Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

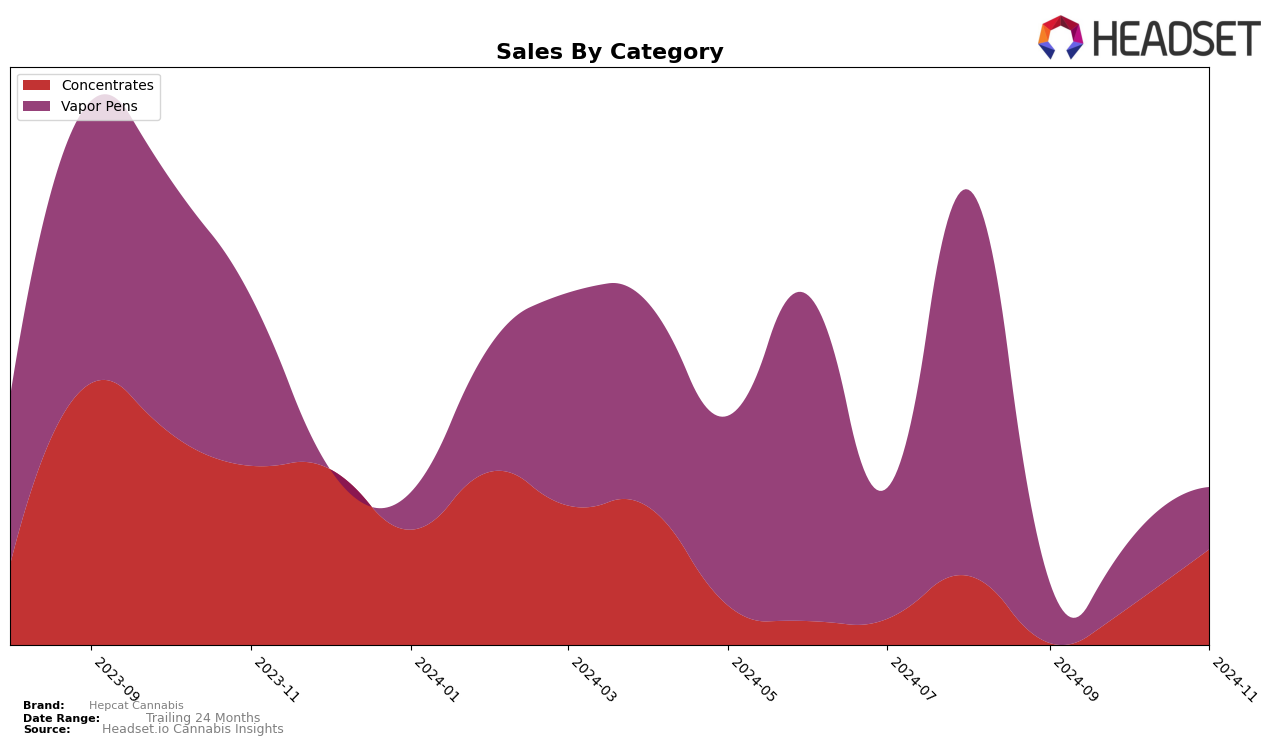

Hepcat Cannabis has seen varied performance across different categories and states, with some notable movements in rankings and sales. In the Vapor Pens category in New York, Hepcat Cannabis did not make it into the top 30 brands from August to November 2024. This absence from the top rankings suggests that the brand may be facing significant competition in the New York market, or possibly experiencing challenges in capturing consumer interest in this specific category. Despite not being in the top 30, the brand recorded sales of $20,645 in August 2024, indicating that while they may not be leading the market, they are still maintaining a presence.

The lack of ranking in the top 30 for several consecutive months highlights potential areas for growth and improvement for Hepcat Cannabis. It is crucial for the brand to analyze market trends and consumer preferences to better position itself in the competitive landscape of New York. Understanding the dynamics that contribute to their current market position could offer insights into strategic adjustments that may enhance their visibility and performance in future periods. The absence from the top rankings, while a challenge, also presents an opportunity for Hepcat Cannabis to reassess and refine their approach in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Hepcat Cannabis has experienced notable fluctuations in its market presence. Despite not ranking in the top 20 from September to November 2024, Hepcat Cannabis had a rank of 70 in August 2024, indicating a potential decline in market visibility. Competitors such as Snobby Dankins and Hi*AF have maintained more consistent rankings, with Snobby Dankins peaking at 61 in September and Hi*AF holding steady in the mid-60s. This suggests that these brands may have stronger customer retention or marketing strategies that Hepcat Cannabis could learn from. Additionally, Bison Botanics also reappeared in the rankings in October, indicating a competitive resurgence. For Hepcat Cannabis, understanding these dynamics and the strategies employed by these competitors could be crucial for regaining market share and improving sales performance in the coming months.

Notable Products

In November 2024, Ghost Train Haze Wax (1g) emerged as the top-performing product for Hepcat Cannabis, maintaining its number one ranking from October with impressive sales of 87 units. Papaya Wax (1g) held steady at the second position, showing a slight increase in sales from 33 units in October to 38 units in November. Lemon Berry CO2 Wax (1g) climbed to the third position, marking its entry into the top three with 35 units sold. Blue Dream Full Spectrum Oil Cartridge (1g) dropped to fourth place, experiencing a decrease in sales from 31 units in October to 27 units in November. Trainwreck Distillate Disposable (1g) entered the rankings for the first time in November, securing the fourth position with 27 units sold, indicating a growing interest in this new product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.