Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

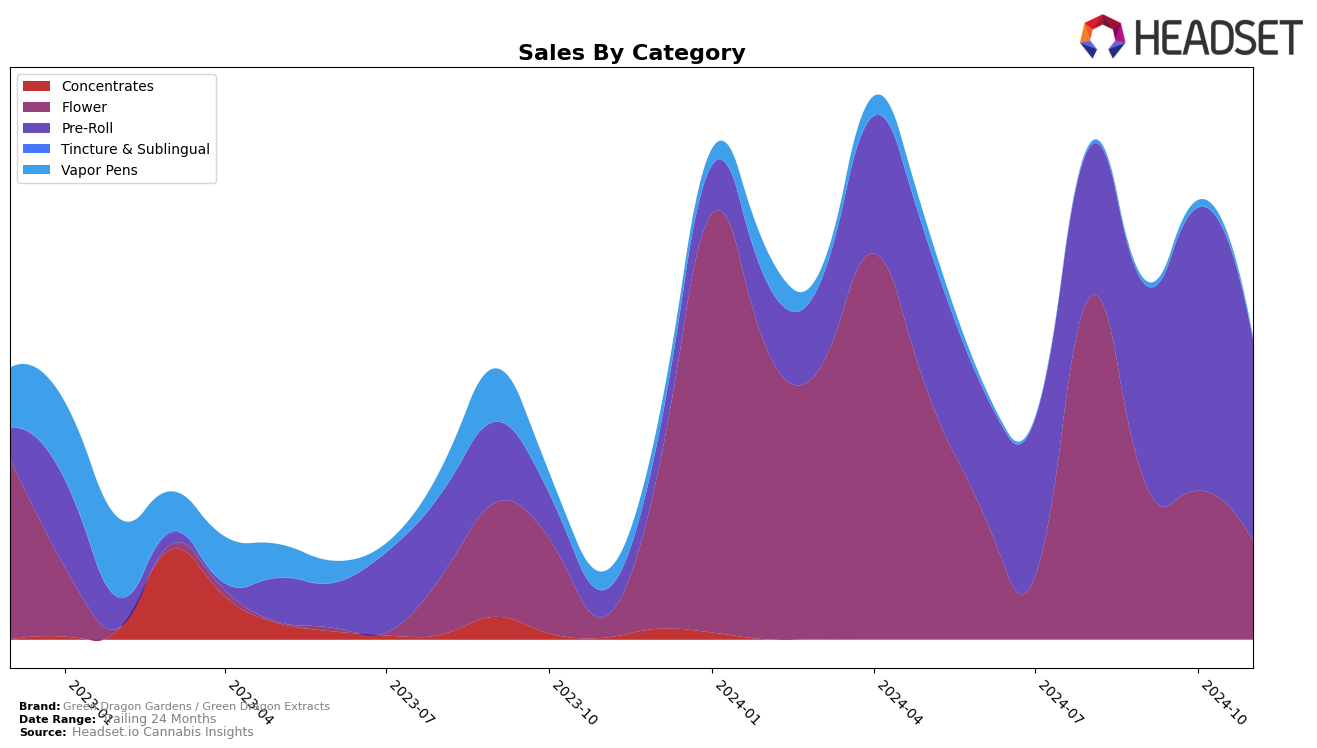

Green Dragon Gardens / Green Dragon Extracts has shown a dynamic performance in the Pre-Roll category in Oregon over the past few months. The brand has experienced a significant upward trend from August to October, climbing from a rank of 85 in August to 62 in October. This positive movement suggests a growing consumer interest and potentially effective marketing or product quality improvements. However, a slight dip to rank 67 in November indicates potential volatility or increased competition in the market. Despite this, the brand's ability to remain within the top 100 consistently points to a stable presence in the market.

Interestingly, Green Dragon Gardens / Green Dragon Extracts did not rank within the top 30 brands in any other state or category for the given period. This could suggest that their market presence is currently limited to Oregon or that their performance in other states is overshadowed by more dominant brands. The sales figures for November, while lower than October, remain robust, indicating that the brand maintains a loyal customer base. The focus on the Pre-Roll category in Oregon could be a strategic decision to capitalize on a niche market, but it also highlights an area for potential growth and expansion into other states or product categories.

Competitive Landscape

In the Oregon pre-roll category, Green Dragon Gardens / Green Dragon Extracts has demonstrated a notable upward trajectory in brand rank over the past few months, moving from 85th in August 2024 to 62nd in October 2024, before slightly dipping to 67th in November 2024. This improvement suggests a positive reception and growing market presence, although the slight decline in November indicates potential challenges in maintaining momentum. In comparison, Dr. Jolly's consistently outperformed Green Dragon Gardens / Green Dragon Extracts, maintaining a higher rank throughout the period, peaking at 50th in October. Meanwhile, NW Kind and PDX Organics experienced fluctuations, with NW Kind improving slightly from 69th to 65th by November, and PDX Organics showing a decline from 69th to 68th. The data indicates that while Green Dragon Gardens / Green Dragon Extracts is gaining traction, it faces stiff competition from established brands like Dr. Jolly's, which could impact its ability to climb higher in the rankings and increase sales.

Notable Products

In November 2024, Green Dragon Gardens / Green Dragon Extracts saw Apples and Bananas Pre-Roll (1g) soar to the top of the sales chart, ranking first with sales of 3570 units, a significant increase from its previous absence in October. Ice Cream Cake Pre-Roll (1g) made a strong debut, taking the second spot. Kush Mints Pre-Roll (1g), which was the top performer in October, slipped to third place in November. Supreme Lee Hi Pre-Roll (1g) experienced a slight drop, moving from second in October to fourth in November. Dj Short Blueberry Pre-Roll (1g) maintained a consistent presence, ranking fifth, though its sales have decreased compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.