Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

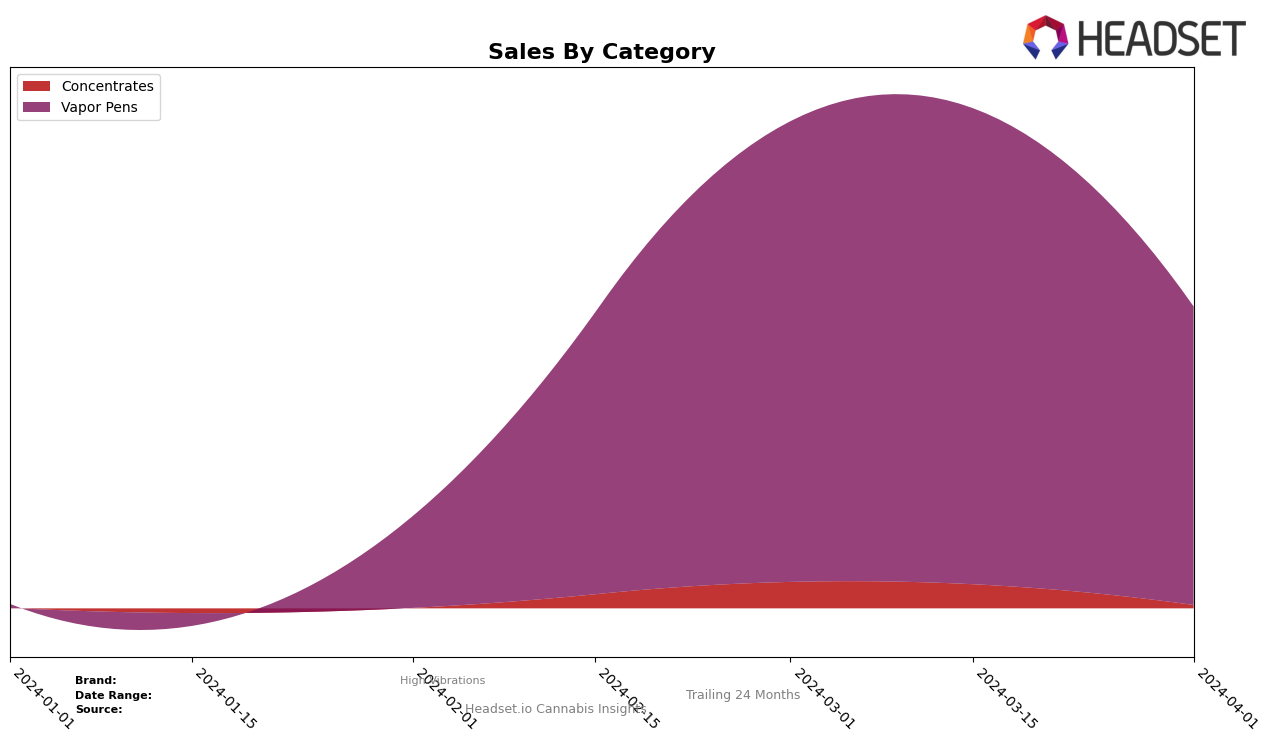

In the competitive landscape of the Arizona cannabis market, High Vibrations has shown a notable trajectory in the Vapor Pens category. Initially, the brand did not rank within the top 30 in January 2024, which is a significant detail considering the competitive nature of the market. However, it made a remarkable entrance in February, securing the 46th position, and then saw a substantial leap to the 24th rank in March, before slightly dropping to the 28th position in April. This fluctuation in rankings indicates a strong market entry and an ability to capture consumer interest, albeit with some volatility in maintaining its market position. The sales figures underscore this narrative, with a notable jump from no sales reported in January to $137,265 in March, highlighting a period of rapid growth for High Vibrations in the Arizona market.

While the specific performance metrics across other states or provinces were not provided, the available data from Arizona offers valuable insights into High Vibrations' market dynamics. The initial absence in the top 30 brands and subsequent climb in rankings is a testament to the brand's growing appeal and market penetration capabilities. However, the slight decline in April, moving from 24th to 28th, suggests challenges in sustaining upward momentum amidst the competitive pressures of the cannabis industry. This pattern of rapid ascent followed by a minor fallback is indicative of the volatile nature of consumer preferences and market dynamics in the cannabis sector. For stakeholders and observers, these movements within a single state hint at the broader strategic challenges and opportunities that High Vibrations may face as it navigates the competitive landscape across different regions.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Arizona, High Vibrations has shown a notable trajectory, despite not being ranked in the top 20 brands in January 2024. By February, it surged to the 46th rank, and impressively climbed to the 24th position by March, settling at the 28th rank in April. This movement indicates a significant uptick in sales and market presence, particularly in March where its sales peaked. Competitors such as PuraEarth (AZ) and Bud Bros have shown varying trends; PuraEarth climbed steadily in rank, indicating growing popularity, while Bud Bros experienced a slight decline in rank from February to April, despite maintaining higher sales figures than High Vibrations. IO Extracts and Venom Extracts also displayed fluctuations in their rankings, with IO Extracts seeing a significant drop in March. High Vibrations' rapid ascent in rankings, particularly in a competitive market like Arizona's Vapor Pens category, underscores its growing influence and potential challenge to established brands, hinting at a dynamic shift in consumer preferences and market dynamics.

Notable Products

In April 2024, High Vibrations saw Lemon Shortbread Live Resin Disposable (1g) as its top-performing product in the Vapor Pens category, with sales reaching 521 units. Following closely was Red Delicious Live Resin Disposable (1g), securing the second position with a notable increase in its ranking from fourth in March to second. Strawberry Milk Live Resin Cartridge (1g) landed in the third spot, showing consistent performance from the previous month. Mimosa Live Resin Disposable (1g) improved its ranking from fifth to fourth, demonstrating a steady increase in customer preference. Lastly, Starfire Cream Live Resin Cartridge (1g), which led the sales in March, experienced a significant drop to the fifth position in April, highlighting the dynamic nature of consumer demands within the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.