Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

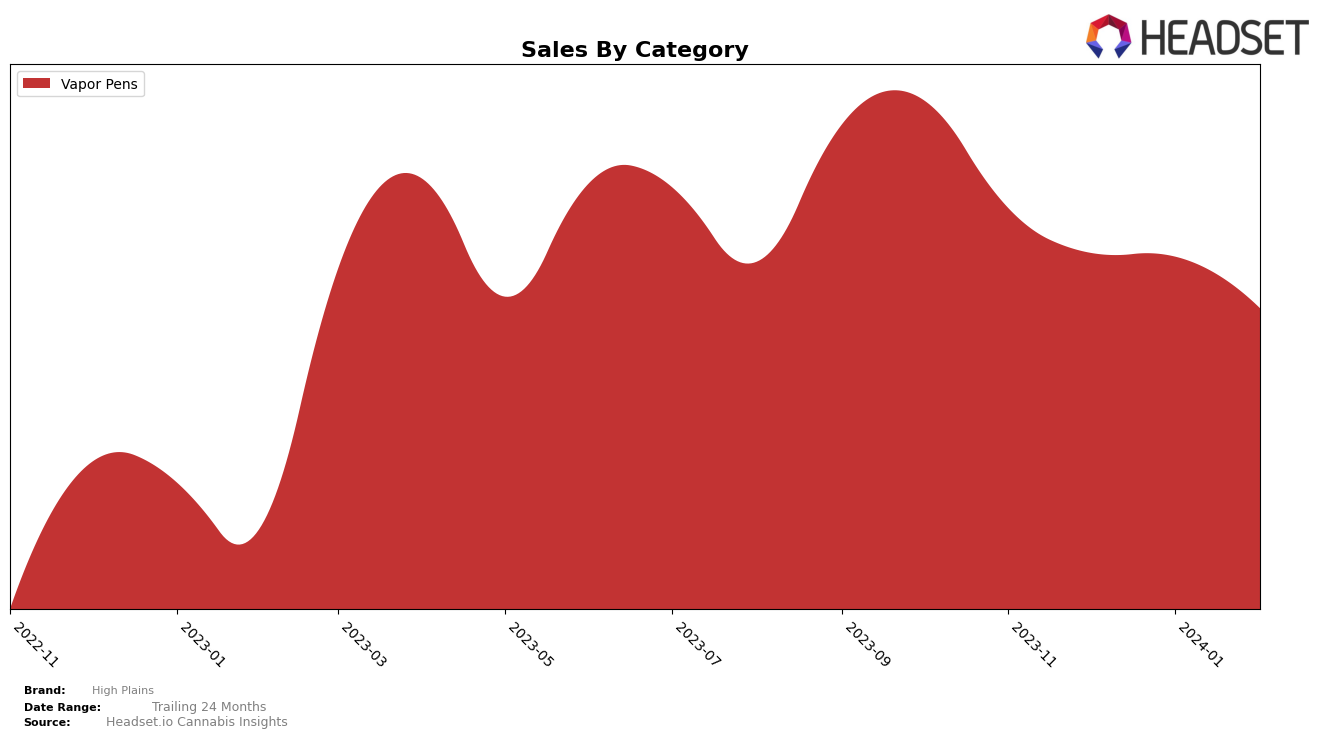

In the competitive landscape of vapor pens, High Plains has shown varied performance across different provinces in Canada. In Alberta, the brand experienced a consistent decline in rankings from November 2023 to February 2024, moving from 52nd to 73rd place. This downward trend was mirrored in their sales figures, dropping from 33,638 in November to 13,721 by February, indicating a significant decrease in market share within the province. Conversely, in Saskatchewan, High Plains demonstrated impressive growth, improving its ranking from 39th in November to 21st by February. This positive trajectory is supported by a substantial increase in sales, particularly notable between December and January, where sales more than doubled, showcasing the brand's growing popularity and improved market position in Saskatchewan.

Meanwhile, in British Columbia and Ontario, High Plains' performance tells a story of stability and slight fluctuations. In British Columbia, the brand maintained a position within the top 32 across the observed months, with a slight dip in rankings from 24th in November to 32nd by February. Although this indicates a stable presence in the market, the gradual ranking decline coupled with decreasing sales figures suggests challenges in sustaining its market share. On the other hand, Ontario saw High Plains moving within the rankings of 66th to 77th and then slightly improving to 72nd by February. This fluctuation in rankings, alongside a recovery in sales in January, hints at potential volatility in consumer preference or competitive dynamics within the Ontario market. The mixed performance across these provinces highlights the complexities of the cannabis market and the need for strategic adjustments to navigate it effectively.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in British Columbia, High Plains has experienced a fluctuating performance in terms of rank and sales over the recent months. Starting from November 2023, High Plains held the 24th position, slightly improving to the 26th in December, before dropping to the 31st in January 2024 and then slightly recovering to the 32nd position in February 2024. This indicates a challenging environment, with High Plains facing stiff competition from brands like Phyto Extractions, which showed a consistent improvement in rank, and Terra Labs, which made a significant leap from the 55th to the 29th position by January 2024. Another notable competitor, No Future, also demonstrated a strong performance, moving up in rank and surpassing High Plains by February 2024. The sales trends for High Plains show a decrease from November 2023 to February 2024, reflecting the competitive pressure and possibly indicating the need for strategic adjustments to regain its market position.

Notable Products

In Feb-2024, High Plains saw its top product as the Blueberry Chemdawg Live Rosin Cartridge (1g) with impressive sales, reaching 1870 units. Following closely, the Orange Rush Live Rosin Cartridge (1g) and Pink Krypt Rosin Cartridge (1g) secured the second and third ranks respectively, showcasing consistent demand within the Vapor Pens category. The Blueberry Dream Distillate Cartridge (1g) maintained its fourth position, indicating stable preference among consumers. Notably, the Pink Kryptonite Live Rosin Cartridge (1g), which was newly ranked in Jan-2024, held onto the fifth spot, hinting at growing interest. This month's rankings underscore High Plains' strong presence in the vapor pens sector, with the top products demonstrating notable sales figures and stability in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.