Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

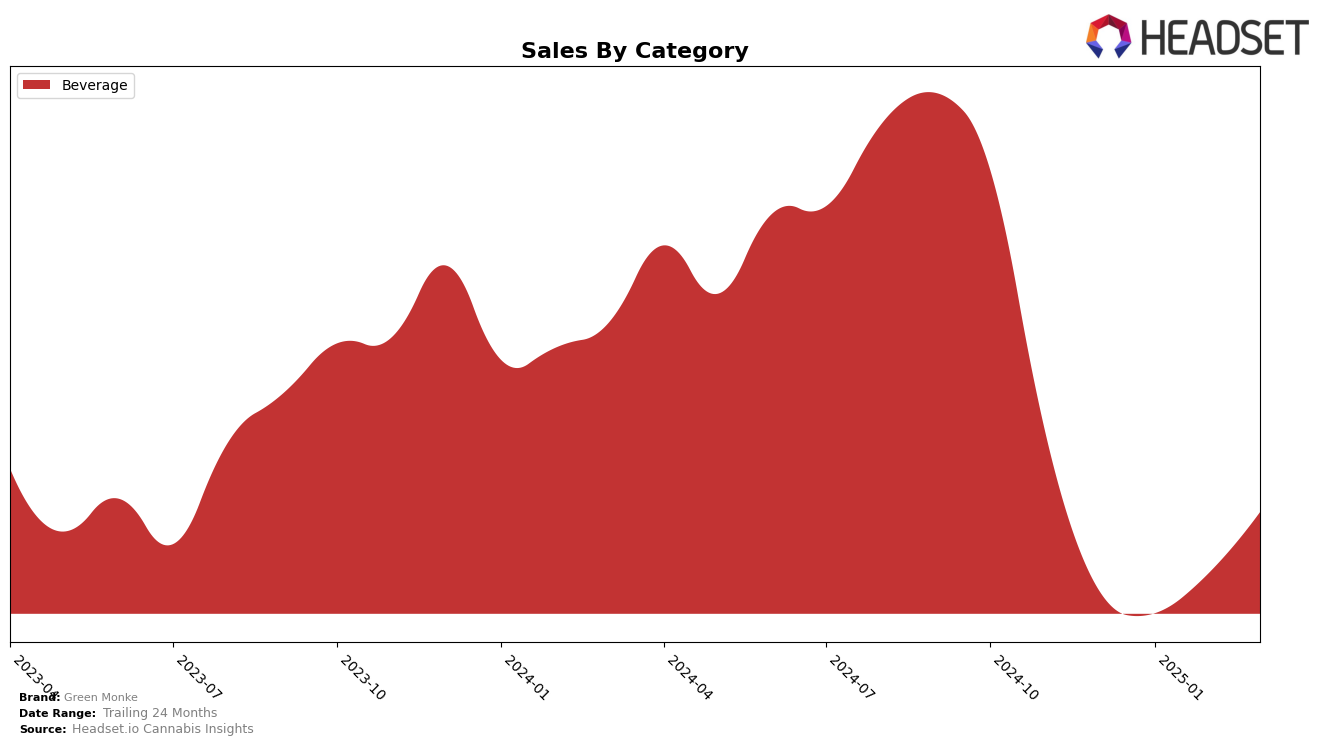

Green Monke has demonstrated notable progress in the beverage category across different regions, with varying degrees of success. In British Columbia, the brand has shown a consistent upward trajectory, moving from the 19th position in December 2024 to the 11th position by March 2025. This steady climb is indicative of increasing consumer interest and growing market presence, supported by a substantial rise in sales from December to March. Conversely, in Ontario, Green Monke's performance has been less consistent. While they maintained a rank of 25th in both December and January, they were absent from the top 30 rankings in February, only to reappear at 23rd in March. This fluctuation suggests challenges in maintaining a stable market position in Ontario, despite a rebound in March.

The absence of Green Monke from the top 30 rankings in Ontario during February could be seen as a setback, highlighting potential issues in market penetration or competition. However, their re-entry into the rankings in March, albeit at a slightly improved position, suggests potential strategies being implemented to regain market share. The disparity in performance between British Columbia and Ontario could be attributed to regional preferences or market dynamics that are more favorable in British Columbia. This information underscores the importance for Green Monke to analyze regional market conditions and consumer preferences to tailor their strategies effectively, ensuring sustained growth and presence across different geographies.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Green Monke has demonstrated a significant upward trajectory in rank, moving from 19th in December 2024 to 11th by March 2025. This improvement is noteworthy given the consistent performance of competitors such as Collective Project, which maintained a stable rank of 8th to 9th during the same period. Despite starting with lower sales figures, Green Monke's sales have shown a remarkable increase, closing the gap with brands like Summit (Canada) and HYTN, whose sales have fluctuated or declined. Meanwhile, Second Nature has experienced a slight dip in rank, indicating a potential opportunity for Green Monke to further capitalize on its growth momentum and continue climbing the ranks in the coming months.

Notable Products

In March 2025, the top-performing product for Green Monke was the CBD/THC 2:1 Mango Guava Sparking Soda (6mg CBD, 3mg THC, 350ml) in the Beverage category, maintaining its number one rank consistently for four months with sales reaching 3264 units. The CBD/THC 2:1 Tropical Citrus Sparking Soda (6mg CBD, 3mg THC, 12oz) held the second position, showing a significant increase in sales from previous months. The Orange Passionfruit Sparkling Soda (6mg CBD, 3mg THC, 350ml) moved up to third place from fifth in February, indicating a notable rise in popularity. The Tropical Citrus Sparking Soda (20mg CBD, 10mg THC, 12oz) fell from third to fourth place, while the Blue Raspberry Sparkling Beverage (20mg CBD, 10mg THC) entered the top five for the first time. These shifts highlight changing consumer preferences within Green Monke's beverage offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.