exotics saw the Wild Sherbet Distillate Cartridge (1g) as its top-selling product in the Vapor Pens category, with sales reaching 8134 units. This product climbed from the second position in March to the top spot, indicating a significant increase in demand. Following it, the Mimosa Distillate Cartridge (1g) secured the second rank, with the Lychee and OG Kush Distillate Cartridges (1g) taking the third and fourth places, respectively. The Grape Punch Distillate Cartridge (1g) rounded out the top five, showcasing a diverse preference among consumers within the Vapor Pens category. The shift in rankings, especially the rise of Wild Sherbet, highlights changing consumer preferences and the competitive dynamics within Golden State Exotics' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.