Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

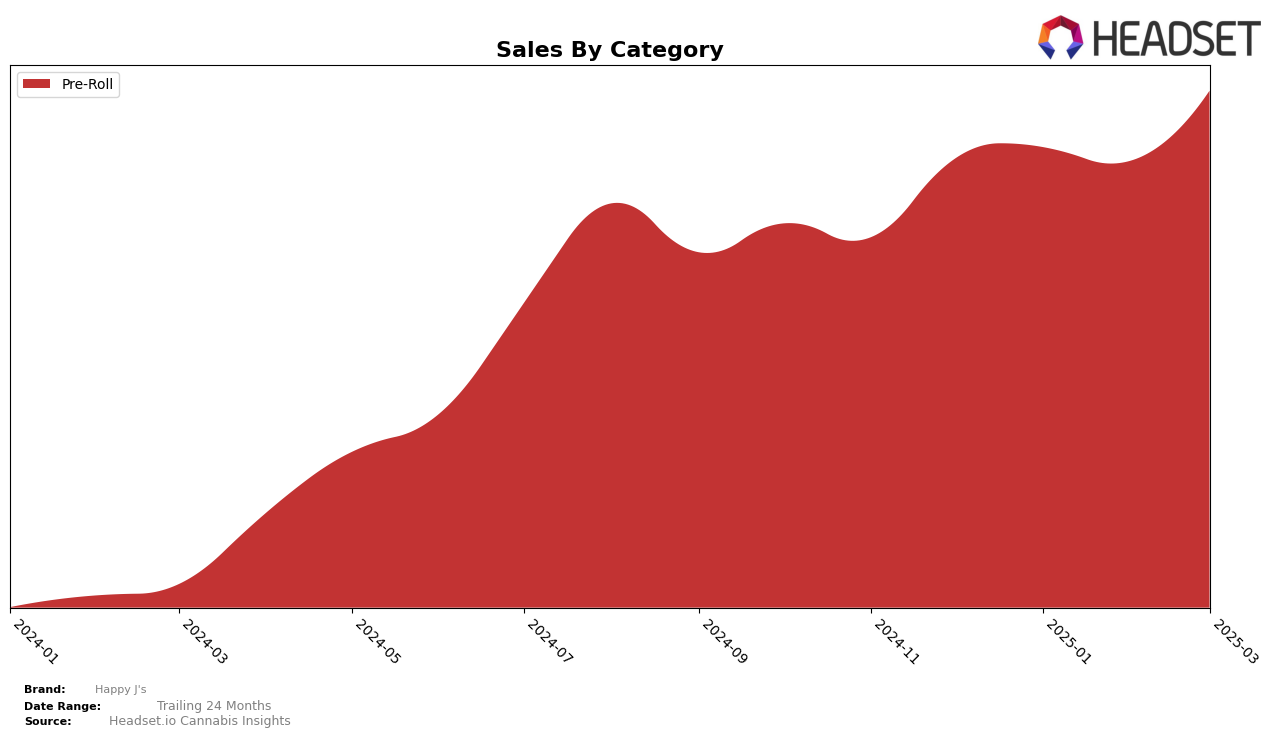

Happy J's has shown a consistent performance in the Pre-Roll category within the state of Maryland, maintaining a steady rank of 4th place from December 2024 through March 2025. This stability suggests a strong foothold in the Maryland market, particularly in the Pre-Roll segment. Notably, there was a significant uptick in sales from February to March 2025, indicating a positive reception among consumers or possibly a successful marketing strategy or product launch during this period. While maintaining a top-five position is impressive, the absence of Happy J's in the top 30 rankings in other categories or states could suggest areas for potential growth or diversification.

Despite the success in Maryland's Pre-Roll category, Happy J's absence from the top 30 in other states and categories highlights the brand's limited geographical reach or category diversification. This could be perceived as a challenge or an opportunity, depending on the brand's strategic goals. Expanding their presence into other states or exploring additional product categories might be avenues for growth. The consistent ranking in Maryland, however, does provide a solid foundation upon which Happy J's could build further success. Understanding the dynamics of other markets and consumer preferences could offer pathways for the brand to replicate its Maryland success elsewhere.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Maryland, Happy J's has maintained a consistent rank of 4th from December 2024 through March 2025. This stability in ranking suggests a solid market presence, although it trails behind top competitors like SunMed and Curio Wellness, which have consistently held higher ranks. Notably, Curio Wellness saw a significant sales increase in March 2025, which may indicate a growing customer preference or successful marketing strategies. Meanwhile, Verano and Strane have shown fluctuations in their rankings, with Strane experiencing a notable jump from 11th in January to 5th in March, potentially posing a future threat to Happy J's position. Despite these competitive pressures, Happy J's has demonstrated resilience in maintaining its rank, supported by a steady increase in sales, particularly in March 2025, indicating potential for upward momentum if strategic adjustments are made.

Notable Products

In March 2025, the top-performing product from Happy J's was the Midnight Circus Pre-Roll 2-Pack (1g), maintaining its number one rank from February, with sales at 3933 units. Ice Cream Cake Pre-Roll 2-Pack (1g) made a notable entry, securing the second position with a sales figure of 2902, despite not being ranked in the previous two months. Sour Peel Pre-Roll 2-Pack (1g) debuted at the third position with sales of 2767 units. Lemon Cherry Gelato Pre-Roll 2-Pack (1g) dropped from the third rank in December 2024 to fourth in March 2025. Gumi #6 Pre-Roll 2-Pack (1g) entered the rankings at fifth place, showing a fresh interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.