Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

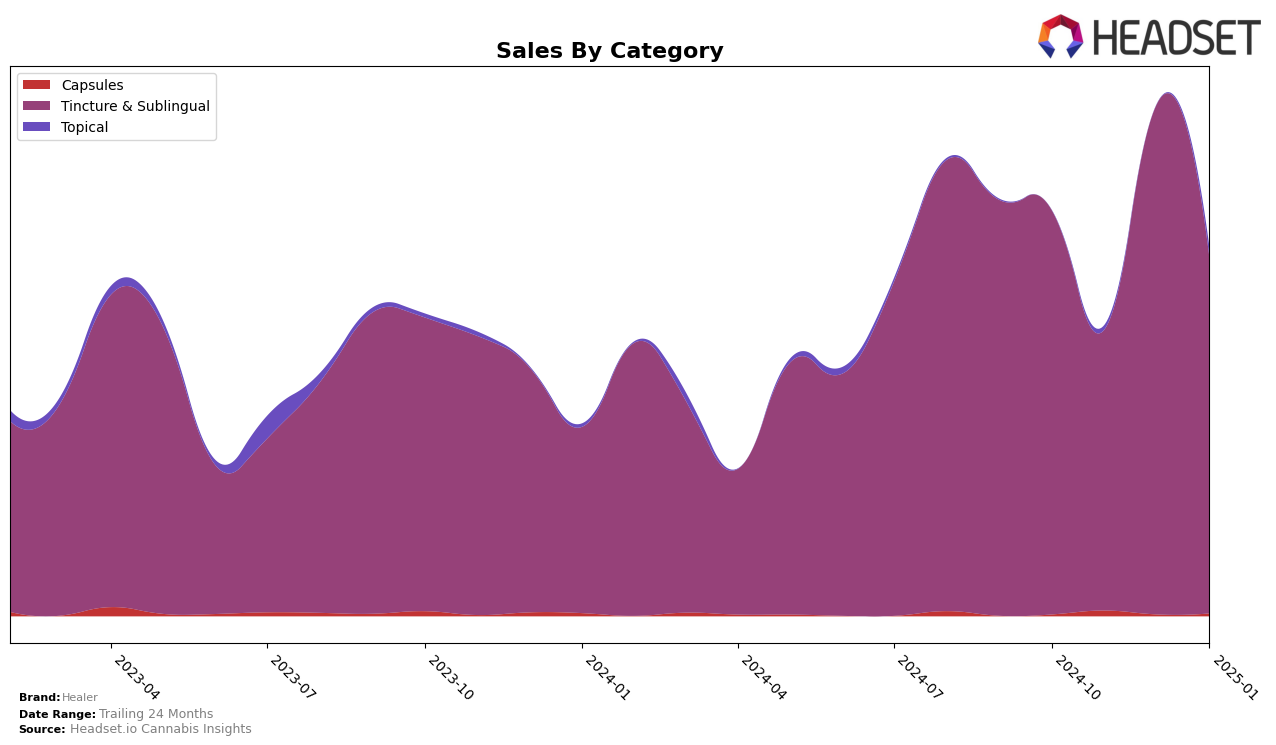

Healer has demonstrated strong performance in the Tincture & Sublingual category, particularly in Maryland. The brand maintained the top position from October to December 2024, before experiencing a slight dip to second place in January 2025. This slight change in ranking suggests a highly competitive market landscape, but Healer's ability to stay within the top two positions highlights its robust presence in the state. Despite the fluctuation in sales figures, with a notable peak in December 2024, Healer's consistent ranking indicates a strong consumer base and effective market strategies.

Interestingly, Healer's absence from the top 30 brands in other states and categories suggests a concentrated focus or perhaps differing market dynamics outside of Maryland. This could be interpreted as a potential area for growth or an indication of the brand's strategic prioritization within the state. The brand's performance in Maryland's Tincture & Sublingual category provides valuable insights into consumer preferences and market conditions, which could inform future expansion or marketing efforts. Observing how Healer adjusts its strategies in response to these dynamics will be key for understanding its long-term trajectory in the cannabis market.

Competitive Landscape

In the Maryland Tincture & Sublingual category, Healer experienced a notable shift in market dynamics from October 2024 to January 2025. Initially holding the top rank, Healer maintained its leading position through December 2024, showcasing strong sales performance. However, a significant change occurred in January 2025 when Doctor Solomon's overtook Healer, moving from a consistent second place to claim the number one spot. This shift was accompanied by a substantial increase in sales for Doctor Solomon's, indicating a competitive surge that Healer must address to regain its leading position. The data suggests that while Healer's sales remained robust, the competitive landscape is intensifying, necessitating strategic adjustments to maintain its market dominance.

Notable Products

In January 2025, the top-performing product for Healer was the CBD/THC/THCA/CBDA 1:1:1:1 Balance Tincture, maintaining its number one rank from December 2024 with sales of 349 units. The THC/THCA 1:1 Pain Relief Tincture held steady in the second position, consistent with its ranking from the previous month. The THC/THCa 6:1 Night Tincture remained in third place, showing stable performance over the past three months. Notably, the THC/THCA 1:1 Pain Relief Tincture with 100mg of each compound re-entered the rankings at fourth place after being unranked in November and December 2024. Lastly, the THC/THCA 6:1 Night Tincture dropped to fifth place, continuing its decline from the top spot in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.