Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

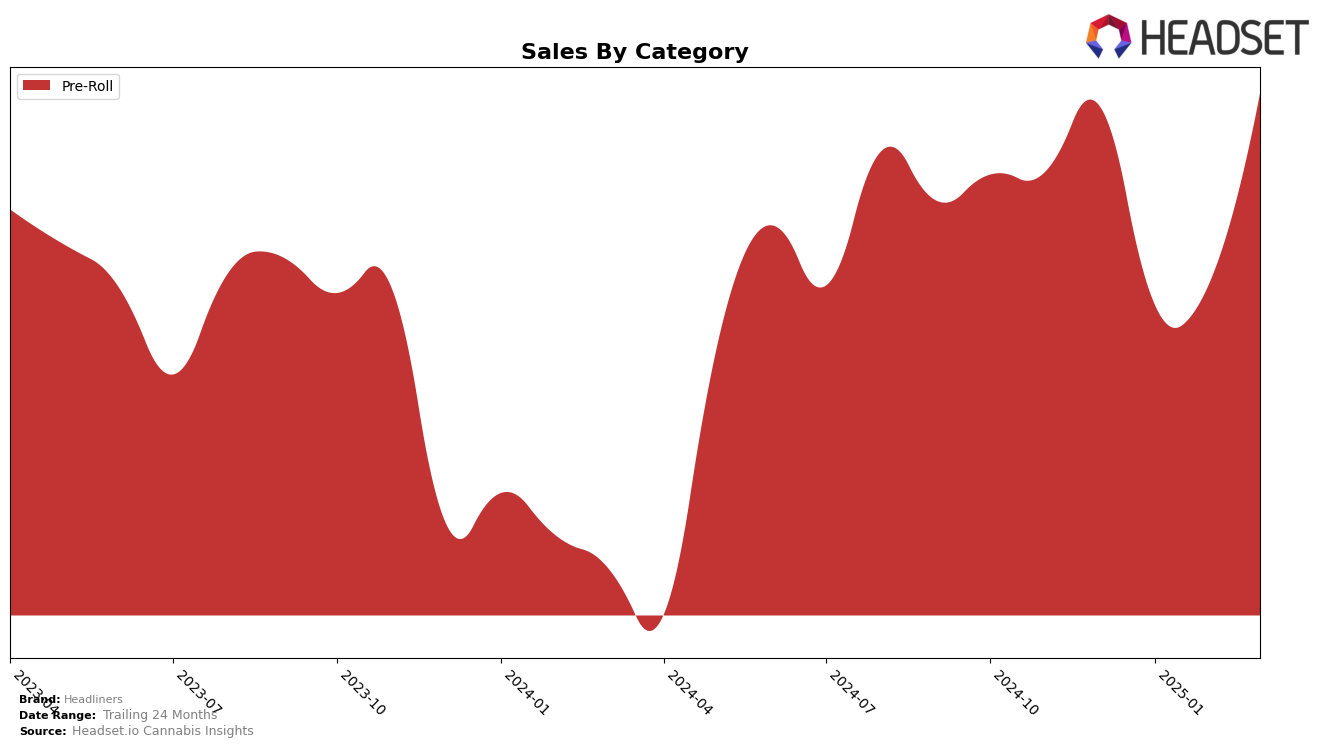

Headliners has shown a notable performance in the Pre-Roll category in Massachusetts over the past few months. The brand's ranking improved from 22nd place in January 2025 to 15th place by March 2025, indicating a strong upward trajectory. This improvement is particularly significant given that they were not in the top 30 in some categories in other states, which highlights their focused success in Massachusetts. Despite a dip in sales in January, Headliners managed to recover and even surpass their December sales figures by March, suggesting effective strategies and product offerings that resonated well with the Massachusetts market.

While Headliners has made strides in Massachusetts, their absence from the top 30 in other states and categories suggests there is room for growth and expansion. This could be seen as a potential area for improvement or a strategic choice to concentrate efforts in markets where they have established a foothold. The brand's ability to climb the ranks in Massachusetts might serve as a case study for potential success in other regions. Observers and stakeholders may want to keep an eye on whether Headliners will leverage their Massachusetts success to enter or improve their standings in other markets.

Competitive Landscape

In the competitive landscape of the Massachusetts pre-roll category, Headliners has shown a notable upward trajectory in rank from December 2024 to March 2025, moving from 19th to 15th position. This improvement in rank is indicative of a positive trend in sales performance, particularly when compared to competitors like Miss Grass and Tower Three, both of which have experienced fluctuations in their rankings. Notably, Tower Three surged from 28th to 14th, surpassing Headliners in March 2025, suggesting a competitive edge in recent months. Meanwhile, Springtime maintained a relatively stable position, consistently outperforming Headliners in terms of rank. Despite these dynamics, Headliners' consistent climb in rank reflects a strengthening market presence, potentially driven by strategic marketing efforts or product innovations. This competitive context underscores the importance for Headliners to continue leveraging data-driven insights to sustain and enhance its market position.

Notable Products

In March 2025, the top-performing product from Headliners was the Strawberry Candy Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank from February with sales of 2504 units. Strawberry Guava Pre-Roll (1g) held steady at the second position, showing an increase in sales from 1716 in February to 2409 in March. Pura Vida Pre-Roll 2-Pack (1g) climbed to third place, improving from its fifth position in February, with notable sales growth. The Pura Vida Pre-Roll (1g) slipped from third to fourth rank, despite consistent sales figures. Lastly, Dulce De Uva Pre-Roll 2-Pack (1g) maintained its fifth position, showing a steady performance compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.