May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

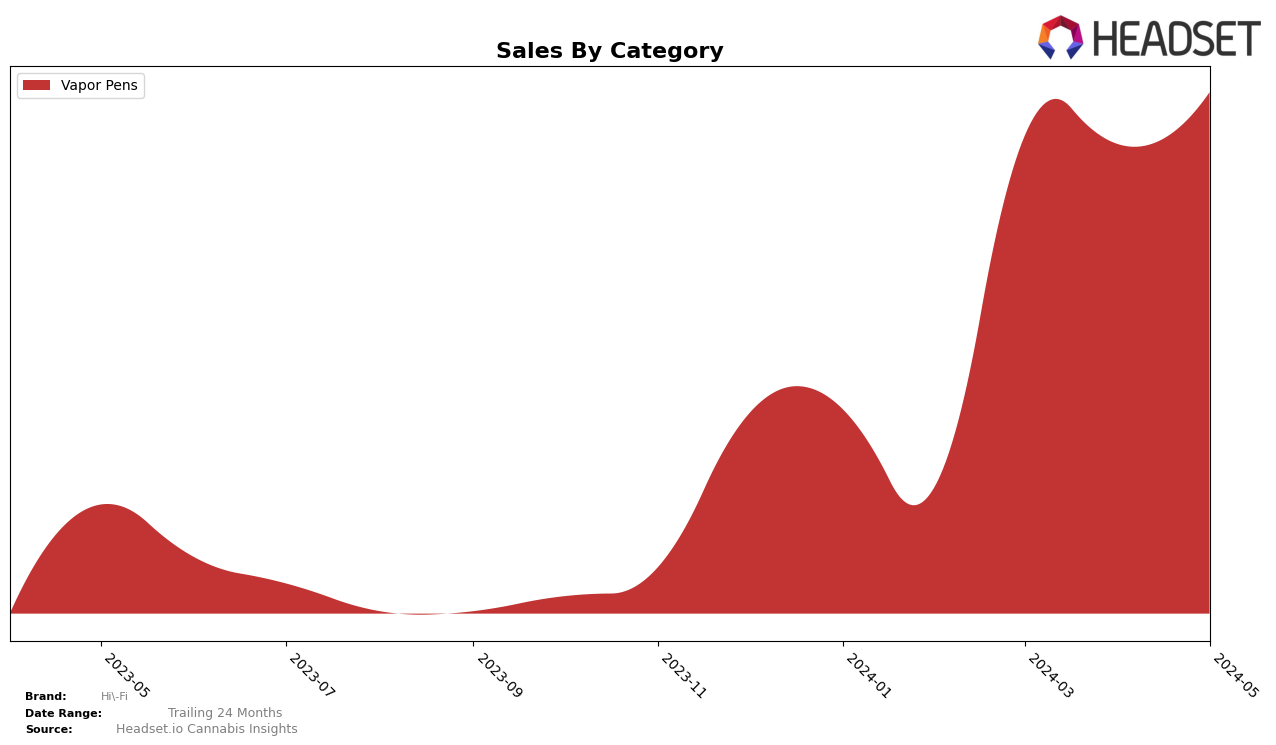

Hi-Fi has shown significant performance improvements in the Vapor Pens category in Michigan. In February 2024, Hi-Fi was ranked 71st, but by May 2024, it had climbed to the 30th position. This upward trajectory is a positive indicator of the brand's growing popularity and market penetration in Michigan. The substantial increase in sales from $85,084 in February to $319,563 in May further underscores this trend. However, the fact that Hi-Fi was not in the top 30 brands in February highlights that there is still room for improvement and potential for growth in this competitive market.

The steady climb in rankings from 36th in March to 32nd in April and finally breaking into the top 30 by May suggests a consistent and strategic approach to market positioning by Hi-Fi. This trend is particularly noteworthy as it demonstrates Hi-Fi's ability to adapt and respond to market demands effectively. While the sales figures provide a glimpse into the brand's performance, the significant leap in rankings over a short period is a testament to the brand's increasing acceptance and preference among consumers in Michigan. The absence from the top 30 in earlier months serves as a reminder of the competitive landscape and the importance of maintaining momentum.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Hi-Fi has shown a remarkable upward trajectory in its rankings over the past few months. Starting from a rank of 71 in February 2024, Hi-Fi climbed to 36 in March, 32 in April, and reached 30 in May. This consistent improvement indicates a strong market presence and growing consumer preference. In contrast, Cresco Labs and Bossy have experienced fluctuating ranks, with Cresco Labs not even making it into the top 20 in any of these months. Meanwhile, Rkive Cannabis and Mac Oils have shown more stable but less dramatic changes in rank. Rkive Cannabis, for instance, improved from 47 in February to 29 in May, while Mac Oils moved from 24 to 28 in the same period. Hi-Fi's significant rise in rank suggests a successful strategy in capturing market share, potentially at the expense of its competitors, and positions it as a brand to watch in the Michigan vapor pen market.

Notable Products

In May-2024, the top-performing product from Hi-Fi was Starbuzz FSE Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking with sales of 5620 units. Twisted FSE Cartridge (1g) held steady at second place, demonstrating consistent performance over the months. Hulk Hole FSE Cartridge (1g) remained in third place, showing a slight increase in sales from April. Blue Nerds FSE Cartridge (1g) climbed to fourth place, indicating a notable improvement from its fifth-place rank in April. Super Stoned Bros Distillate Cartridge (1g) ranked fifth, maintaining its position while showing a steady sales increase.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.