May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

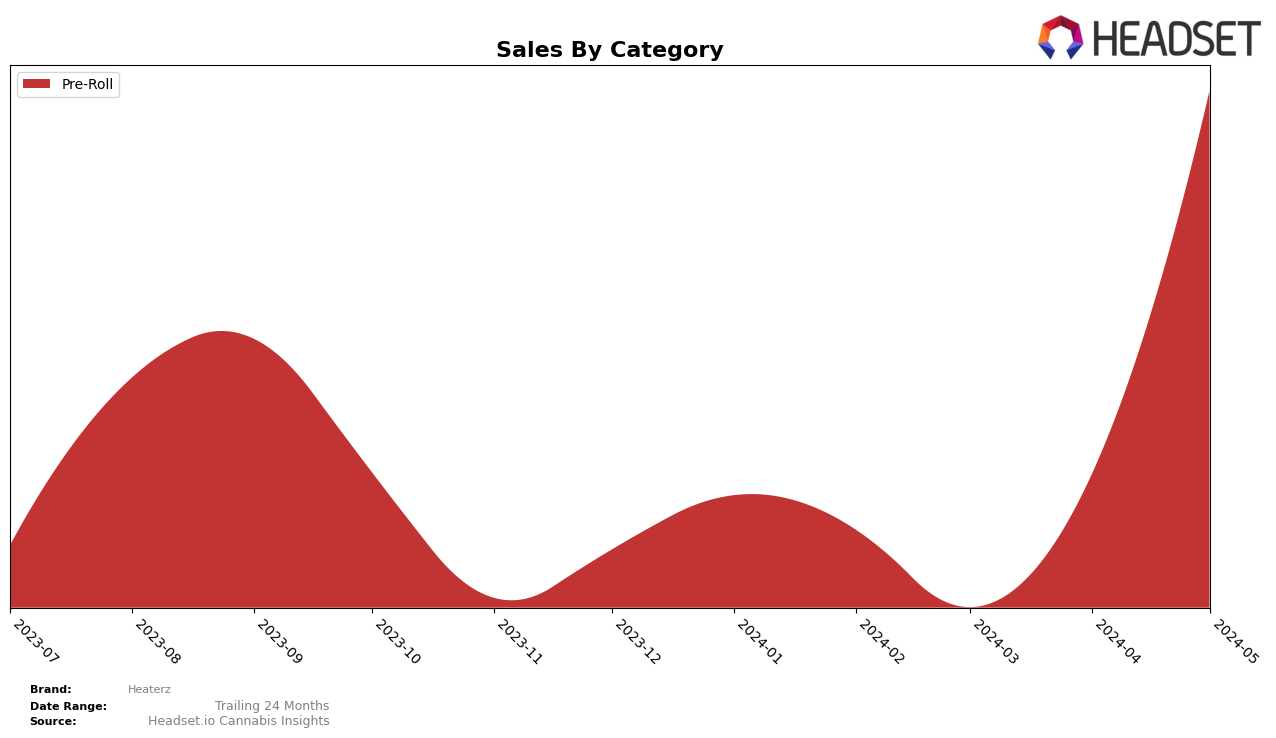

Heaterz has demonstrated notable performance fluctuations across various states and categories. In Missouri, the brand has seen a significant upward trend in the Pre-Roll category. Starting from a rank of 46 in February 2024, Heaterz improved to 21 by May 2024. This movement reflects a strategic gain in market presence, likely driven by increased consumer preference or effective marketing strategies. However, Heaterz did not make it to the top 30 brands in Missouri for March 2024, indicating a temporary dip in performance that the brand managed to recover from swiftly.

Across other states, Heaterz' presence and performance in the Pre-Roll category show varied trends. While they have achieved a commendable rank in Missouri, similar data for other states is not available, suggesting that Heaterz did not make it into the top 30 brands in those regions for the months in question. This disparity highlights areas for potential growth and market penetration. It would be beneficial to monitor Heaterz' strategies in Missouri and see if similar approaches could be replicated across other states to enhance their overall market footprint.

Competitive Landscape

In the Missouri Pre-Roll category, Heaterz has demonstrated a significant upward trajectory in recent months. After starting at a low rank of 46 in February 2024, Heaterz made a remarkable leap to rank 21 by May 2024. This improvement in rank is indicative of a substantial increase in sales, with Heaterz's sales figures rising from $43,439 in February to $129,434 in May. In comparison, Ostara Cannabis also experienced growth, moving from rank 38 to 23, but with a less dramatic sales increase. Meanwhile, Greenlight and Vibe Cannabis (MO) maintained relatively stable positions, with Greenlight experiencing a slight decline from rank 16 to 19 and Vibe Cannabis hovering around the 19-20 range. Jelly Roll showed some fluctuation but remained competitive, ending May at rank 22. The data suggests that Heaterz's aggressive climb in rank and sales could be attributed to effective marketing strategies or product improvements, positioning them as a rising competitor in the Missouri Pre-Roll market.

Notable Products

In May-2024, the top-performing product for Heaterz was Grid Iron OG Infused Pre-Roll (0.65g) in the Pre-Roll category, maintaining its rank at number 1 with notable sales of 21,954 units. The second-ranked product was Grid Iron OG Infused Pre-Roll 3-Pack (1.95g), also in the Pre-Roll category, which has consistently held the number 2 spot. Compared to previous months, both products have shown significant growth in sales, with the 0.65g Pre-Roll experiencing a substantial increase from 6,680 units in April to 21,954 units in May. The 3-Pack (1.95g) Pre-Roll also saw a rise from 284 units in April to 1,370 units in May. This consistent ranking and growth indicate a strong market preference for these specific Heaterz products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.