Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

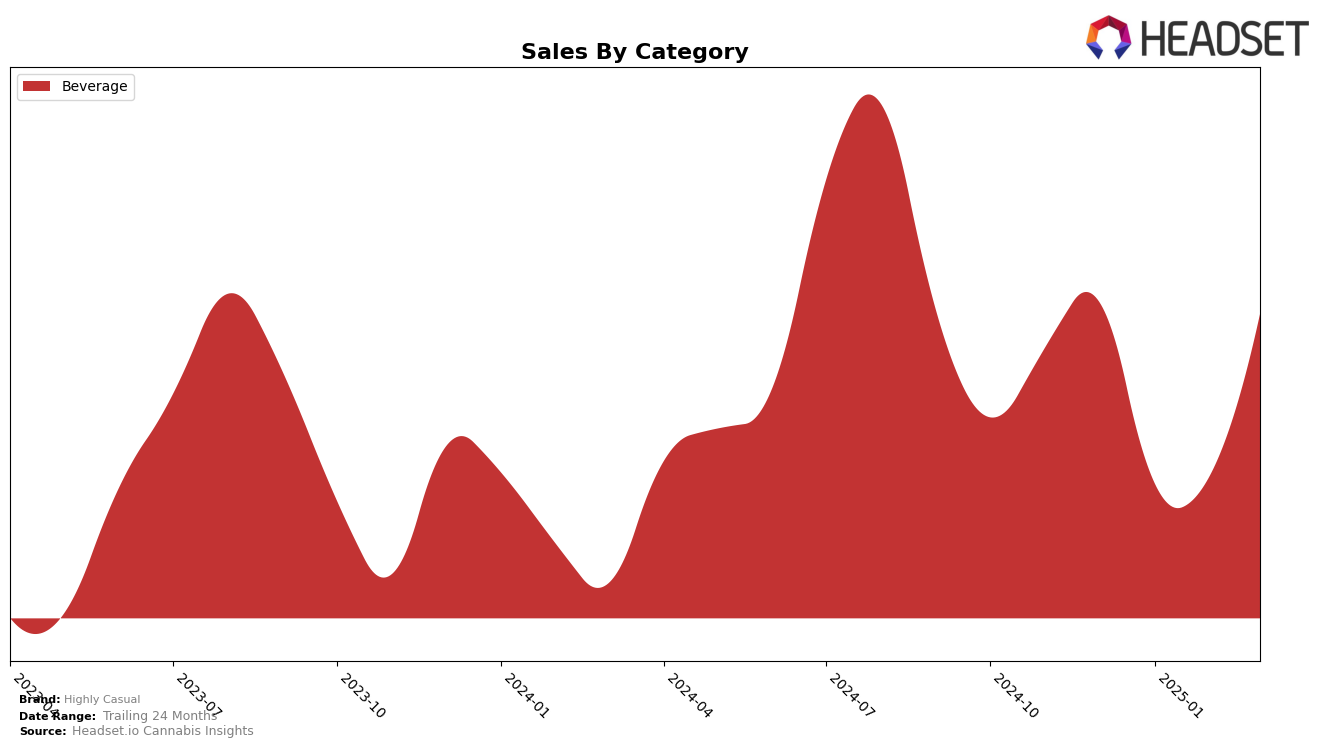

Highly Casual has demonstrated a consistent presence in the Michigan beverage category, with its rankings fluctuating slightly over the months. Starting at 4th place in December 2024, the brand experienced a dip to 7th place in January 2025, followed by a moderate recovery to 6th place in February. By March, Highly Casual had regained some ground, climbing back to 5th place. This movement suggests a resilient brand performance amidst competitive market dynamics, indicating that while there are challenges, Highly Casual is maintaining a solid foothold in the Michigan beverage market.

Despite the fluctuations in rankings, Highly Casual's sales figures in Michigan reveal some interesting trends. After a notable decrease in sales from December to January, the brand's sales figures began to recover in February and continued to rise into March, nearing December's levels. This rebound in sales, coupled with the improvement in ranking from January to March, underscores the brand's ability to adapt and recover in a competitive landscape. However, it is worth noting that Highly Casual did not appear in the top 30 brands in any other state or category during this period, which could be an area for potential growth or concern.

Competitive Landscape

In the competitive landscape of the Michigan beverage category, Highly Casual has experienced fluctuating rankings from December 2024 to March 2025. Starting at 4th place in December, Highly Casual dropped to 7th in January, improved slightly to 6th in February, and climbed back to 5th in March. This volatility in rank is indicative of a competitive market environment, where brands like Chill Medicated and CQ (Cannabis Quencher) consistently maintained higher ranks, with Chill Medicated reaching as high as 3rd place in January and March. Notably, Mary Jones made a significant leap from 9th place in February to 3rd in March, suggesting a strategic move or product launch that resonated well with consumers. Highly Casual's sales trajectory shows a recovery in March, aligning with its improved rank, yet the brand remains under pressure to innovate and capture market share from these agile competitors.

Notable Products

In March 2025, the top-performing product for Highly Casual was the Honeycrisp Apple Hang Ten Seltzer (10mg), maintaining its number one rank from February with a notable sales figure of 4519 units. The High 5 - CBD/THC 1:1 Strawberry & Watermelon Seltzer (5mg CBD, 5mg THC) secured the second position, marking its first appearance in the rankings. The CBD/THC 1:1 Blueberry & Pineapple Seltzer (5mg CBD, 5mg THC, 12oz, 355ml) debuted at the third rank. The High 5 - CBD/THC 1:1 Lemon & Lime Seltzer 4-Pack (20mg CBD, 20mg THC) remained consistent in fourth place, while the High 5 - CBD/THC 1:1 Blueberry & Pineapple Seltzer 4-Pack (20mg CBD, 20mg THC) dropped to fifth after previously holding the second and third positions. These shifts highlight a dynamic market with new entries impacting established rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.