Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

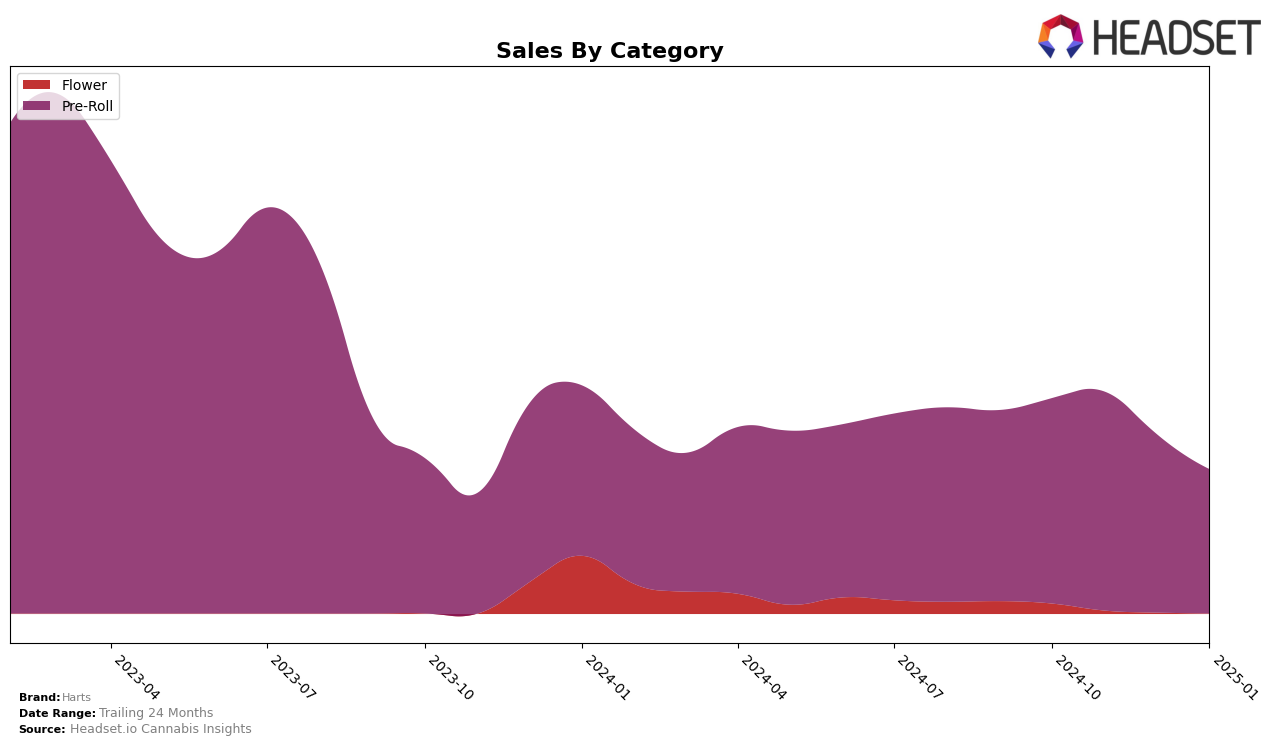

Harts has shown a dynamic performance in the Pre-Roll category across the Canadian province of Saskatchewan. Notably, the brand's ranking fluctuated over the months, starting at 16th place in October 2024, rising to 11th in November, and then slipping back to 16th in December. By January 2025, Harts had further descended to the 18th position. This movement indicates a competitive environment in the Pre-Roll category, where maintaining a steady rank appears challenging. Despite these fluctuations, Harts managed to achieve a peak in sales during November, suggesting a strong market presence during that period.

However, it's important to note that Harts did not consistently maintain a top 10 position in the Pre-Roll category in Saskatchewan, which could be seen as a missed opportunity to consolidate their market position. The decline in sales from November to January might imply seasonal factors or increased competition. Being absent from the top 10 in January could be a concern for the brand's strategy moving forward, as it highlights the need for potential adjustments to regain momentum. This analysis serves as an indicator of the brand's current standing and potential areas for improvement, particularly in maintaining a consistent top-tier ranking.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Harts has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked 16th in October 2024, Harts improved to 11th in November but then faced a decline, dropping to 18th by January 2025. This shift in ranking correlates with a decrease in sales from November to January, suggesting potential challenges in maintaining consumer interest or facing increased competition. Meanwhile, North 40 Cannabis consistently improved its rank from 25th to 17th over the same period, indicating a positive sales trajectory that may have drawn market share away from Harts. Similarly, 5 Points Cannabis maintained a stable presence, slightly improving its rank from 17th to 16th, which could also contribute to the competitive pressure on Harts. These dynamics underscore the importance for Harts to strategize effectively to regain and sustain its market position amidst evolving consumer preferences and competitive advancements.

Notable Products

In January 2025, Harts' top-performing product was the Watermelon Zkittlez Pre-Roll 10-Pack (3.5g), maintaining its lead from October and November before slipping slightly in December. The Tangie Sunset Pre-Roll 10-Pack (3.5g) climbed to the second position, with sales reaching 761 units, marking a notable improvement from its previous rankings. Previously ranking first in December, the Screwface OG Pre-Roll 10-Pack (3.5g) fell to third place. Lion's Breath Pre-Roll 10-Pack (3.5g) debuted in the rankings at fourth place, while Pink Gas Pre-Roll 10-Pack (3.5g) secured the fifth spot. These shifts indicate dynamic changes in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.