Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

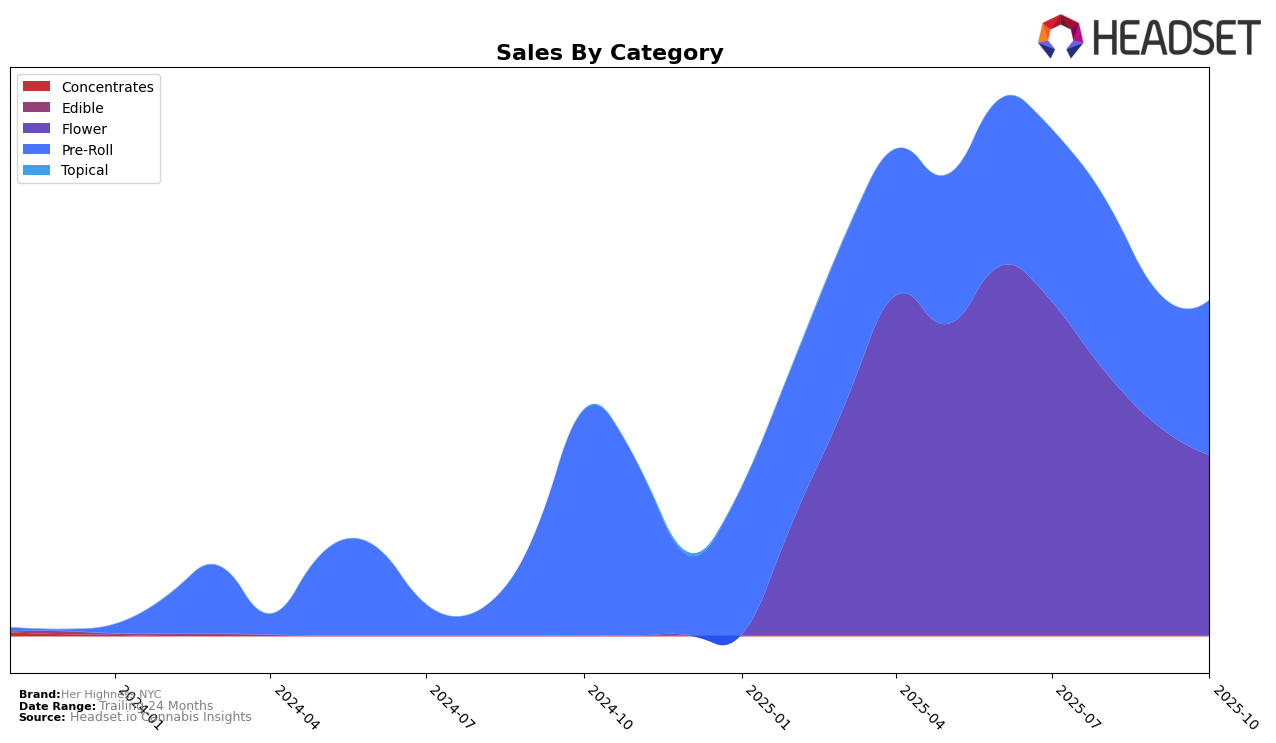

In the state of New York, Her Highness NYC has experienced notable fluctuations in its Flower category rankings over the past few months. Starting from a rank of 41 in July 2025, the brand has seen a downward trend, slipping to a rank of 63 by October 2025. This decline in ranking is mirrored by a decrease in sales, dropping from $339,023 in July to $183,176 in October. Such a trend suggests that the brand may need to reassess its strategy in the Flower category to regain its footing in the competitive New York market.

In contrast, the Pre-Roll category in New York shows more stability for Her Highness NYC. The brand maintained a relatively consistent ranking, hovering around the 47 to 50 range from July to October 2025. Despite a slight dip in sales during September, the Pre-Roll category managed to rebound by October, indicating resilience and a potential area for growth. The consistent presence in the top 50 suggests that Her Highness NYC has a solid foundation in this category, which might be leveraged for further expansion.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Her Highness NYC has experienced a notable decline in rank and sales from July to October 2025. Starting at rank 41 in July, Her Highness NYC fell to rank 63 by October, indicating a significant drop in market position. This decline is contrasted by competitors such as To The Moon, which, despite fluctuations, managed to improve its rank from 68 in September to 62 in October, and Golden Garden, which maintained a relatively stable position, ending at rank 65 in October. Meanwhile, RIPPED entered the top 20 at rank 60 in October, suggesting a strong market entry. Additionally, urbanXtracts showed a positive trajectory, climbing from an unranked position to rank 66 in October. These shifts highlight the competitive pressures faced by Her Highness NYC, as emerging brands gain traction and established competitors maintain or improve their standings, potentially impacting Her Highness NYC's market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In October 2025, the top-performing product from Her Highness NYC was the Giggle Puffs Infused With Appetite-Suppressant Terpenes Pre-Roll 5-Pack, maintaining its lead from the previous two months with sales of 1102 units. The Stoner Puffs Infused Pre-Roll 5-Pack secured the second position, consistent with its performance in August and September. The Sleepy Puffs Kief Infused Pre-Roll 5-Pack climbed back to third place, showing a slight improvement from its fourth position in September. Tiki Cookies Infused Pre-Ground maintained its fourth place rank, mirroring its performance from August. The Giggle Puffs - Rainbow Sherbet Infused Pre-Roll 5-Pack remained steady at fifth place since its introduction in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.