Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

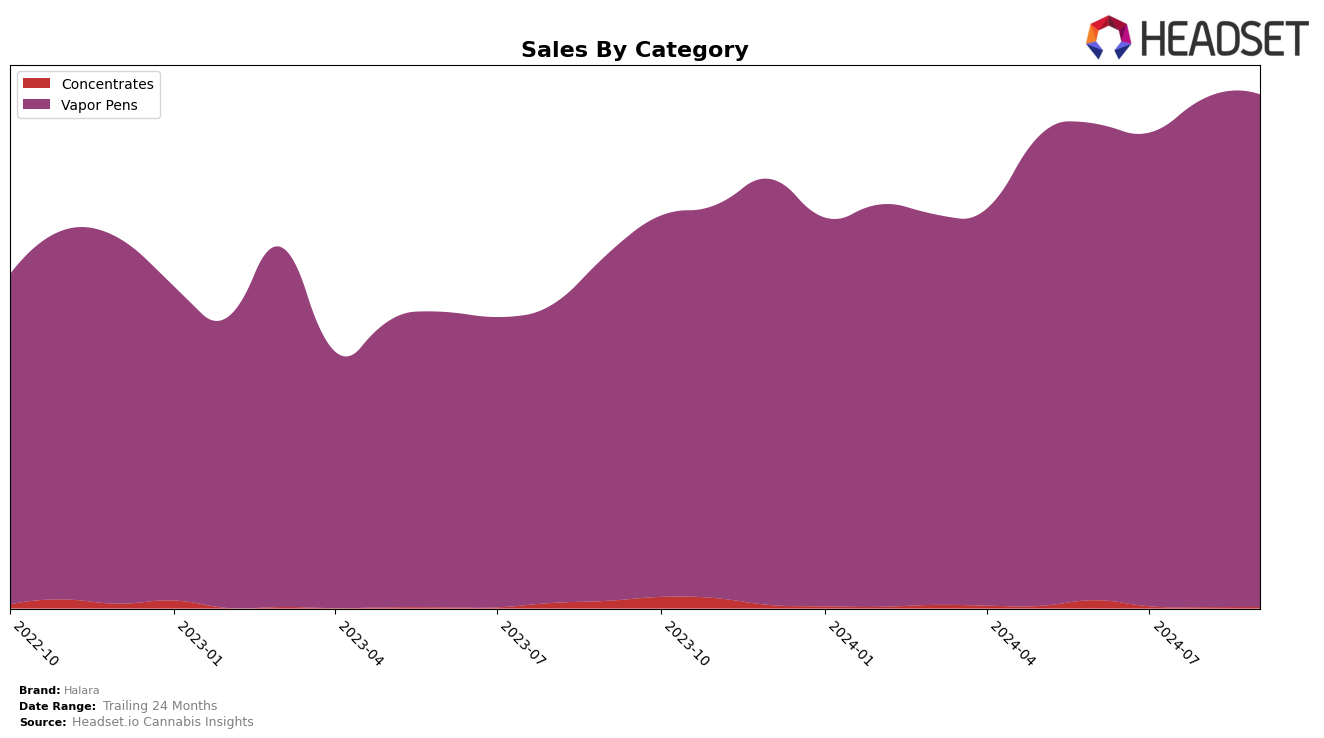

Halara has shown noteworthy progress in the Vapor Pens category within California. Over the past few months, the brand has gradually climbed the ranks, moving from 38th place in June 2024 to breaking into the top 30 by September 2024. This upward trajectory is a positive indicator of Halara's growing presence and acceptance in the competitive California market. The consistent increase in sales, with a notable jump in August, suggests that Halara's products are resonating well with consumers, potentially due to effective marketing strategies or product enhancements.

Despite the positive trends in California, Halara's absence in the top 30 brands in other states and categories may indicate challenges in gaining traction outside its stronghold. This could point to regional preferences or differences in market dynamics that Halara might need to address to replicate its California success elsewhere. The brand's focus on Vapor Pens in California appears to be paying off, but expanding its footprint across different states and categories could offer new growth opportunities. Understanding these dynamics could be crucial for stakeholders looking to capitalize on Halara's brand potential.

Competitive Landscape

In the competitive landscape of vapor pens in California, Halara has shown a steady improvement in its ranking over the months from June to September 2024. Starting at rank 38 in June, Halara climbed to rank 30 by September, indicating a positive trend in market presence. This upward movement is notable when compared to competitors such as Kingpen, which improved from rank 32 to 28, and PAX, which fluctuated slightly but ended at rank 32. Meanwhile, Buddies and Connected Cannabis Co. experienced a decline in rankings, with Buddies dropping from 24 to 29 and Connected Cannabis Co. from 28 to 31. Halara's consistent sales growth, despite not having the highest sales figures, suggests a strengthening brand loyalty and market strategy that is effectively capturing consumer interest in the competitive California vapor pen market.

Notable Products

In September 2024, the top-performing product for Halara was Apricot Octane Distillate Disposable (1g) in the Vapor Pens category, maintaining its leading position from July and rebounding from third place in August, with sales reaching 1620 units. The Zkooby Znakz Full Spectrum Cartridge (1g) secured the second spot, slightly down from its top rank in August. Purple Daddy Full Spectrum Cartridge (1g) improved its standing to third place, showing a steady rise from fifth in the previous two months. Apricot Octane Distillate Cartridge (1g) slipped to fourth place, despite consistently strong performance in earlier months. Notably, Purple Daddy Live Resin Disposable (1g) appeared in the rankings for the first time, debuting in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.