Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

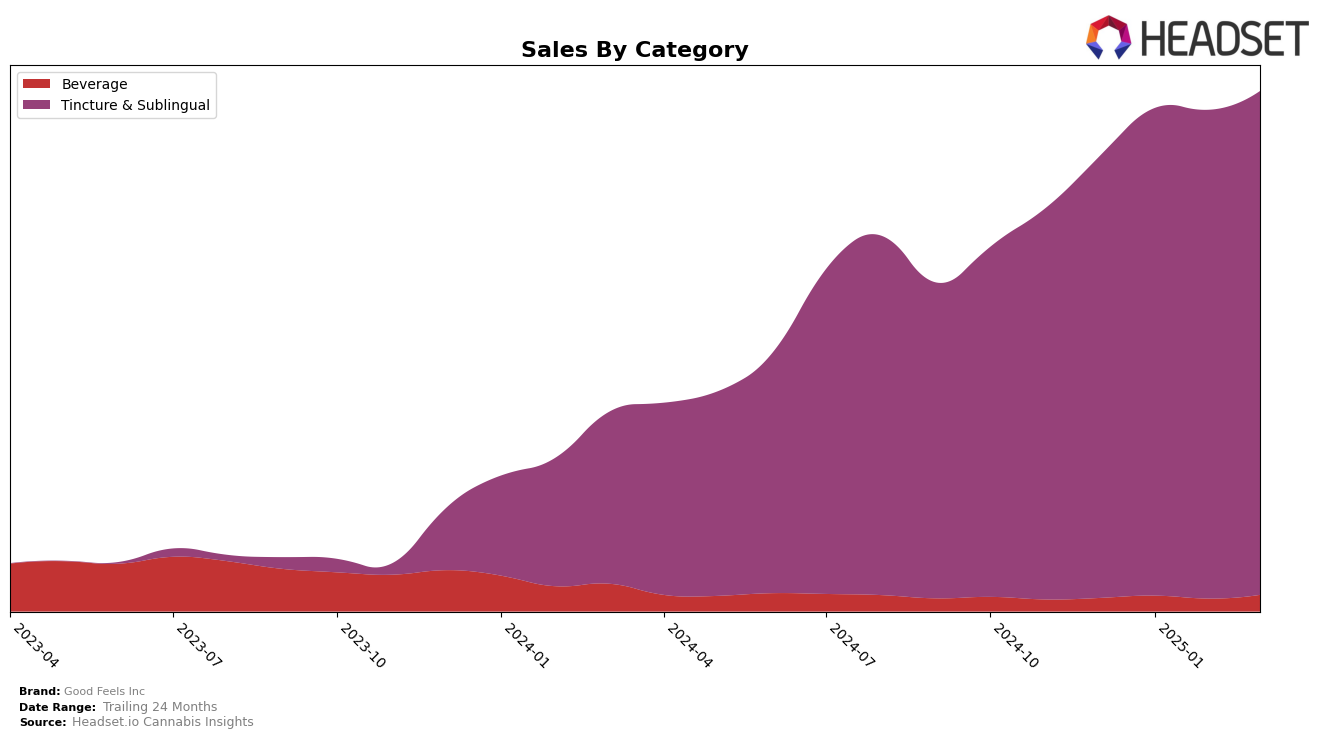

Good Feels Inc has shown notable performance in the Massachusetts market, particularly excelling in the Tincture & Sublingual category where it has consistently held the number one rank from December 2024 through March 2025. This sustained top position reflects a strong consumer preference and possibly effective market strategies. In contrast, their performance in the Beverage category, while stable, has seen a slight improvement, moving from the 16th position to the 15th in March 2025. This upward movement in rank, despite a dip in sales in February, suggests potential growth opportunities or strategic adjustments that could be capitalized on in the future.

In other states, the absence of Good Feels Inc from the top 30 brands across categories could be interpreted in different ways. It may indicate underperformance or a lack of market penetration compared to their stronghold in Massachusetts. For instance, their absence from the rankings in other states for the Beverage category could suggest either a highly competitive market environment or a need for enhanced distribution strategies. The consistency of their top ranking in the Tincture & Sublingual category in Massachusetts, however, underscores a successful niche presence that might offer insights or strategies applicable to other regions.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Good Feels Inc has consistently maintained its top position from December 2024 through March 2025, showcasing a robust market presence and consumer preference. Despite a slight dip in sales for competitors, Good Feels Inc has demonstrated a positive sales trajectory, with an increase from December 2024 to March 2025. Notably, Treeworks has held the second rank throughout this period, but its sales figures have fluctuated, indicating potential volatility in consumer demand. Meanwhile, Levia has consistently ranked third, with a noticeable decline in sales, which may suggest challenges in maintaining consumer interest. These dynamics highlight Good Feels Inc's strong market leadership and resilience against competitive pressures in the Massachusetts market.

Notable Products

In March 2025, Good Feels Inc's top-performing product was the Good Vibez X - Pink Lemonade Syrup Tincture, reclaiming its number one rank from February with sales reaching 2446 units. The Strawberry Syrup Tincture, which was the top seller in February, dropped to the second position. The Cranberry Pomegranate Syrup Tincture made a notable climb to third place, after being unranked in February. The Watermelon Fast Acting Syrup Tincture maintained a steady performance, holding the fourth rank for two consecutive months. Finally, the Blue Raspberry Syrup Tincture remained in the fifth position, showing consistent sales throughout the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.