Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

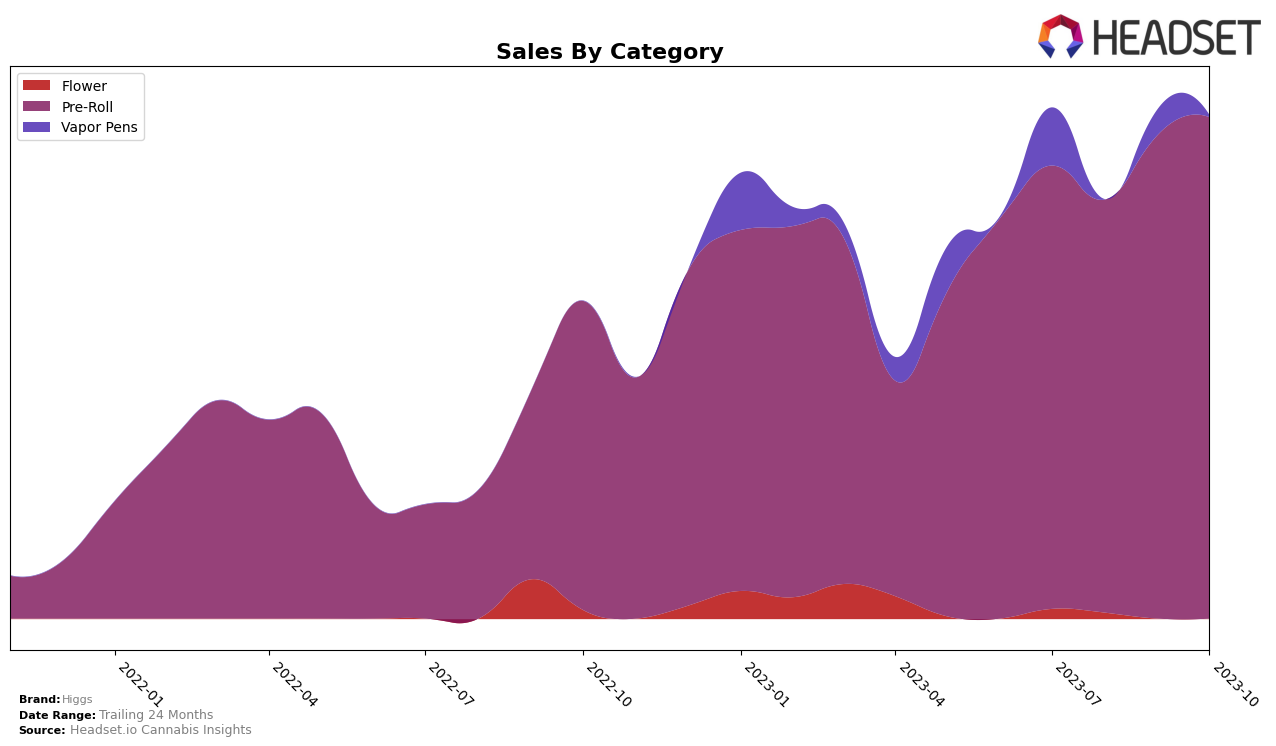

The cannabis brand Higgs has shown an interesting performance across different states and categories. In the Colorado market, Higgs was not ranked in the top 20 brands for the pre-roll category in July and August 2023. However, it made an impressive comeback in September and October, ranking 97th and 89th respectively. This indicates a positive trend for the brand in this state, although the exact sales figures for July and August are not disclosed. In October, the brand managed to achieve sales of 535 units, a significant increase from 1,260 units in September.

In Michigan, Higgs showed a consistent performance in the pre-roll category, maintaining its position in the top 20 brands from July to October 2023. The brand ranked 16th in July, dropped slightly to 22nd in August, but regained its position at 17th in September and 16th in October. In terms of sales, there was a noticeable increase from 480,638 units in July to 547,216 units in October. However, in the Vapor Pens category, Higgs' performance was less consistent. It ranked 75th in July, was not in the top 20 in August, ranked 98th in September, and again did not make it to the top 20 in October. This could suggest that while Higgs is doing well in the pre-roll category, it might need to bolster its efforts in the Vapor Pens category.

Competitive Landscape

In the Michigan Pre-Roll category, Higgs has shown a consistent performance, maintaining its position within the top 20 brands from July to October 2023. Despite a slight drop in rank in August, Higgs managed to recover and maintain a steady position, outperforming competitors like Redemption and Distro 10 in October. However, it's worth noting that LOCO had a higher rank in July and August but dropped below Higgs in October. Interestingly, Magic only appeared in the top 20 in October, indicating a potential rise in competition. While Higgs didn't top the list, its consistent presence in the top 20 suggests a steady demand for the brand in the Michigan market.

Notable Products

In October 2023, the top performing product from Higgs was the Banana Split Mini Infused Pre-Roll 10-Pack (3.5g), which climbed from its previous third place in August to the top spot with a remarkable sales figure of 2018 units. The second best-seller was the Oreo Frost Pre-Roll 6-Pack (3.5g), a new entrant in the ranking. The Melonade Burst Infused Mini Pre-Roll 10-Pack (3.5g) moved up two places from September, securing the third position. The fourth and fifth places were occupied by Marshmallow OG Pre-Roll 6-Pack (3.5g) and Lemon Cha Cha Infused Pre-Roll 10-Pack (3.5g), respectively, both also new to the list. This analysis shows a significant change in the rankings from the previous months, indicating a dynamic and competitive market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.