Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

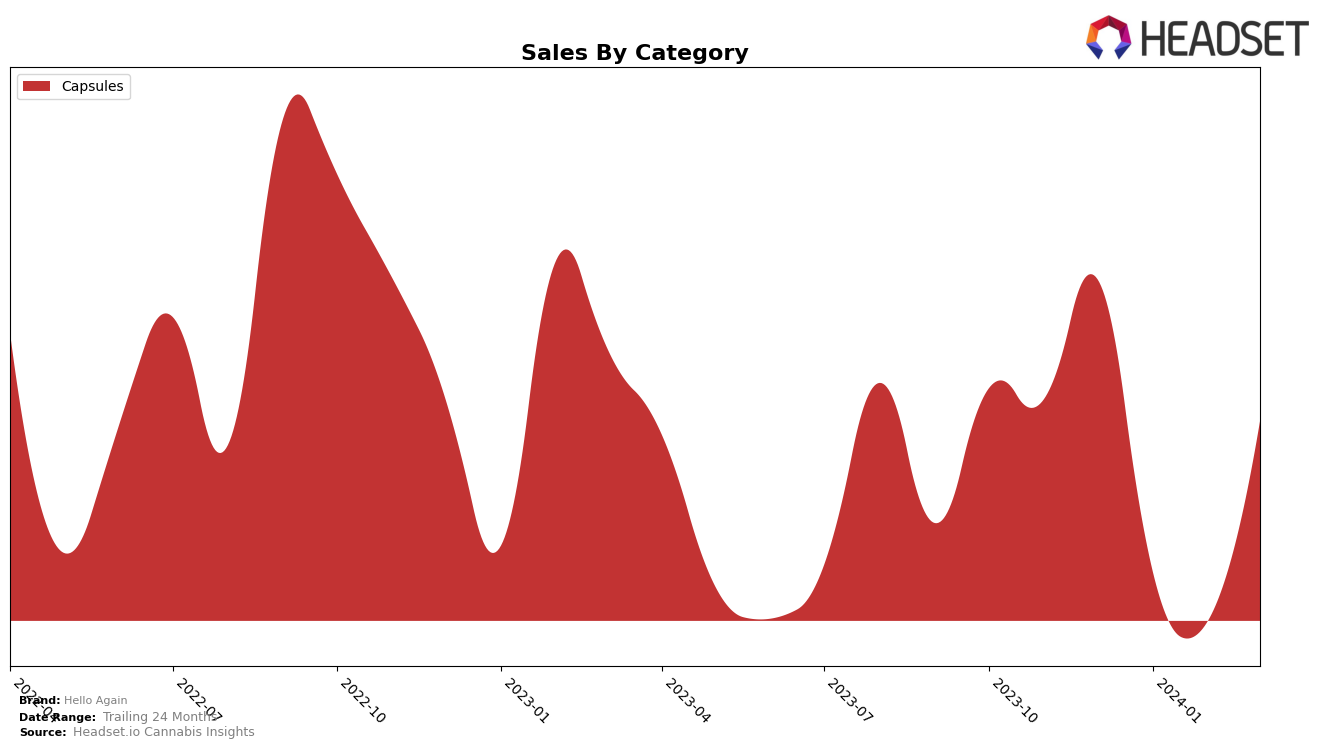

In the competitive cannabis market of California, Hello Again has shown a consistent presence within the Capsules category, maintaining its position among the top 15 brands over the recent months. The brand experienced a slight improvement in its ranking from December 2023 to January 2024, moving up from 14th to 13th position. However, it faced minor setbacks in February and March 2024, slipping to the 15th spot. This fluctuation in rankings indicates a fiercely competitive landscape but also highlights Hello Again's ability to stay relevant among consumers. The sales figures reflect a notable dip in January 2024, dropping to 3062 from December's 5577, followed by a further decrease in February before experiencing a rebound in March 2024 to 4357. This recovery suggests an effective strategy or market dynamics that allowed Hello Again to recapture some of its lost ground.

While the brand's performance in the Capsules category shows resilience, the absence of Hello Again from the top 30 brands in other categories or states/provinces suggests a focused or limited market presence. This concentration in a single category within the California market could be seen as both a strength and a vulnerability, depending on the brand's ability to adapt and expand. The lack of expansion into other categories or states/provinces might indicate a strategic decision to deepen its market penetration and brand loyalty in a specific niche before branching out. However, without visibility into these additional markets or categories, it's challenging to fully assess the brand's overall market performance and potential. The observed trends and sales movements offer a glimpse into Hello Again's strategic positioning and market dynamics but also leave room for speculation on future growth opportunities and areas of improvement.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in California, Hello Again has experienced a fluctuating performance in terms of rank and sales over the recent months. Starting from December 2023, Hello Again was ranked 14th, improving to 13th in January 2024, before dropping to 15th in February and maintaining this position into March 2024. This indicates a challenge in sustaining its upward trajectory amidst stiff competition. Notably, Mary's Medicinals has consistently held a higher rank, fluctuating slightly from 12th to 13th, suggesting a more stable market position despite a downward trend in sales. Cookies and Kind Medicine have also been key competitors, with Cookies experiencing a slight decline from 15th to 16th rank and Kind Medicine showing a more volatile rank change but ending up at 14th in March 2024, directly above Hello Again. Blue River Extracts remains the closest behind, showing some improvement in rank from 16th to 17th. The competitive dynamics suggest that Hello Again needs to bolster its market strategies to reclaim and enhance its position in the California cannabis capsule market, as both rank and sales have shown vulnerability to fluctuations amidst aggressive competition.

Notable Products

In March 2024, Hello Again saw the CBD/THC 8:1 Everyday Suppository 2-Pack (32mg CBD, 4mg THC) maintain its top position in sales with 91 units sold, continuing its streak as the best-selling product across previous months. Following closely, the CBD/THC 3:4 Hangover Suppository 2-Pack (30mg CBD, 20mg THC) secured the second spot, indicating a stable consumer preference as it held the same rank since January. The CBD/THC 1:4 Sleep Suppository 2-Pack (10mg CBD, 40mg THC) showed a notable improvement, climbing up to the third rank in March from its fourth position in February, suggesting a growing interest in sleep aid products. Conversely, the CBD/THC 2:1 Period Suppository 8-Pack (160mg CBD, 80mg THC) dropped to the fourth rank, despite being the second-best seller in December 2023, highlighting a shift in consumer demand. The CBD/THC 8:1 Everyday Suppository 8-Pack (128mg CBD, 16mg THC) remained in the fifth position, underscoring a consistent, albeit lower, demand for larger pack sizes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.